Applying for a tax directive on eFiling is a crucial process for employers and employees in South Africa. A tax directive is an official document issued by the South African Revenue Service (SARS) that instructs employers to deduct tax from specific employee payments. Understanding how to navigate the eFiling platform for tax directives is essential for ensuring compliance with tax laws and accurately managing tax obligations.

How to Complete a Tax Directive Application on eFiling

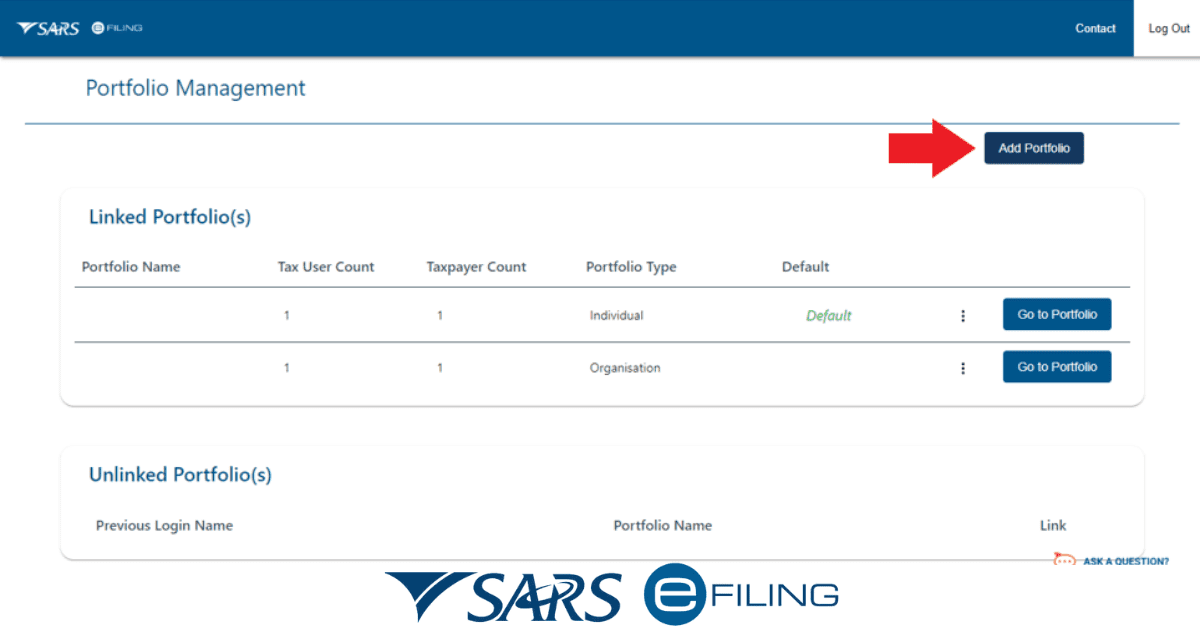

- Log In to eFiling: Access the SARS eFiling platform using your username and password. Registering is unavoidable if you miss an eFiling account.

- Check the”Directive application page” once signed in. This is where you’ll initiate your application.

- Select the Appropriate Directive Type: Specify the type of tax directive you need. Common directive categories include retirement, lump-sum payments, severance benefits, and more.

- Provide Required Information: Complete the application form by supplying all necessary details. This can include personal data, financial particulars, and transaction-specific details.

- Upload Papers: Based on the directive, you may need to upload files, like retirement fund particulars, severance package computations, or other similar files.

- Assess and Forward: Carefully assess the application for clarity and fullness. Once you’re satisfied, submit it electronically through eFiling.

- Await SARS Response: SARS will review your application and approve or reject it. You will receive an official tax directive document with instructions on proceeding.

How Does a Tax Directive Work in South Africa?

A tax directive in South Africa serves as official authorization from SARS regarding the taxation of specific payments. It clarifies how tax should be deducted from payments made to individuals, ensuring that tax is deducted correctly and complies with tax laws. Here’s how a tax directive works:

- Issuing Authority: SARS is the issuing authority for tax directives. Employers and individuals can apply for a directive to obtain guidance on the tax treatment of various payments, such as retirement benefits, severance packages, and lump-sum payments.

- Directive Types: Tax directives are categorized based on the nature of the payment. Common directive types include IT3(d) directives for retirement and lump-sum payments, IT3(c) directives for dividends, and IT3(p) directives for interest income.

- Application Process: To apply for a tax directive, individuals and employers must submit an application to SARS. This application outlines the payment details and the intended tax treatment.

- SARS Review: SARS reviews the application to ensure it complies with tax laws and regulations. If the application meets the criteria, SARS issues a tax directive specifying the tax treatment and the applicable tax rates.

- Employer Compliance: Employers must adhere to the instructions in the tax directive when processing payments to individuals. This includes deducting the correct amount of tax and ensuring compliance with SARS guidelines.

- Individual Obligations: Individuals receiving payments subject to a tax directive should report these payments accurately on their tax returns.

- Record Keeping: Both employers and individuals must keep records of tax directives for reference and auditing purposes.

How Long Do You Wait to Receive the SARS Tax Directive?

The time it takes to receive a tax directive from SARS can vary depending on factors such as the complexity of the application and SARS’ processing times. SARS generally aims to process tax directive applications efficiently, and the typical timeframe for receiving a tax directive is approximately 21 business days.

How Do I Submit a Manual Tax Directive?

- Download the Application Form: Visit the official SARS website and download the relevant tax directive application form. Ensure you select the correct form based on the type of directive you need.

- Complete the Form: Fill out the required information with the application form.

- Gather Supporting Documents: Depending on the type of directive, you may need to attach supporting documents. This can include calculations, fund details, or other relevant paperwork.

- Submit the Application: Send your completed application form and any supporting documents to the nearest SARS branch or tax office.

When Should I Apply for a Tax Directive?

Here are some scenarios when you should consider applying for a tax directive:

- Prepare for Retirement/Lump-Sum Payments: When it comes to retirement or receiving a lump-sum payment, it’s wise to plan ahead. Applying for a tax directive in advance is a good idea if you expect such a payment.

- Severance Benefits: Similarly, if you find yourself entitled to severance benefits, typically due to retrenchment or the termination of your employment, securing a tax directive is a smart move.

- Dividends or Interest Income: Additionally, for those receiving dividends or interest income, contemplating a tax directive is a prudent step.

- Variable Payments: Applying for a tax directive helps avoid overpaying tax for variable or irregular payments.

- SARS Requirements: Sometimes, SARS may require a tax directive as part of their compliance procedures.

How Do You Fill Out the Tax Directive Form for Retrenchment?

- Obtain the Appropriate Form: Download the tax directive application form for retrenchment from the SARS website or collect a physical copy from a SARS branch.

- Complete the Form: Fill out your personal details, employment history, and severance package details.

- Documentation Matters: For certain situations, especially those involving intricate retrenchment packages, it’s crucial to include supporting documents. These might encompass a detailed breakdown of your severance benefits.

- Get The application in. You can send the completed application form and supporting documents to SARS.

- Await SARS Response: SARS will review your application and issue a tax directive specifying how your severance package should be taxed.

- Notify Your Employer: Provide your employer a copy of the tax directive to ensure that your severance payment deductions are made correctly.