Claiming a portion of your costs spent on medical aid (and associated medical costs through the year) can be a sizable deduction on your income tax return each year. So, if you are a paid-up member of a recognized South African medical aid scheme for any portion of the tax year in question, it is well worth taking the time to make this deduction on your income tax return. Here’s everything you need to know about medical scheme tax certificates, which are a critical part of proving your medical aid expenditure to SARS to qualify for your deduction.

Where Can I Get My Medical Scheme Tax Certificate?

Every year, after the end of the tax year (typically February 28th), your medical aid will issue you with a medical scheme tax certificate. This not only proves that you were a member of the scheme and for how many months of the year, but it shows other vital information, too. This includes the amount you pay to the scheme every month and for whom- i.e. your dependants.

Remember that you can claim the MTC, the Medical Scheme Tax Credit, in cases where you yourself are not registered with the scheme but have a recognized dependant as the primary member for whom you are paying every month. This will have to be a dependent recognized by SARS- typically children and spouses, although other adults are also accepted in some cases.

You will get your Medical Scheme Tax Certificate directly from your medical aid provider.

How Do I Get My Medical Aid Tax Certificate?

You should receive your medical aid tax certificate directly from your provider sometime between the end of the tax year (February 28th) and the opening of ‘tax season’, which has a variable date but always starts in July of each year.

Typically, the medical aid will either mail you the certificate as a PDF attachment directly or will inform you via email or SMS of where to get it. Should you lose the email or need to re-download your tax certificate, most medical aid providers have an online self-service portal where you can do this from. It is likely to be the same portal you already use to monitor your policy and submit manual claims. Look for it under ‘documents’ or similar tabs, and select the correct certificate for the year whose tax return you are compiling.

If you have any doubt about where to find your medical aid tax certificate, or if you never received yours, reach out to your medical aid provider directly and ask them to resend it to you or give you details on how to access it.

How Much Do You Get Back From SARS for Medical Aid?

You can claim a fixed rebate, the Medical Schemes Tax Credit (MTC), for every month you are a member of the scheme. For the 2024 tax year, this rebate is R247 for the primary member, R694 for a primary member and one dependant, and an additional R234 per dependant thereafter.

Additionally, you can roll some of the cost of more expensive medical aids into the AMTC, or Additional Medical Tax Credit. For most young people without disabilities, this will be any excess above four times the MTC. For those over 65, and those with disabilities or supporting a person with disabilities, this becomes 33.3% of three times the MTC.

How Do I Download My Discovery Medical Tax Certificate?

Discovery is one of the largest medical aids in South Africa, and many taxpayers use it. Luckily, they have many channels for you to download your Discovery medical aid tax certificate. You can log in to your Discovery Medical Portal and search for it using ‘find a document’. This is also available to you on their medical aid app. Discovery has both a WhatsApp contact point and a call center which will assist you if you have any problems accessing the certificate.

Most major medical aids in South Africa work similarly and will have similar channels for you to request help from as you need. Do remember that medical aid tax certificates will not be immediately available on the last day of the tax year, as the provider has to compile all your information (including the final month of the year) for tax purposes. It should be available to you before tax season opens every year, however, so make inquiries if you haven’t received it by the end of June.

How Do I Calculate My Medical Expenses Tax Refund?

Calculating your medical expenses tax refund can be tricky, and it is likely to be one of your biggest deductions for income tax every year. Firstly, you will look at the basic credit you earn for the MTC, which allows you to deduct a set amount per month (updated annually) for being part of a medical aid scheme. This will be your primary medical expenses tax refund.

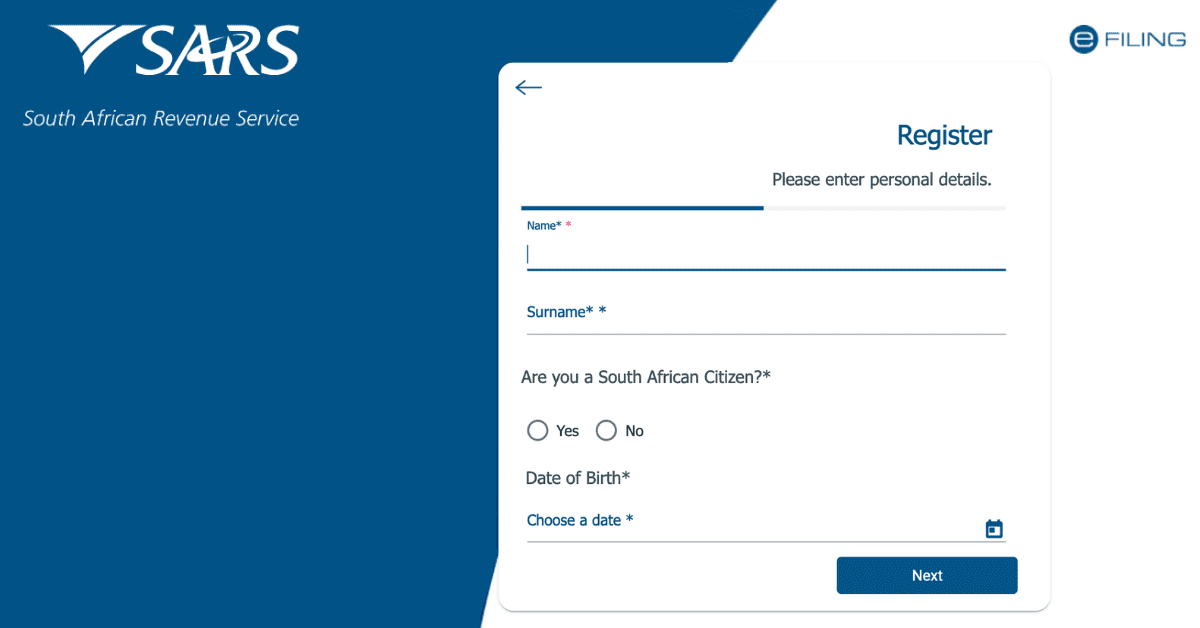

After that, you will need to work out your AMTC, or additional medical tax rebate. This covers recognized medical expenses not claimed from a medical aid. A specific portion (25% of expenses over 7.5% of your taxable income) of these qualifying expenses can also be claimed as your secondary medical tax refund. As this is very complex indeed, you will be glad to know that the income tax form on eFiling will auto-calculate it for you from the total of your qualifying medical expenses. Remember, you will need to be able to prove these expenses. SARS won’t just take your word for it.

Hopefully, you now better understand the role the medical scheme tax certificate plays in proving your MTC claim on your income tax form each year, as well as other medical claims you can make.