SARS eFiling is the official tax return portal for the South African Revenue Service. This online portal was launched to allow taxpayers to complete almost any tax-related function on their own and without the need to visit a SARS branch.

Once you register for income tax

How can I get my tax number from SARS?

Recovering any of your SARS-related information can be done easily and in several ways once you’re registered for eFiling. The most common piece of information that taxpayers may require is their tax number, and you can retrieve it in these ways:

- Send SARS a query on the SARS website.

- If you are a registered eFiler, it will be displayed on your eFiling profile once you log in.

- You can request a notice of registration via the eFiling MobiApp.

- Call the SARS Contact Centre on 0800 00 7277.

- Visit a SARS branch. You will need to make an appointment.

To receive a tax number, you will need to be registered for that tax type first. The most common is Income Tax or Pay As You Earn. If you are not registered for eFiling for the specific tax type, you can do so easily by visiting www.sars.gov.za, clicking on ‘Register’, and completing the form presented.

Registering for a tax number via eFiling

You can only receive a tax number for a specific tax type if you register for that tax type.

There are 3 easy ways that eFilers can register for tax:

Auto registration:

When you register for eFiling with SARS for the first time, SARS will automatically register you and issue a tax reference number as soon as your information has been validated. Only individuals with a v alid South African ID number will be able to register for tax through eFiling.

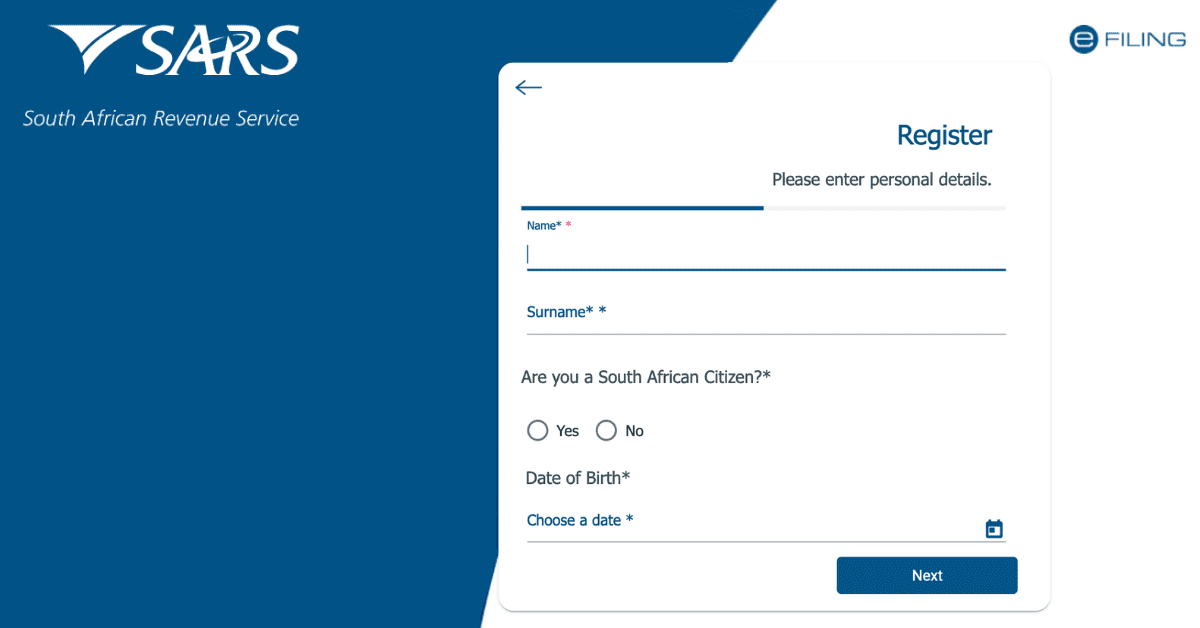

Here are the easy steps to register on eFiling:

- Visit www.sars.gov.za or download the SARS MobiApp.

- Click on ‘Register.’

- Follow the prompts and complete the form presented to you.

- Upload any supporting documents that are requested and submit them.

Once you complete the process above, SARS will commence validating your details, and you should be allocated a tax number shortly thereafter.

Register through your employer:

Efiling provides a registration function that allows your employer to submit income tax registrations to SARS on your behalf.

Speak to your employer or payroll department about this option, and they should be able to explain the process; alternatively, you can find out more here.

Register at a SARS branch

If you choose to complete the registration in person at a SARS branch, here’s what you need to know:

- You must make an eBooking before going to the branch.

- The only way to make an eBooking is to call the SARS Contact Centre on 0800 00 7277, and select option ‘zero’ from the voice prompts.

- A SARS consultant will book an appointment on your behalf and provide you with the booking details.

Registering for a tax number at a branch

If you choose to complete your first-time registration in person at a SARS branch, here’s what you need to know:

- You must make an eBooking before going to the branch

- The only way to make an eBooking is to call the SARS Contact Centre on 0800 00 7277, and select option ‘zero’ from the voice prompts.

- A SARS consultant will book an appointment on your behalf and provide you with the booking details.

Registered taxpayers have two additional methods to make an eBooking:

- Send an SMS to 47277 with the following information:

- Booking (Space) ID number/Passport number/ Asylum Seeker number.

This service is only available to taxpayers and registered representatives who are registered for Personal Income Tax. It is not available to tax practitioners.

- You can request an appointment using the online eBooking form before you visit the branch.

If you are planning to visit a branch to complete your registration, you should ensure that you take the completed relevant supporting documents with you. You can view these supporting documents here.

Can I look up my tax information online?

If you are a registered eFiler, you will able to look up your tax numbers at any time on your eFiling profile or through the SARS MobiApp.

Once you are logged in to SARS eFiling, you can access the Client Information System which will allow you to register and maintain the following taxes:

- Income Tax

- Corporate Income Tax

- Value-Added Tax

- Mineral and Petroleum Resource Royalty (MPRR)

- Pay As You Earn and Unemployment Insurance Fund

- Customer and Excise

New users and first-time registrations that do not have a tax number will be automatically issued a tax number after registering with SARS.