While most individuals will only ever need one taxpayer profile on eFiling, even if they use different tax types, there are cases where you will need to add the profiles of multiple taxpayers to one account. Think organizations and tax practitioners who handle multiple clients’ accounts from a central profile. Today we walk you through everything to know about manipulating profiles on eFIling, creating portfolios, and more.

How do I add a New Taxpayer Profile to eFiling?

Here’s how to add a new taxpayer profile to your eFiling profile:

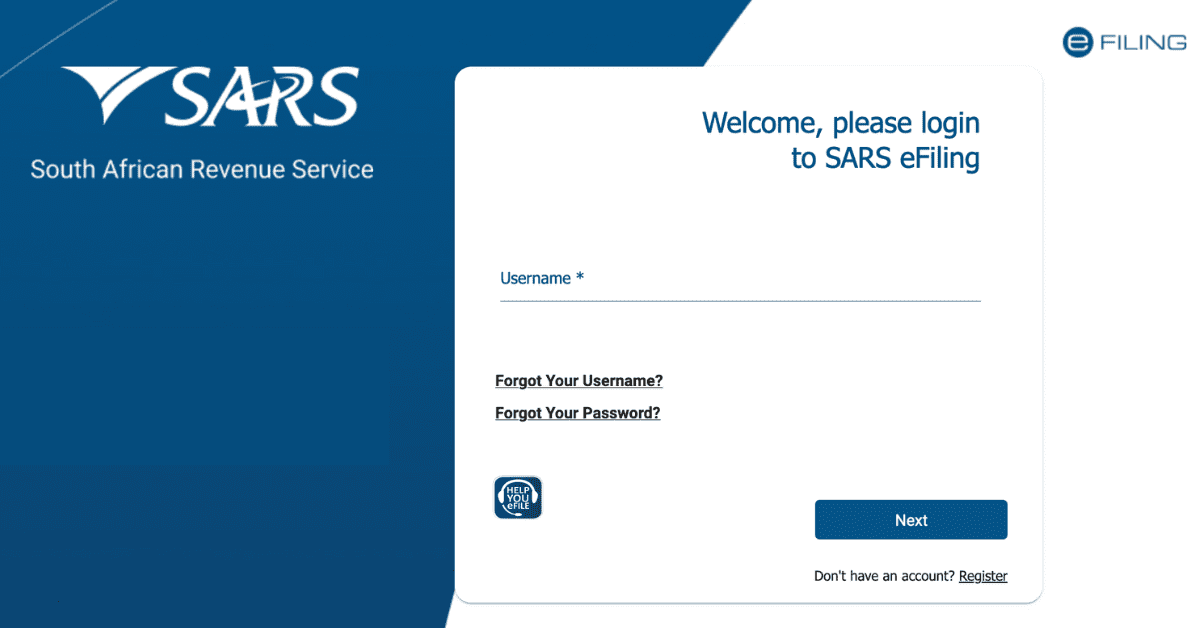

- Go to the eFiling website

- Register for a new account (see steps below) or log in to your existing account.

- Click on the “Register New” button in the “My Account” or “Organization” section (profile type dependant).

- Enter the necessary information, such as the taxpayer’s name, SA ID number, and physical address.

- Select the type of tax for which the taxpayer is registered (e.g., personal income tax, VAT, etc.).

- Add any additional details as required (such as bank details for refunds, or the taxpayer’s telephone number).

- Review the information you have entered and make sure it is correct.

- Submit the new taxpayer profile.

- Once the taxpayer profile has been successfully submitted, you will be able to view it in the “My Account” section and use it for future eFiling submissions.

To run multiple profiles concurrently on eFiling, you typically have to have a profile set up to handle them. For most individuals, you will need to merge profiles if you have to change them for any reason, although new changes to the SARS system have made this much easier to do. If you are a tax practitioner taking over an existing account, you may have to apply to merge profiles, rather than recreating the client’s profile from scratch, which could cause issues.

How do I add a Portfolio to eFiling?

Instead of running a new profile, you also have the option to add a portfolio to better manage your profiles and tax types. This allows you to create different roles for added convenience.

Follow the same steps as for a profile- go to the eFiling site and log in to your account. Now do the following:

- Click on the “Portfolio Management” tab in the “My Profile” section.

- Click on the “Add Portfolio” button. It will be on the top right of the screen

- Enter a name for the portfolio (e.g. “Personal Tax Returns”) and type for the portfolio (e.g income tax).

- Review the information you have entered and make sure it is correct.

- Submit the new portfolio.

Once you have submitted the portfolio, you will be able to view it in the “Portfolios” tab, where you can manage the taxpayers included in the portfolio and submit tax returns for the portfolio as a whole.

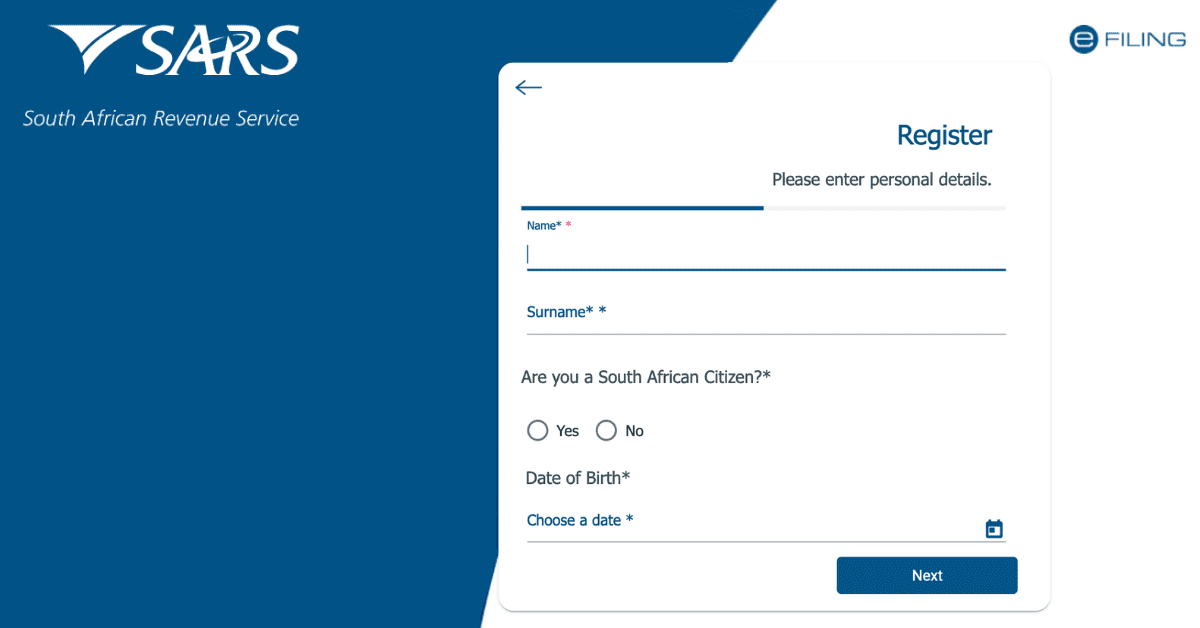

How do I Create an eFiling Profile?

As you can see, having your SARS portfolio correctly set up is essential, especially if you are handling multiple profiles and portfolios. You can only have one primary Username to access eFiling, so if you are creating profiles for clients and so on, do not try to recreate the overall profile. Rather add and link them to the primary username, as detailed above. Here’s the easy steps to create your first eFiling profile:

- Go to the eFiling website.

- Click on the “Register” button in the top right corner of the page.

- Enter your personal information, including your name, ID number, and contact details.

- Create a username and password for your account.

- Read and accept the terms and conditions of the eFiling service.

- Verify your email address by clicking on a link sent to you in an email from eFiling.

- Log in to your new eFiling account!

Once you have logged in to your new eFiling account, you can add taxpayer profiles, manage portfolios, and submit tax returns easily and digitally. It’s important to keep your personal information up to date in your eFiling profile to ensure that you receive important communications from SARS and are able to submit returns and access services without any issues. It is good practice to check your profile details (especially email, bank, and phone options) at least annually to ensure you are up to date.

How do I Manage Users on eFiling?

Organization profiles, in particular, will often allow for multiple users to log in to the same eFiling profile. Over time, you may need to alter what a specific user can access, or even remove them from the account. Here’s what to do:

- Once again, start by logging in to your eFiling profile. Enter the User Management section on the left-hand tab.

- To add a new user, click on the “Add User” button and enter the new user’s information, including their name, contact details, and the level of access you want to grant them (e.g., view-only or full access).

- To edit or delete an existing user, click on the user’s name to access their profile, then click on the “Edit” or “Delete” button as appropriate.

- Don’t forget to ensure the original profile administrator has all rights, or you will create issues and conflicts accessing parts of the profile.

It’s important to regularly review the list of users associated with your eFiling account to ensure that only authorized individuals have access to your tax information. You can revoke access or update the level of access granted to any user at any time.

How do I Change my Primary account on eFiling?

Your primary account is the account that is used as the default for accessing and managing your tax information on eFiling. By changing your primary account, you can easily switch between different portfolios or taxpayer profiles without having to log out of your eFiling account and log in again. Make sure you choose the username and default profile you want to log in to directly.

- Click on the “My Profile” tab in the top navigation bar then head to “Profile and Preference Setup”

- Click on the “Change Primary Account” button.

- Select the new primary account from the list of available accounts.

- Confirm the change by clicking on the “Change Primary Account” button.

How Can I Reset My eFiling Profile?

You cannot truly ‘reset’ an eFiling profile. Remember, this is a digital system linked to your tax number, with your tax history associated with it. If for any reason you need to change tax numbers, or create a new eFiling profile due to errors with the old, you will be better off chatting to a SARS consultant to merge the old profile or help create and correctly link the new one. However, if you cannot remember your eFiling access details, you can do the following from the eFiling website:

- Click on the “Forgot Password” link on the login page.

- Enter the email address associated with your eFiling account.

- Follow the instructions in the password reset email sent to you by eFiling to reset your password.

- If you have forgotten your username, choose the “Forgot Username” option and enter the cell and email details for your account alongside your tax number. Follow the reset instructions provided.

If you are having trouble resetting your password or accessing your eFiling account, you can also contact the eFiling Call Centre at 0800 00 7277 for assistance. They will be able to assist you in resetting your account and help you regain access to your eFiling profile.

And there you have it! It is important to correctly set up and manage your primary profile, users associated with it. The profiles and portfolios you add to it, so make sure to regularly check that everything is correct on your eFiling profile as a matter of habit.