Wondering how you can settle your outstanding tax debt to SARS? Individuals and businesses often experience cashflow problems and uncertainties that can affect their tax payments and returns. However, the good news is that SARS offers an instalment or deferment payment arrangement for your tax debt. This agreement allows you to pay all the money you owe, including applicable interests over time. Read on to learn how you can pay for SARS

How Do I Pay SARS in Instalments?

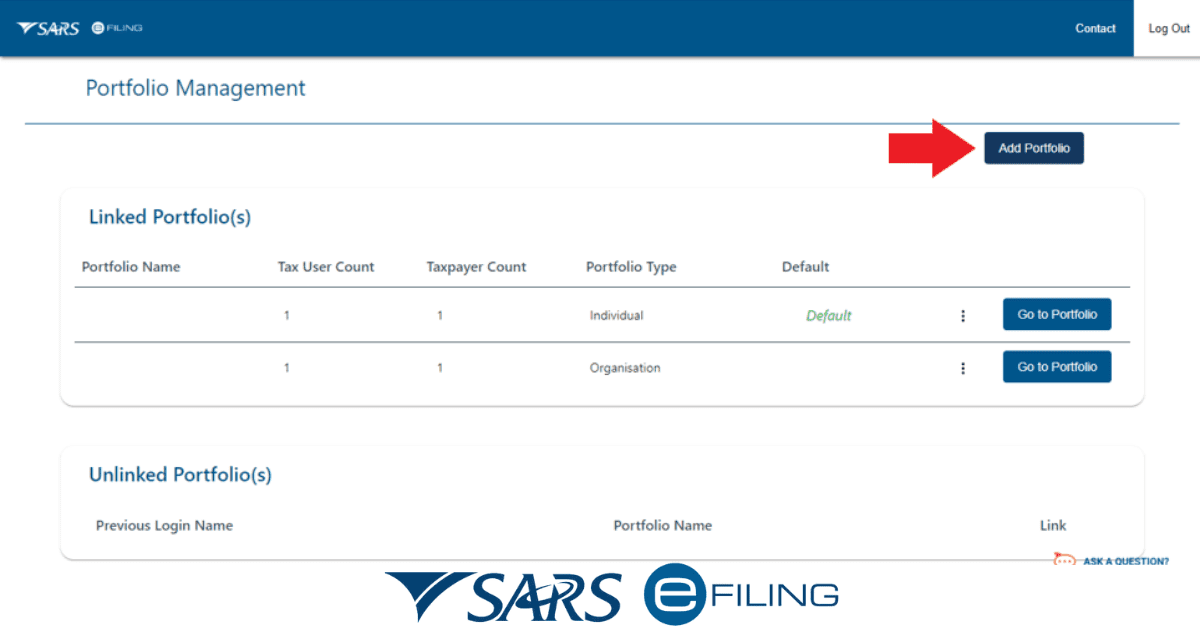

If you want to pay your outstanding SARS debt in instalments, you can do it through different channels. You can request the payment arrangement through SARS eFiling. Log in to your account on SARS eFiling website and identify the area where there is an outstanding debt.

The payment arrangement request feature is limited to the tax types, including VAT, Personal Income Tax (PIT), Dividends Withholding Tax, CIT, PAYE, SDL/UIF, and Admin penalties. Once you initiate the payment request, eFiling will provide an auto-simulated payment plan you can use.

Alternatively, you can call the SARS Contact Center on 0800 00 7277 or send your deferred arrangement requests to Sarsdebtmanagement@sars.gov.za. When the payment agreement has been reached, you can pay the outstanding debt to SARS through the same channel you use to pay your taxes, or you can choose another option that suits your situation.

Can I Pay My Tax With a Monthly Payment?

Failure to pay taxes and file tax returns to SARS attracts penalties and interest on outstanding debt. If you cannot pay your full amount due, you can consider a monthly payment option, where you agree on a payment plan with SARS.

Your tax situation determines the payment option available. If you have a huge debt, you can consider a long-term payment plan or instalment agreement where you pay monthly until your debt is cleared. You can enter this noble agreement with IRS to clear your debt within an extended timeframe.

With the monthly payment option, you can get peace of mind because IRS will not send letters of demand, especially when you are working to settle your debt. More importantly, your outstanding debt will not attract interest when you have a valid payment plan.

If you default on your instalment agreement, IRS can revoke it, but collections will be suspended for 30 days. When the instalment payment is rejected, it means you have to find other means to clear your debt, including interest and penalties.

How Do I Pay SARS on the Mobile App?

If you want to pay SARS on the mobile app, you must first download and install it on your mobile phone. The SARS MobiApp icon appears on your smartphone screen when installation is complete. You can make payment via the mobile app through the issued Notice of Assessment (ITA34) or issued statement of account.

To use the SARS MobiApp, you must be a registered taxpayer with SARS. When you install the app on your phone, you can follow the prompts that appear when you log in to your SARS account. Make sure the SARS MobiApp you download is always up to date and compatible with the latest operating system. Additionally, your phone must be connected to the internet when using the application.

How Do I Pay My SARS Tax Online?

There are different methods you can use to pay your SARS tax online. You can send your tax payments via eFiling. When you register for SARS on the eFiling platform, you should set up the credit push option. Alternatively, you can utilise SARS’ payment methods available.

When you choose the credit push option, you will perform the payment via your bank. When you want to make a payment to SARS eFiling sends a payment request to your bank, which reflects the amount that should be paid. You will need to authorise the request via the appropriate bank product.

The credit push payment option gives your bank instructions to process the payment to SARS. This functionality is irrevocable, and you should ensure that your account has sufficient funds to perform the transaction. You can use the following banks for eFiling payments. Capitec Bank, ABSA, Citibank, Bidvest, HSBS, FNB, Nedbank, Investec, Standard Bank, Mercantile Bank, Standards Chartered Bank, Sasfin, AlBaraka, and HBZ.

Another option you can consider to pay SARS tax online is Electronic Funds Transfer (EFT). You can make the payment via the internet banking facilities provided by the bank. The SARS beneficiaries have the prefix “SARS” to ensure the payments are referenced correctly and allocated to the appropriate account.

If the reference is incorrect, you will not be able to make a payment. The following banks support the EFT payment method to SARS: FNB, AiBaraka, Absa, Capitec, Standard Bank, JP Morgan, Discovery Bank, HSBC, Grindrod Bank, Investec, Nedbank, and Mercantile Bank.

How Do I Check if I Owe SARS Money?

To check your SARS balance, call the SARS contact Center at 0800 00 7277 or +27 11 602 2093. When you call the SARS contact Center, request a statement of your account. You will be asked to provide your tax reference number, ID number, or business registration number.

The SARS agent follows an authentication process. Make sure you call between 0800 hours and 1630 hours during weekdays, except for Wednesday, when you should call between 0900 hours and 1630 hours.

The second option to consider is to log in to your eFiling account and request a statement. Similarly, you can also log into the SARS MobiApp and request your account statement.

You can also request your income tax statement or balance statement by sending an SMS to SARS on 47277. You can use this facility with or without airtime or data.

If you are a registered taxpayer with SARS, you should make sure you pay your taxes and returns on time to avoid penalties or interest. However, if you cannot pay the amount you owe in full due to various reasons, you can consider the option of paying SARS in instalments. Make sure you do not default on your instalment agreement.