SARS eFiling is a valuable tool that allows South African taxpayers to manage their tax affairs online. However, there may be instances when your eFiling account gets blocked or you cannot access it. These cases can be frustrating and cause unnecessary delays in managing your tax affairs. Fortunately, there are several steps you can take to unblock your eFiling account and get back to managing your taxes online. This guide will explore how to unlock SARS eFiling – including how to unlock the portal, reset your profile, reactivate your tax number

How do I unlock SARS eFiling

It can be annoying to get locked out of your SARS eFiling account. Although your account may be blocked, you can still access your tax information if you keep your cool. You have several alternatives for how to unblock your SARS eFiling account.

Try to unlock your account on your own as a first step. On the SARS eFiling login page, click either the “Lost Your Username?” or “Forget Your Password?” buttons. You will be prompted to submit personal information and security questions to reset your username or password.

Furthermore, you can ask your eFiling administrator for help if you represent a tax professional or organization. They can give you access to your tax records and aid in unblocking your account.

Also, you can contact the SARS Contact Center at 0800 00 SARS for assistance (7277). Their customer service representatives are skilled in assisting you in unlocking your account and recovering access to your eFiling profile.

You can typically successfully unblock your SARS eFiling account using one of these methods, allowing you to resume handling your tax matters.

How do you unlock the eFiling portal?

Stay calm if you’ve been shut out of the SARS eFiling portal because there are several ways to recover access.

You can initially attempt to unlock the portal by clicking “Forget Your Username?” or “Lost Your Password?” on the login screen. You’ll be required to submit personal information and respond to several security questions to authenticate your identity. If you have forgotten your password, you will receive an email or text message with a link to reset it. If you forget your username, you will be asked to create a new one.

If you offer services to a Tax Practitioner or Organization, your eFiling Administrator may also be able to assist you in gaining access to the portal. They have access to your account and can reset your password or unlock it if it has been locked due to too many unsuccessful login attempts.

Don’t worry if you’re still unable to activate the portal. Call the SARS Contact Centre at 0800 00 SARS (7277) for assistance. They will be able to assist you in regaining access to your eFiling account by guiding you through the necessary steps.

Remember to maintain the confidentiality of your login information to avoid being locked out in the future.

How do I reset my SARS eFiling profile?

To start over with your SARS eFiling profile, you just need to follow a few simple procedures. It’s easy to forget your password if you only use your eFiling account once a year to submit your tax return. But don’t worry because resetting your password is simple if you follow these instructions.

Visit the SARS homepage and select the appropriate “Forget Password” or “Forgot Username” link. After that, just stick to the on-screen instructions to change your password. Sending your new password to the secure email or phone number you specify will allow you to access your eFiling profile.

It is necessary to retrieve your username before you may reset your password if you don’t remember any of the two. To do this, go to the login page and select “Forget Username.” From there, fill out the form to reset your password. You can reset your password when you regain your username.

Another option for resetting your SARS eFiling profile is downloading the SARS Mobile app. If you’ve forgotten your password, use the “Forget Password” link and enter your username before proceeding to a page where you can reset it. You’ll receive a one-time password (OTP) via the method of your choice. Once you’ve entered the OTP, you can set up your new password.

After you set up your new password, you can reaccess your eFiling profile. Protecting your login information is crucial to avoiding any unwanted intrusions into your profile.

How do I reactivate my tax number with SARS?

If you’ve discovered that your tax number is inactive, you will need to reactivate it by contacting SARS. The easiest way to reactivate your tax number is to call the SARS Contact Centre at 0800 00 7277, and an agent will assist you in reactivating your tax number.

You can also reactivate your tax number by visiting a SARS branch. To reactivate your tax number at a SARS branch, you must provide your identification and proof of residence.

If you prefer the online method, you can reactivate your tax number using SARS eFiling. Log in to your eFiling account, click on the “Home” tab, and select “Register” from the drop-down menu. Next, select “Reinstate Account,” provide the necessary information and click “Submit.”

SARS will review your information and reactivate your tax number if everything is in order. Once your tax number is reactivated, you can continue filing your taxes and enjoy all the benefits of being a registered taxpayer.

How do I re-register for eFiling?

eFiling requires registration before use. Following the instructions below makes everything hassle-free:

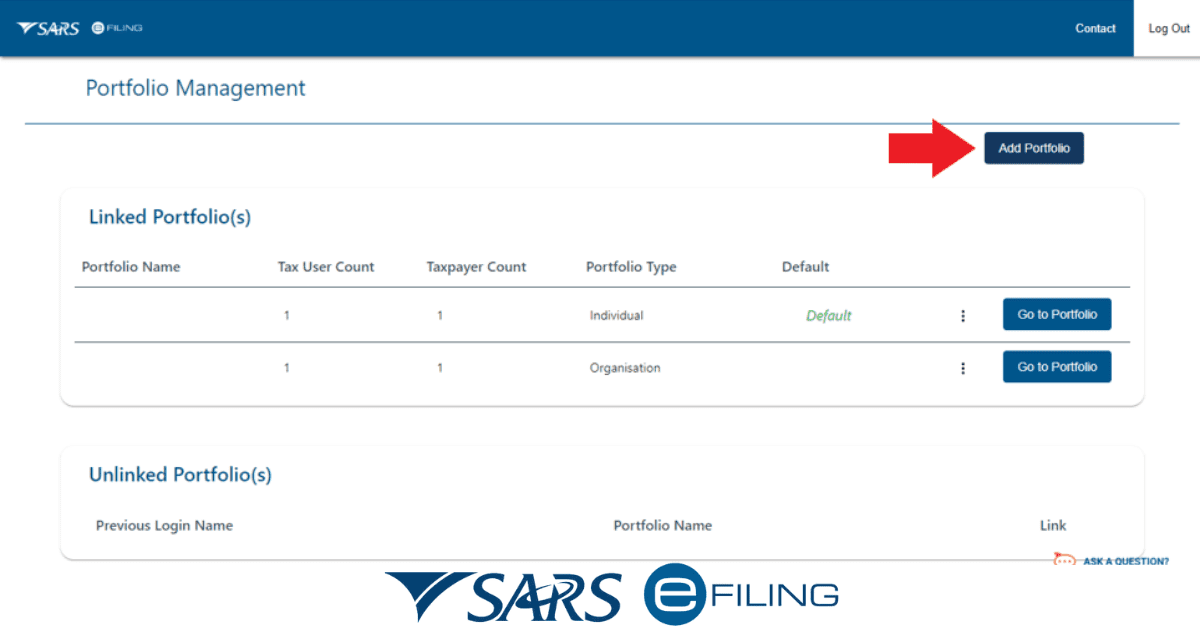

- Click “Register” on the upper right of the SARS website.

- Choose “Individual” or “Organisation” based on your tax status.

- Enter your contact and tax reference number.

- To activate your account, enter the activation PIN you get via email or SMS.

- After activating your account, you must generate a username and password for eFiling.

If you’ve registered but can’t log in, reset your username and password or call the SARS Contact Centre.

eFiling is only for registered taxpayers with a current tax number. But you can register for tax online or at your local SARS branch.

Conclusion

In conclusion, SARS eFiling is a simple and quick method for submitting your tax documents electronically. However, problems with your eFiling profile, such as losing your login or password, having your account blocked, or needing to reactivate your tax number, are common. You can reset your profile or re-register for eFiling, two of SARS’s many choices for dealing with these problems.

Generally, you can get back to using eFiling easily and quickly with just a little time and effort. Keep in mind that SARS also has a contact centre staffed by helpful people to answer any questions you may have. So, don’t worry if you’re having trouble with eFiling; just ensure you follow the instructions and get help if needed.