The South African Revenue Service plays a vital role in upholding the country’s often fragile socio-economic condition.

Contributing over 20 percent in revenue to the country’s Gross Domestic Product (GDP) and tasked with serving as the source of funds for the operation of the country’s vital services such as the salaries of public servants.

SARS serves as the foundation and pillar upon which the country’s many facets, both public and private rest upon.

Yet, despite its pivotal role in both the economic and social strata of South Africa, SARS is not without fault, especially where its submission processes are concerned.

The revenue service’s social media profiles and major media publications covering the topic of SAR’s shortcomings are inundated with complaints from disgruntled taxpayers.

Chief amongst them is the substantial amounts in penalty fees that accrue for taxpayers who owe SARS money should they miss a payment deadline.

This article seeks to help prevent similar situations from occurring by answering all the questions you may have in relation to SARS owing you money.

What happens when you owe SARS money?

In the case of most businesses, monies owed to SARS come about through the complexities of remaining tax compliant due to things such as irregular cash flow and uncertainty.

Due to poor time management on the side of businesses and individuals and the yearly ambiguity in setting deadlines from SARS.

Many tax payers find themselves in the red regarding their annual tax duties, which almost certainly results in penalties for late submissions.

For others, their being in the red is more a fault of their own than that of time, as they completely fail or fail to pay part of their tax return to SARS.

In such cases, SARS will often amend an assessment through an audit or review, which leads to the creation of debt.

And for the most part, this is how businesses and individual taxpayers come to owe SARS money.

The consequences for owing a debt to SARS and not taking any of the lifelines prescribed in law and SARS’s own legal processes can result in severe legal penalties.

Under section 234(2)(d) alongside subsection (k) of the Tax Administration Act (TAA) it is a criminal offence to submit a return without the necessary payment.

It is also considered an offence when individuals do not pay tax when they are eligible (salary of above R83 100 per annum) to do so via the country’s tax laws.

Debt to SARS, however can be dealt with in a number of officially ascribed ways, which include deferrals and appeals.

But failing to make use of these contingencies can result in SARS issuing a civil case against the transgressing taxpayer.

SARS can make use of section 179 of the TAA and collect any monies owed to the transgressing taxpayer that is being held by a third party.

As well as liquidate all the assets of the transgressing taxpayer alongside the option to hold assets until the debt is met.

Can SARS debt be written off?

Although debt to SARS can be taxing and wrought with tangible legal consequences in the event you cannot make due on your debt, there are certain instances where your debt to SARS can be written off completely.

A popular relief mechanism offered by the TAA is a compromise agreement, which if successful, may see SARS writing off a part of your tax debt.

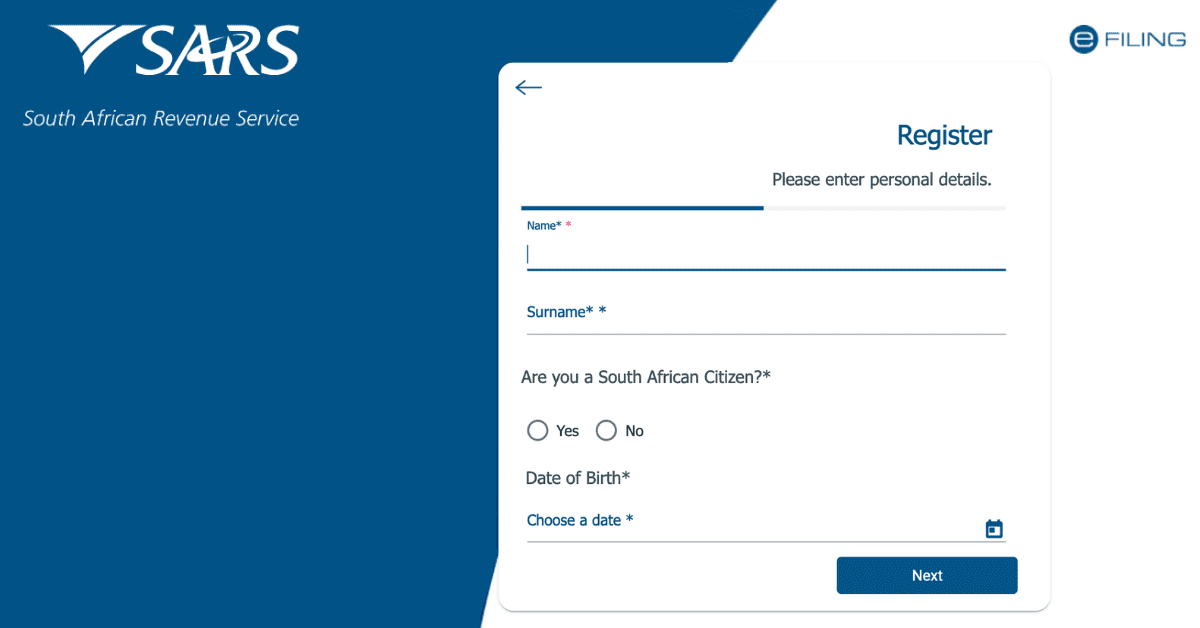

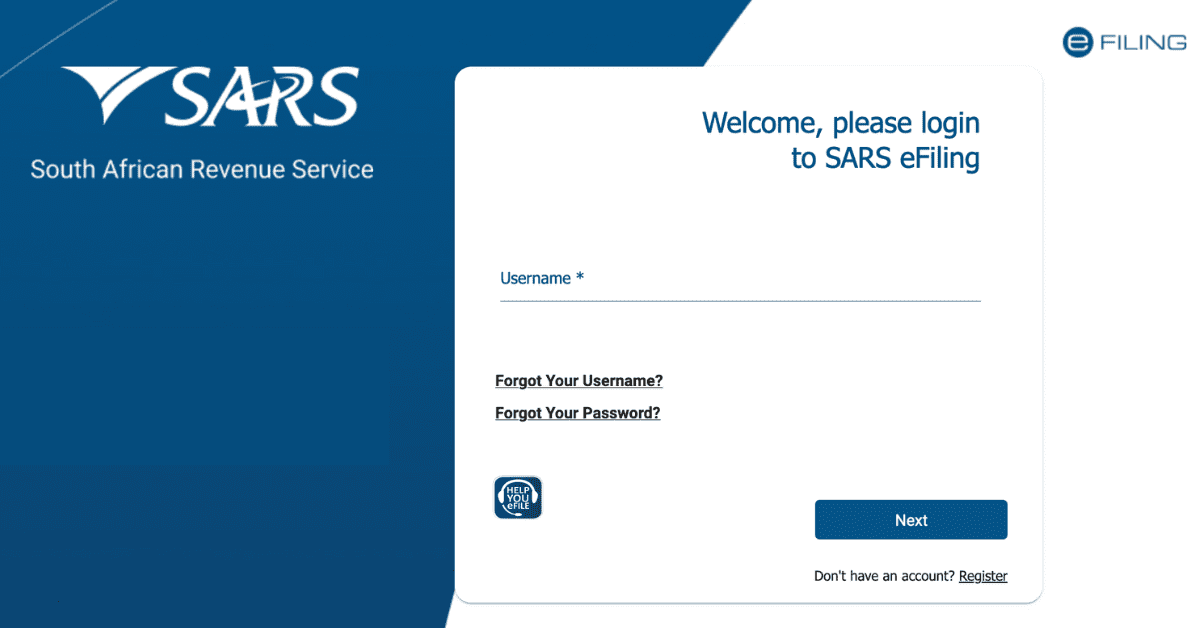

In the event that you wish to dispute or waive the liability to pay tax, you can request a suspension of payment through SAR’s eFiling system or your local SARS branch.

You are also limited by law to only request a suspension of debt for income Income Tax, Employee Tax, Value-Added Tax, and Customs and Excise.

All objections to an official decision by SARS must be made within 30 business days after the date in which the decision or assessment that resulted in debt was made.

How can I lower my SARS debt?

Section 200 of the TAA makes for provisions within the law that grant taxpayers the opportunity to lower their SARS debt, and even pay for it in monthly instalments.

This is often achieved in real-time through deferments and arrangements with SARS to settle your debt in manageable monthly instalments.

You accomplish this by sending SARS a written request either in person at a local branch or via writing through their online portal as stipulated in SARS’s by-laws.

This will grant you the option of paying your outstanding debt in one reduced lump sum or in prolonged instalments, until which time the entirety of your debt has been covered along with interest.

This however, is contingent on the transgressing taxpayer meeting a certain set of criteria.

These include, but are not limited to:

Suffering from a lack of assets, with no foreseeable change in the future that can be held or liquidated in the place of debt.

The prospect of income within the foreseeable future that can be used to cover the debt.

And if said taxpayer’s economic condition, especially in assets, does not allow them to be subject to the standard debt collection practised by SARS in the case of debt.

To initiate a deferral process, simply make use of the following call centre number: 0800 00 7277, or send an email to: sarsdebtmanagement2@sars.gov.za.

How much time do you have to pay SARS?

In most cases where a taxpayer owes money to SARS, especially for a tax return, the due date for payments is typically shown on the Notice of Assessment (ITA34).

It is not uncommon for the due dates on eFilers to be the 31st of January.

And the manual and electronic filing at a SARS branch is to be due by the end of the next month from the assessment date.

In the case of estates and overseas taxpayers, SARS grants them an extra month from the standard due date.

It must be noted that late payments with SARS are subject to penalties that will accrue with credit from the backdated date.

Do you need a tax clearance certificate to buy a house in South Africa?

Yes, the laws and by-laws that govern the purchasing of a house in Southern Africa state that the seller of a property in South Africa provides a Tax Clearance Certificate from SARS should said sale be successful.

A house buyer is also required to pay a transfer duty and registration costs before all relevant documents, including a Tax Clearance Certificate, which are to be submitted to the Deeds Office.