All taxpayers registered with South African Revenue Service (SARS) should fulfil their tax obligations. If you have long outstanding returns and penalties due to failure to submit your income tax returns, SARS can compel you to pay what you owe via an Agent Appointment Notice (IT88). Read on to learn what SARS IT88 is.

What Is SARS IT88?

According to the Income Tax Act No.58 of 1962, SARS can initiate the collection of outstanding taxes through Agent Appointments. The form specifically used for this purpose is the Agent Appointment Notice (IT88). With this initiative, it means SARS appoints the employer to become the agent responsible for recovering the outstanding taxes owed by their employees.

If you owe money for previous taxes, SARS will issue your employer a document known as the IT88. This form states that each month, your employer must deduct a certain amount of money from your salary, which is paid to SARS to recover the debt. This is known as a garnishee order.

SARS often issues an IT88 to an employer for any one of the following three reasons:

- The employee has outstanding PAYE.

- An employee owes PAYE from the company share scheme.

- The employee has not been submitting annual returns for personal taxes.

When the employer receives the IT88 Agent Appointment Notice, they must garnish the stipulated amount from the respective employee’s salary. The employer should pay the money to SARS on or before the due date shown on the IT88 form.

How Do I Pay SARS Admin Penalty?

An administrative penalty (admin penalty) is levied on people who fail to submit income tax returns for one or more years. While there are various types of non-compliance penalties, the income tax penalty is the most common for individuals. Whether you agree or disagree with the admin penalty, it is recommended that you pay your outstanding return to avoid further admin penalties.

As long as you have outstanding returns, the penalty will recur monthly for 35 months. You can pay your penalty to SARS using different payment channels available. For instance, you can pay SARS at any of the following banks: FNB, Absa, Nedbank, Capitec, and Standard Bank. Ensure you quote the correct payment reference number (PRN) and beneficiary ID.

You can also pay your admin penalty via eFiling. You need to set up a credit push to perform the payment at your bank. Efiling first sends you a payment request to your bank showing the amount that must be paid on a specific bank product. You should authorize your bank to make the payment to SARS.

A credit push payment is only possible when you have sufficient funds in your account and is irrevocable. You can make eFiling payments at Absa, FNB, Citibank, Capitec, Bidivest Bank, HSBC, Investec, Standard Bank, Nedbank, Standard Chartered Bank, HBZ, Mercantile Bank, Sasfin, and AlBaraka.

The SARS MobiApp is another payment method you can use if you want to pay your money to SARS. You can determine the amount you want to pay. Taxpayers can also make payments at their nearest SARS branches.

How Do You Waive Interest and Penalties With SARS?

If you cannot make a full payment to SARS, you can request a deferred payment arrangement. If your penalty is not paid, it will contribute to attracting interest. Therefore, requesting remission is a good idea if you dispute the penalty levied against you due to non-compliance.

You must provide the reasons for non-compliance to SARS. If your request for remission is not considered, you can appeal the decision if you still do not agree with SARS’s decision for objection. Once you submit the RFR or appeal, SARS can cancel or reduce the penalty, depending on your situation.

You can request an RFR via eFiling if you are registered to use this platform. You can also request waiving of penalties or suspension of interest on late payments by visiting your nearest SARS branch. However, this can only be possible if you have valid reasons to support your claim for suspension of payment of the penalty.

You can only apply for waiving or suspension of interest and penalties on the following types of taxes:

- Pay-As-You-Earn (PAYE)

- Customs and excise

- Value-added tax (VAT)

Penalties on UIF and SDL cannot be waived because the commissioner for SARS has no such powers. If you disagree with the decision by SARS, you should file an objection within 30 business days. Your interest will continue to increase if you fail to notify SARS of your intention to object to its decision.

How Do I Submit Using Easyfile?

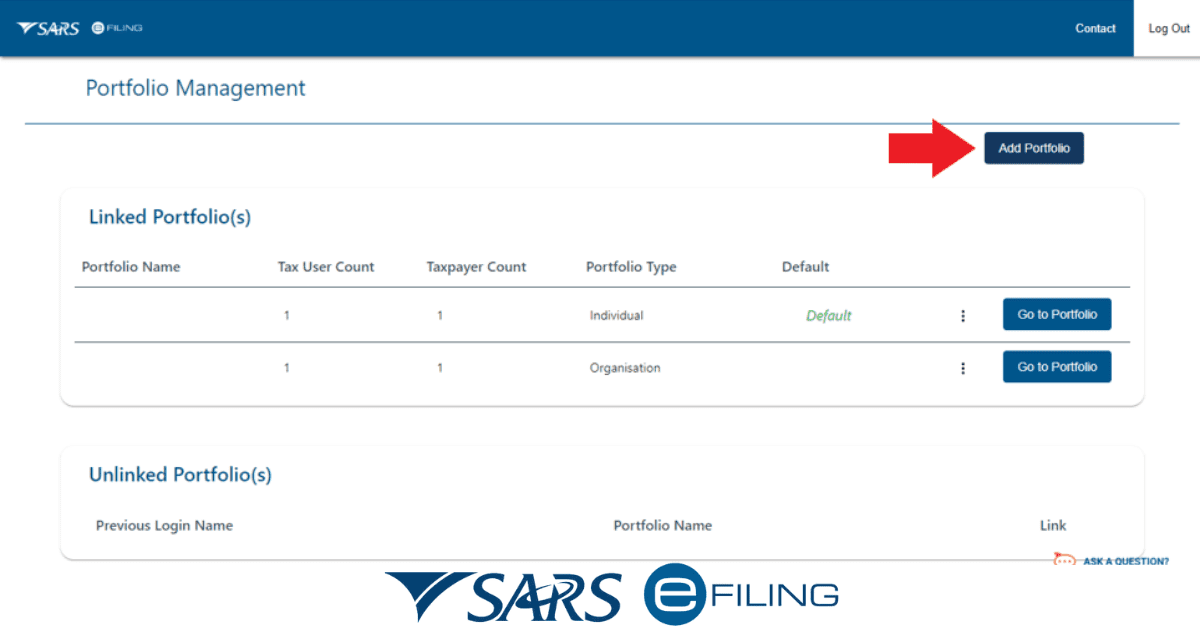

If you are an employer and intend to submit your Interim Reconciliation Declaration (EMP510), you can do it through SARS eFiling using the software known as Easyfile. This method is easy and convenient since it can handle everything for you.

You need to download the latest employer’s version of e@syFile and install it on your computer. You can use it to submit your outstanding monthly declarations (EMP201) and your yearly (EMP501) to SARS.

All employers must register their employees for income tax purposes. With SARS EasyFile, you can calculate your outstanding payment to SARS and process it without any problems. Click on the Submit block when you log in to your EasyFile account. Select “Submit, ” generate your IRP/IT3a from e@syFile and click export.

If you owe SARS any outstanding tax returns, you will likely be charged penalties and interest. Additionally, SARS has a right to demand the payment of what you owe. It can recover this money through SARS it88 or the Agent Appointment Notice, where the employer is used as the agent to recover outstanding payments. This is also known as a garnishee order, where SARS instructs the employer to deduct a certain amount from the employee’s salary. Remember that if you owe SARS money, you must pay it.