All South African citizens who are employed are required to have a tax number with SARS. This is needed even if they are not earning at the tax threshold (where they are required to pay tax on their earnings) and even if they do not need to submit a tax return annually. As a working person, you may need to prove that you are registered for tax to a third-party. For example, you may need to provide it to the HR department of a new employer. You will do this via a Notice of Registration or an IT50 document. Luckily, you can access your SARS Notice of Registration easily from different platforms or the SARS MobiApp. Here’s everything you need to know about the Notice of Registration.

What is a notice of registration?

Sometimes called a ‘SARS Confirmation Letter,’ a Notice of Registration is simply official proof from SARS itself that you have registered as a taxpayer within South Africa and the tax number they assigned you. It is also called an IT50 form.

Remember, you will receive a tax number when you first apply for eFiling. You may already have one. Employers often generate a tax number for first-time employees when they pay over your PAYE portion to SARS. If you are unsure if you already have a tax number, you can ask your employer or phone the SARS Call Center for assistance.

How do I request SARS notice of registration?

You can request the Notice of Registration for Individuals (IT150) through the following channels:

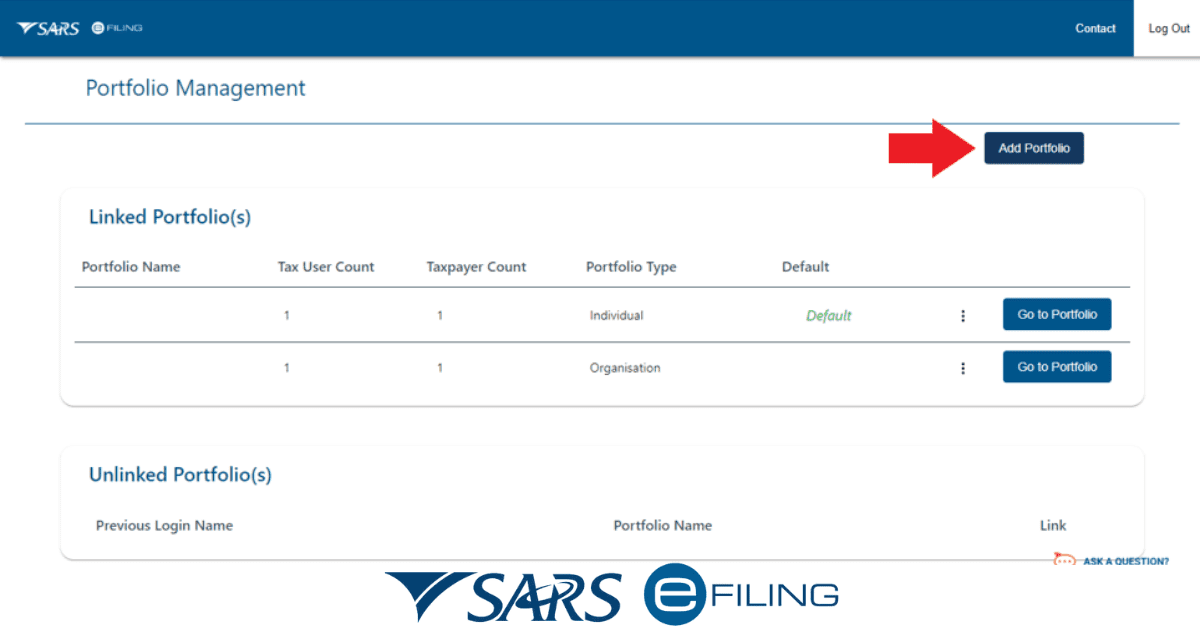

Via eFiling

You can access your Notice of Registration/IT50 on the eFiling platform. Simply log in to your eFiling profile, select ‘Home’ (or ‘Organizations’ for business profiles), then navigate to:

SARS Registered Details> Notice of Registration> Request New

If you have done this before, the final option may say ‘View’ instead. This can then be downloaded and provided to whoever needs it. If there’s a problem retrieving it, the SARS Contact Center can help individual taxpayers. SARS Contact Centre on 0800 00 7277 to issue the Notice of Registration to your registered email address as per records provided during the registration process.

Via SMS

To request your Notice of Registration (IT150), send an SMS to SARS on 47277 with the following detail: TRN (Space) ID number/Passport number/ Asylum Seeker number.

Via SARS MobiApp

On the Landing page, tap on “My Services”. This will display the My Services page.

Tap on the “eNotice of Registration (IT150)” option.

Where do I get notice of registration on eFiling?

As we mentioned above, you can access your notice of registration easily on eFIling. This is done via SARS Registered Details> Notice of Registration> Request New/View. These options all appear in the left-hand menu of your eFiling portal. It is also possible to do this via the SARS MobiApp. There is also an SMS option.

What is proof of SARS registration?

Your Proof of SARS registration allows you to prove to third-parties (like new employers) that you have an active tax number with SARS. This ensures they can seamlessly make payments such as your PAYE and that SARS will correctly record and register all tax-related tasks you undertake. Remember that this is proof you are registered as a tax-paying entity with SARS. It is not proof of registration for other tax types you may also need to file, such as PAYE as an employer, VAT or Customs Duty

Where do I find my SARS registration details?

Your SARS registration details are easily accessed via the eFiling portal per the methods we outlined above (SARS Registered Details> Notice of Registration> Request New/View). If you are not yet registered on SARS eFiling, or simply need to confirm your tax number and don’t need a full formal Notice of Registration to give to a third-party, you can also see your tax number on any official correspondence from SARS or on an old income tax return. It is typically listed on the top right-hand side of any SARS letters or documents or in the header section of income tax returns. You can also send an SMS to the official SARS line at 47277 in the following format:

TRN (space) (Insert your ID number, passport number, or asylum seeker number)

It is also available on the Sars MobiApp.

How long does it take to get notice of registration from SARS?

If you are activating your eFiling profile for the first time, it will be verified and live within 48 hours of submitting all your details to SARS. Once you have an active eFiling profile and you submit a request for an IT50/Notice of Registration/SARS Confirmation Letter on the system, it will be generated immediately and can be downloaded.

How do I check an individual’s tax registration status?

Are you a third-party entity that needs to check someone else’s tax registration status? You can request them to provide you with a Notice of Registration through the steps we detail above. Otherwise, SARS has now launched the Tax Compliance Status system, which will confirm registration as well as their tax compliance status. They will need to authorize you for this access via an electronic access PIN.

Accessing your Notice of Registration is a simple matter if you use eFiling. Remember that there are other methods to get it, although they will not be as convenient. You can use the SMS system, ask for help from the Call Center, or visit a SARS branch to get your IT50 form/Notice of Registration if you prefer- but eFIling remains the fastest and simplest way to access it.