The SARS eFIling platform allows you to digitally manage your tax affairs. With quicker turnarounds and a more secure method of filing that is instantly received by SARS, it’s safer and quicker than other tax options in South Africa. There are many solid reasons to use eFiling, so we compiled this guide to eFiling to help you.

What is eFiling?

SARS eFIling is an online platform that helps you digitally manage your tax affairs. You can file returns, submit payment instructions, file disputes and make payment arrangements, and perform other tax-related services. It is an official portal managed entirely by the South African Revenue Service, not a third-party.

It is completely free to use and allows you to conduct most of your tax-related business online without the need for manual form submission. It is accessed via the www.sars.gov.za internet link or the SARS MobiApp.

Why should I register for eFiling?

SARS eFIling is a quicker, simpler, and more convenient way to conduct your tax-related needs digitally. Not only can you file and perform other tasks online without queuing at a branch or relying on the mail, you can also upload supporting documents digitally, both for verification and audit purposes.

Additionally, the eFiling system pre-populates a lot of information received from other parties regarding your tax affairs- such as PAYE amounts received from your employer or amounts you have saved in an RA or pension. This makes the process of submission a lot easier for you. Instead of facing bewildering options on a manual form, most of the income tax and other forms you submit will be tailored to your particular circumstances, too. Comprehensive instructions are also given to guide you.

Once you submit a tax document on eFiling, it is immediately recorded by SARS, preventing loss or delays. You also receive your tax correspondence safely and immediately on the platform and pay using secured methods if you choose. Lastly, some tax types also receive extended deadlines if filing via eFiling- such as provisional taxpayers filing annual income tax.

How do I file on eFiling?

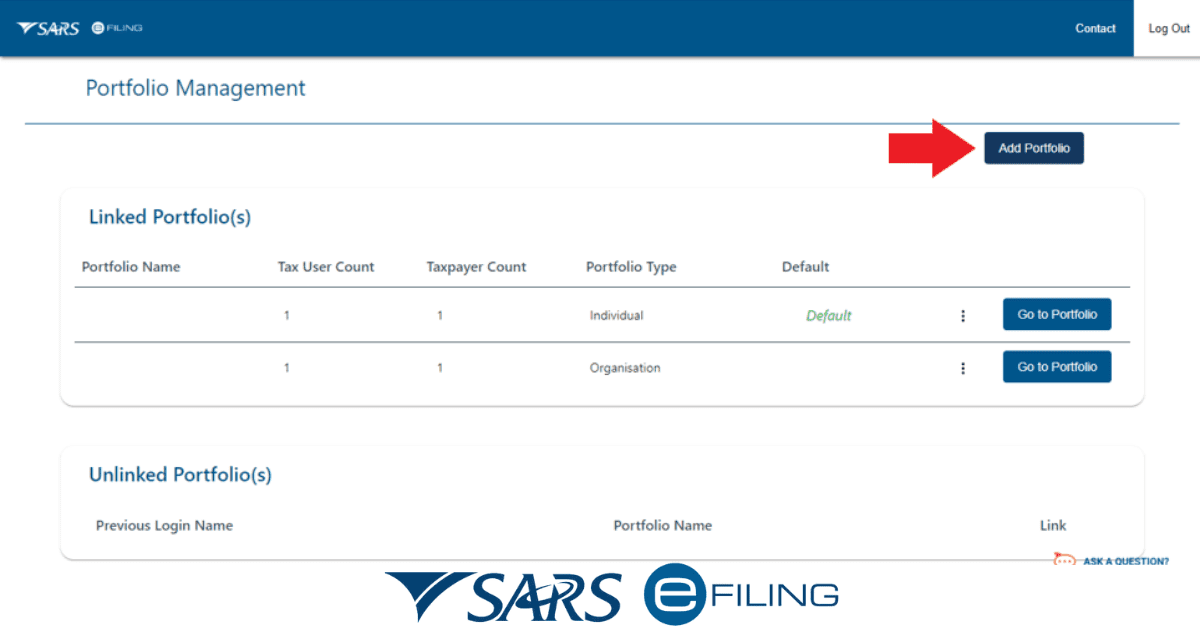

Most people will use eFiling only for their annual income tax submission during tax season. However, business entities and other tax payer types (like provisional tax payers) can also add these tax types to their eFiling profile to file them online.

When you log on to the SARS eFiling platform, in the left-hand menu, you will see all tax types you are registered for, and you can click on the relevant tax type there. Here you can request forms, which you can then open and fill in online. Some parts may even already be filled in, where information has been received from a third-party. When all information is complete, you simply press “submit”, and the document will be received by SARS.

Any communication from them about the form will also be received on the eFIling platform for you to access via “SARS Correspondence”, This includes assessments and penalties. If you need to pay over money in regards to the tax form you filed, you can initiate a credit push payment on the eFiling platform or pay via EFT and other methods using the reference number you receive.

What documents are needed for eFiling?

To register for eFiling, you simply need your proof of identity (ID number or CIPC registration number), proof of banking details and address, and your tax number

You may need some additional document types depending on the other tax types you wish to pay. These will always be indicated to you when you file on the platform and can be digitally uploaded there. You can also digitally file your supporting documents for audits on eFiling.

Who is eligible for eFiling?

Every South African citizen or person earning an income in South Africa (including legal asylum seekers) is eligible to use eFiling. Remember that all working people in South Africa are required to register for tax, even if you earn below the income threshold, within 60 days of earning an income or 21 days of registering a business with CIPC.

It is suggested that you register on eFiling for your convenience in handling your tax matters. The only people who may not need to use eFiling are those who are unemployed, or who earn a single salary from an employer and are below the tax threshold, or who will not need to make any claim-backs regarding PAYE paid over by their employer for them. It is still a good idea to have an eFiling profile in these cases, as your employment status may change in the future.

Is eFiling compulsory?

SARS eFiling is not compulsory, and you can still file through a SARS branch if you prefer. However, between the unreliable South African post, and the need to queue for long hours at a branch and take time from your daily life, eFiling is a smarter, faster, and more reliable way to ensure you stay tax compliant.

How long does efiling take?

Your eFiling profile is typically active within 48 hours after SARS verifies the details you provide. Once you have completed the relevant forms for any tax type (and uploaded any supporting documents you need) on the platform, submission is instant. The only time it will take is the time needed to prepare the form itself.

How do I know if I am registered for eFiling?

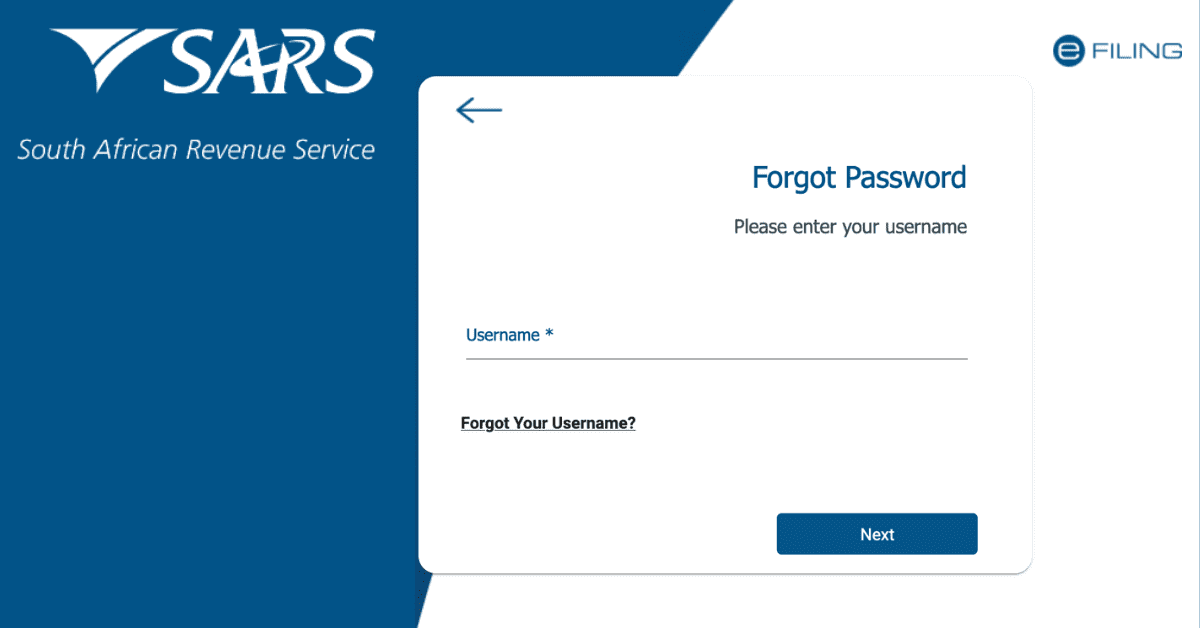

If you try to create a new profile on your ID number/CIPC number and tax number, and a profile already exists for you, the system will notify you. You can recover access through the ‘Lost Username’ and ‘Lost Password’ options on the eFIling website. If this fails, or you don’t have access to the same email and phone number as when the profile was created, you can contact the SARS Contact Center for assistance in recovering access.

If you use a tax practitioner to handle your tax affairs, they will very likely create an eFiling profile for you that is linked to their tax practitioner account. You can request control of it yourself or on behalf of a new tax practitioner if you change practitioners or want to file on your own.

SARS eFiling is a simple way to handle all your tax-related matters online without the need to visit a SARS branch, so it makes sense to use the system.