eFiling by SARS is a service offered to South African taxpayers that makes it possible for them to file their income and other taxes conveniently online. Taxpayers are able to enjoy this secure service at no cost, and it is accessible to anyone that has a valid South African ID Document and a residential address.

SARS urges all taxpayers to make use of the eFiling service, and once you know how, it will change the way you do your taxes forever. Navigating the eFiling website as a new user can be a little tricky, and as with any filing system, you want to minimize making any errors.

In this article, we’ll discuss how to access your SARS profile and answer some of the common questions users have when using eFiling.

How do I access my SARS profile?

To access your SARS profile, you will first need to be registered for eFiling. Taxpayers that are registered for eFiling are able to communicate with SARS online to perform a number of transactions in a secure online environment.

If you have already registered for eFiling but have forgotten your username or password, there are two methods you could use to gain access.

Method 1

Visit the SARS eFiling website www.sars.gov.za, and click on “Forgot Username” or “Forgot Password”.

- To request your username, you will be asked to input your cell number and email address and confirm that you are a South African Citizen. If your profile is active, SARS will send your username to the number and email provided.

- To request your password, you will be asked to confirm your username. They will then send you an OPT, which you will need to submit to proceed.

Method 2

Call SARS Contact Centre on 0800 00 7277, and one of their consultants will be able to assist you telephonically.

If you are not registered on SARS eFiling, you will not have a username or password. Therefore, you will need to create an account, which can be done easily online. Here’s how to set up your SARS profile:

- Visit the SARS eFiling website at www.sars.gov.za.

- Click on ‘Register.’

- Fill out all the registration information and submit it.

When you register for eFiling for the first time, you will not have a tax reference number immediately. Once SARS validates all your information, a tax reference number will be issued to you automatically.

Individuals that are unable to register via eFiling can request an eBookng appointment with SARS by calling the SARS Contact Centre. A SARS official will book an appointment on your behalf, and you will be required to visit your nearest branch with the following documents to complete the registration process:

- Proof of Identity

- Proof of Address

- Proof of Bank Details

Not sure if you are registered?

First-time users may be unsure if they already have a SARS profile because their employer or a tax practitioner may have handled their filing needs in the past.

In this instance, you can either:

- Ask your Employer or Payroll department.

- Use the SARS online ‘Query function.’

- Call the SARS Contact Center.

Once you have your username and password, you can log in to SARS eFiling and access your profile.

What is a SARS primary Login?

Your SARS primary login is the default username that you select to access your eFiling profile.

The purpose of having a primary user is to allow you to use a single username accessing eFiling, and it is mainly used by individuals that have multiple profiles linked to their account.

By using a Primary username, none of the clients listed on your profile will be affected and will still be accessible as normal.

How do I change my profile on eFiling?

It’s important to keep your profile up to date. Any key changes, such as a change of contact number or address, will require you to update your profile accordingly.

Here’s how to do this:

- Visit the SARS eFiling website at www.sars.gov.za.

- Login using your existing username and password.

Once you are on the eFiling home screen, you will notice a button labeled ‘My Profile’ on the left menu pane.

- Click on ‘My Profile.’

- Click on ‘Profile and Preference Setup.’

The ‘Profile and Preference Setup’ section will allow you to update and manage the following details:

- Your primary login details.

- Security contact details.

- Two-factor authentication.

- Passwordless login.

Once you have updated and saved the new information, an online approval request will be sent to your email or cell number, which you will need to submit to confirm your changes.

Note: You will not be able to change your ID number or Tax Reference Number on this screen.

How do I link my company to my personal eFiling profile?

First, the company must have a Registered Representative on SARS’s record to complete this process correctly. If you want to register as a company representative, you can visit the SARS website or call the SARS Contact Centre.

If your company has several registered representatives, you will need to nominate one person to be the official ‘representative person’ for the company with SARS.

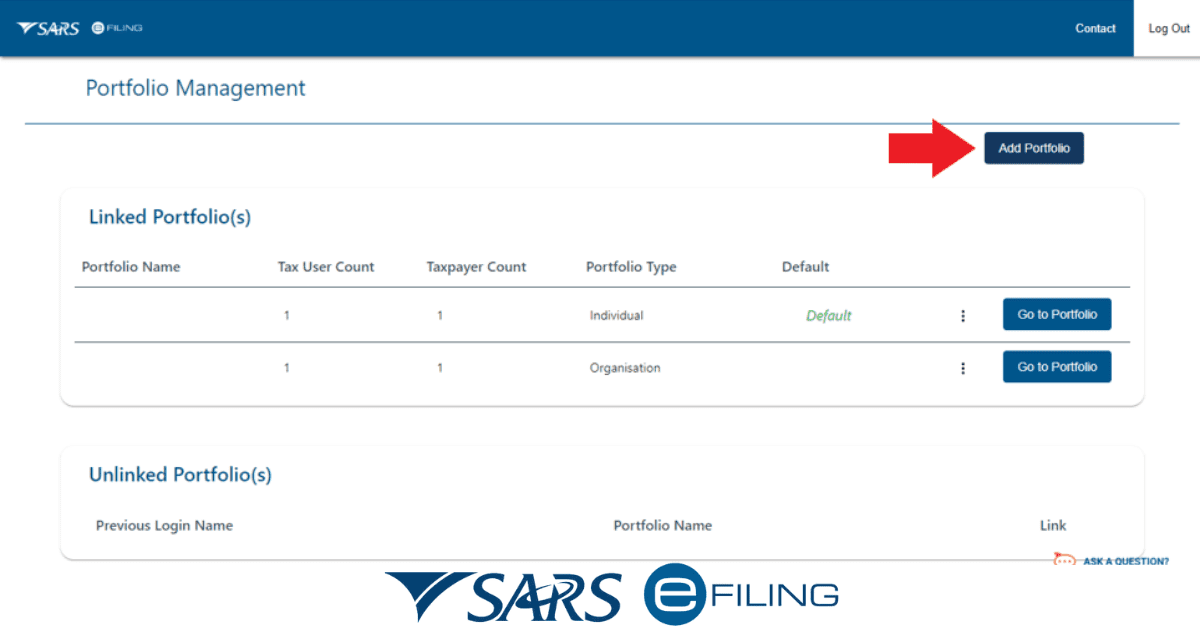

Thereafter you can proceed to link your company to our profile. Here are the steps:

- Login to your SARS eFiling profile at www.sars.gov.za.

- Click on ‘My Profile.’

- Click on ‘Portfolio Management.’

- Click ‘Add Portfolio.’

- Enter the Portfolio Name.

- Select ‘Organisation’ from the ‘Portfolio Type’ options on the drop-down list.

- Click ‘Add Portfolio.’

A pop-up message should then appear, confirming that your portfolio has been added successfully.

Once you’ve added an organisation portfolio:

- Click on ‘Go to Portfolio’ on the organisation portfolio that you just created.

- Click ‘Organisations’ on the left navigation tab.

- Click ‘Register New.’

At the top of the page, you will see a section for ‘Registered Representative’. If you are the registered representative, then simply click the link in the ‘Registered Representative’ section to choose the company you want to add.

If you are not the registered representative, your company details will not appear when you click the link, and you will receive an error message. Therefore, you will have to enter the entity details manually and request access from the registered representative.

Requesting access from the registered representative can be done on the same screen under the section labeled “Capture Entity Details.’

How do I retrieve my tax user ID and password?’

If you have already registered for eFiling but have forgotten your username or password, there are two methods you could use to regain access.

Method 1

Visit the SARS eFiling website www.sars.gov.za, and click on “Forgot Username” or “Forgot Password”.

- To request your username, you will be asked to input your cell number and email address and confirm that you are a South African Citizen. If your profile is active, SARS will send your username to the number and email provided.

- To request your password, you will be asked to confirm your username first. If your username is valid, SARS will send you an OTP which you will need to submit to gain access.

Method 2

Call SARS Contact Centre on 0800 00 7277, and one of their consultants will be able to assist you telephonically.

How can I get my username and password at SARS?

Getting your username and password is easy to do on the SARS eFiling website. All you need to do is visit www.sars.gov.za, click on “Forgot Password” or “Forgot Username”, and follow the simple prompts.

If you require both your username and password, you will need to recover your Username first.

- Click ‘Forgot Username’.

- Complete the information and submit it.

To request your password, you will be asked to confirm your username. They will then send you an OTP which you will need to submit to gain access.

How can I access my tax file online?

Accessing your tax file to check your previous assessments, refunds due, etc., can be done easily on the SARS eFiling website.

- Visit www.sars.gov.za.

- Login to your account using your existing Username and Password.

- Click on ‘User’ in the menu tab at the top of the page.

- Click on ‘Organisation Tax Types.’

On this page, you will be able to see all the tax types, such as Individual Income Tax, Provisional Tax, etc. You will also be able to see if the tax type is successfully activated.

Note: You must be registered for Income Tax in order to view this.

To check the status of each tax type:

- Click on ‘Returns’ from the menu at the top of the page.

- Click on ‘Returns History.’

- Select the tax type you want to view.

On this ‘Returns’ page, there are several other functions that you can access, including:

- Historic and pending submissions.

- Historic and pending payment.

- SARS correspondence, and much more.

How do I retrieve my tax information?

Recovering your tax number can be done easily and in several ways, once you’re registered for eFiling. The most common online methods include:

- Send SARS a query on the SARS website.

- If you are a registered eFiler, it will be displayed on your eFiling profile.

- You can request a notice of registration via the eFiling MobiApp.

You can also receive the information you require at a SARS branch directly.