Are you looking to move into the bookkeeping and accounting field? Being registered as a tax practitioner with SARS means you have the right to compile and file tax returns and other tax matters at SARS on behalf of clients, instead of just for yourself. Of course, they won’t allow just anyone to do this. You will have to be a registered tax practitioner with SARS, and keep this status through the years you practice on other people’s behalf. We’re here with the details you need about becoming a tax practitioner at SARS today.

How Do I Become A Tax Practitioner At SARS?

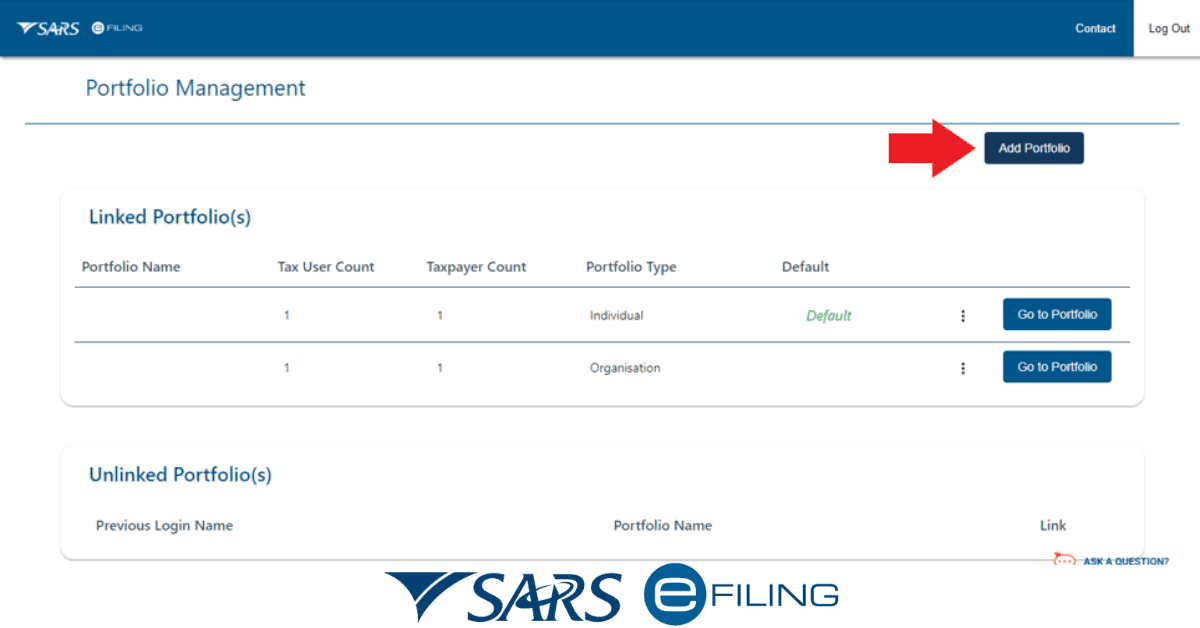

If you want to provide tax advice of any sort to other people and assist with the completion of returns that are not your own, you need to register as a tax practitioner and be recognized by SARS.

Of course, you can’t just approach them and claim to be a financial guru! You will need the underlying qualifications to operate in the tax field (more on this in a moment). If you are qualified, you must then also be part of a Recognised Controlling Body, or RCB. These institutions are governed by section 240A of the Tax Administration Act. There are several recognised RCBs for tax practitioners in South Africa,

These include SAICA, the SA Institute of Chartered Accountants, as well as SAIPA, the SA Institute of Professional Accountants. While these are the best known, there are also:

- The Chartered Institute of Management Accountants (CIMA)

- The Financial Planning Institute (FPI)

- The Chartered Governance Institute of Southern Africa (CGISA)

- The Institute of Accounting and Commerce (IAC)

- SA Institute of Taxation (SAIT)

- The Chartered Institute for Business Accountants (CIBA)

- The Association of Chartered Certified Accountants (ACCA)

You should consider which RCB best matches your field of specialization. Additionally, you will need a clear criminal record and will have to participate in continuous professional development programs recognized by your RCB each year to keep your training current. You will then pay an annual fee to SARS and your RCB to retain your tax practitioner status.

How Do You Qualify As A Tax Practitioner?

There are several educational routes you can take to become a tax practitioner. Regardless of whether you opt for a 3-year financial degree program or take certification courses, you must have a minimum of an NQF 5 qualification. You also need to meet the minimum educational requirements of your chosen RCB.

How Much Do Tax Practitioners Charge in South Africa?

The fees charged by tax practitioners in South Africa will vary significantly. They are affected by the complexity of your tax work, the experience and qualifications of the tax practitioner, the location of the tax practitioner’s office, and the specific services you need from them.

Many tax practitioners charge by the hour for their services. These hourly rates can vary widely, ranging from around R300 to R1,500 or more per hour. Higher rates are typically charged by experienced and specialized tax professionals.

Some tax practitioners offer specific services at flat fees. For example, they may charge a fixed fee for preparing an individual tax return, a company’s financial statements, or conducting a tax audit. These flat fees can range from a few hundred rand to several thousand rand, depending on the complexity of the work.

For more complex tax issues or larger enterprises, you may find tax practitioners who work on retainers or who take a percentage of the savings they create for you on your tax return. Remember that experienced tax practitioners with advanced qualifications, such as chartered accountants (CAs) or tax specialists, typically command higher fees than less experienced professionals.

Can You Become A Tax Practitioner Without A Degree?

As the minimum requirement for a tax practitioner in South Africa is an NQF 5, there are a few paths to becoming a tax practitioner without a formal Bachelor’s degree. Many aspiring tax practitioners choose the ICB, or Institute of Certified Bookkeepers, to kickstart their tax practitioner careers without having to enroll in a formal degree at university. Their top 2 qualifications are at NQF 5 and 6, and you can then gain accreditation with SAIT to practice as a tax practitioner.

What Is The Difference Between A Tax Practitioner And A Taxpayer?

Tax practitioners are experienced financial experts who are recognized by a controlling body (or RCB), have paid their membership dues to the body, and are recognized by SARS. This means they can advise the public on tax matters and can compile and file tax returns on their behalf.

In contrast, a taxpayer is a common term used to apply to anyone who pays income tax to SARS from their salary or income. While a taxpayer with sufficient financial expertise and confidence can compile their own returns, they cannot do so on behalf of other people, nor can they advise others on tax matters.

Becoming a tax practitioner is a great career path for qualified and recognized individuals in the financial field and one well worth considering if you enjoy working with the nitty-gritty of tax affairs.