A Tax Clearance Certificate, or TCC, was once a key part of the SARS ecosystem. A TCC would allow you to do things like apply for government tenders and become an official vendor to companies. It acted as critical proof that you were fully tax compliant with SARS. While SARS has simplified the system and given the classic TCC a facelift, it’s still an important way to prove your tax status with them. Here’s everything you need to know about eFiling, SARS, and TCCs, now known as TCSs.

What is a TCC from SARS?

TCC stands for Tax Clearance Certificate, which is issued by SARS. A TCC is a certificate that indicates that an individual or a company has met their tax obligations to the government and is considered tax compliant. It is a requirement for certain transactions, such as tenders, contracts, and procurement, and is a way for the government to ensure that all businesses and individuals are paying their fair share of taxes. The classic TCC was stopped by SARS in November 2019 and replaced with a quicker and easier system called the Tax Compliance Status System (TCS). Luckily, it is still a simple process to apply for one, and it can be done online through the SARS eFiling website.

How to Apply for SARS TCC via eFiling

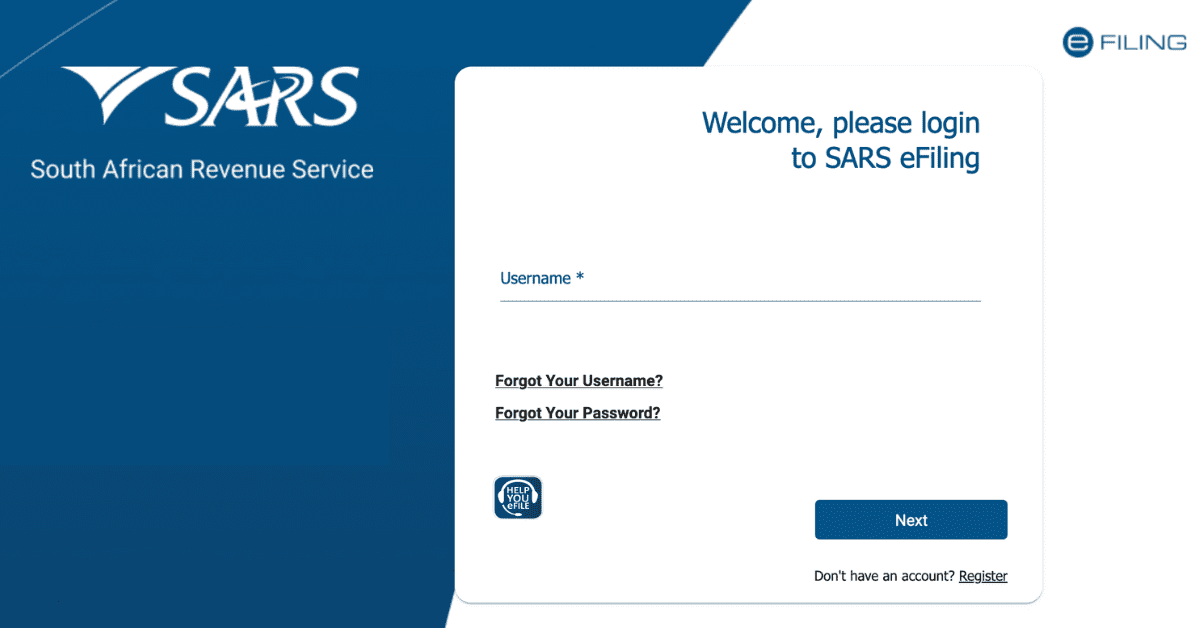

To apply for the new SARS TCS (which replaced the TCC system in 2019), you will need to have an existing and operational eFiling profile. Log in to your profile. Of course, you need to actually be tax compliant to receive a positive status, so take the time to make sure all your tax compliance is up-to-date.

You will need to activate your Tax Compliance Status. This is a one-time step and will not be needed again in future. You will need to have the user rights to do so if you are using an Organization-type profile. Once you have activated the service, you will be able to access the MCP, or My Compliance Profile, tab on your eFiling.

When you head to this menu, you will see your tax compliance profile there. Of course, you don’t want to allow strange entities to log in to your eFiling profile! So select the ‘Tax Compliance Status’ option. Select the type of TCS you want to generate (the same options as the old TCC). Follow the prompts to create the request and have it sent to SARS.

You will then be sent a PIN you can provide to the interested party, which will allow them to view your tax compliance status via their own eFiling.

How do I Check my SARS TCC Online?

Once you receive your TCS PIN, your tax compliance status can be provided to any interested party. However, you can also use the MCP dashboard to access your own tax compliance status and see what action you need to take.

Areas where you are compliant will show as green. If there is an issue, it will show as red. To fix any red areas, you should first remedy the issue- usually outstanding payments or returns. You may even have a payment which has been unallocated or incorrectly allocated

How do I Claim my Transfer Duty Back from SARS?

Transfer duty is a tax type levied on any property sales in South Africa. There are rare circumstances under which you can claim back the transfer duty you have paid from SARS. If you meet these qualifying circumstances, here’s what you need to do:

- You will need to provide proof of payment of transfer duty, such as a receipt or bank statement, as well as proof of the transaction, such as a copy of the sale agreement or transfer documents.

- You will need to complete a form from SARS, such as a Tax Directive or Refund Application, to request a refund of transfer duty. The form you need will depend on the specific circumstances of your case.

- You can submit your claim to SARS either in person at a SARS branch or electronically. When submitting your claim, make sure to include all the required documents and forms.

- SARS will review your claim and determine if you are eligible for a refund. This process can take several weeks or months, depending on the volume of claims received.

If your claim is approved, you will receive a refund of the transfer duty you paid into your bank account.

It’s important to note that transfer duty refunds are only available in certain circumstances, such as if the property transfer did not go through or if there was a mistake in the calculation of the transfer duty. Additionally, there may be time limits for making a claim, so it’s important to act promptly if you believe you may be eligible for a refund.

How do I do SARS eFiling online?

You can do many other things besides access your TCS on SARS eFiling. To get started with eFiling:

- Go to the SARS eFiling website

- Register for eFiling. You will need to provide your personal information, including your tax reference number and ID number, and choose a username and password.

- Wait for SARS to process your eFiling. This can take several days, depending on the volume of submissions received.

- Log in to your eFiling account once created.

- Add your tax types to your profile, like Income Tax returns, Value-Added Tax (VAT) Returns, or Provisional Tax Returns.

- Upload any supporting documents required.

Using eFiling with SARS is mandatory for certain taxpayers, such as companies and individuals with a taxable income above a certain threshold. Additionally, you need to be up to date with your tax obligations, including filing all required returns, before you can use eFiling or generate a positive TCS/TCC.

Now you know more about the TCS (which replaced the SARS TCC) and how to access it on your eFiling profile, you hopefully feel empowered to maintain this important part of doing business in South Africa via your eFIling profile.