Taxation is essential in South Africa because it’s how the government pays for things like building infrastructure, education, health care, and social welfare.

The goal of tax directives is to help taxpayers understand and follow their tax obligations and make sure that the money collected is used effectively and efficiently.

The South African Revenue Service, which is abbreviated as SARS, also needs tax directives to enforce tax laws and collect the right amount of tax. With a good tax system, South Africa can grow its economy, reduce poverty and inequality, and give its people a better future.

Our article will focus on registering tax directives on eFiling

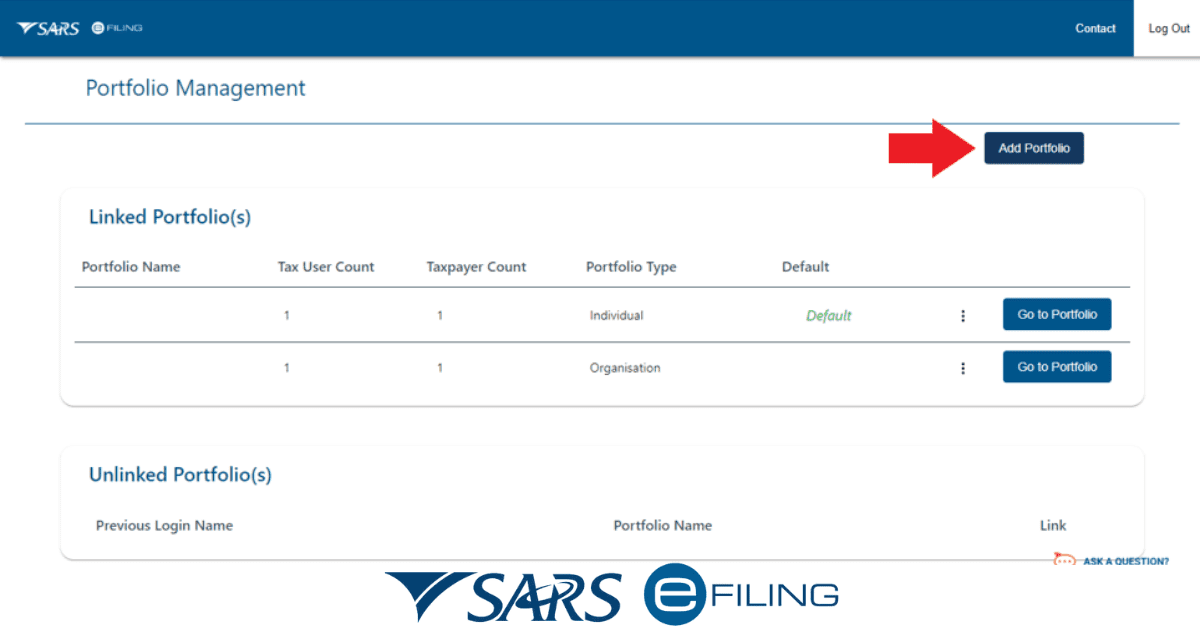

How do I register for tax directives on eFiling?

Taxpayers in South Africa can sign up for tax instructions on eFiling, an online platform run by the South African Revenue Service (SARS). eFiling lets taxpayers take care of their taxes online and makes it easier for them to meet their tax obligations. Follow these steps to sign up for tax directives on eFiling:

- Go to the website for eFiling using www.sarsefiling.co.za and sign up for an account.

- Give your personal and tax information to finish the registration process.

- Click on the link that was sent to your email to confirm your email address.

- Sign in to your eFiling account and click on the “Registration” tab.

- Tax Directives is one of the registrations you can choose from.

- Fill out the form to register for the tax directive and send it in.

- Once you have signed up for tax directives, you can view and manage them online.

If you need to, you can also ask for changes or updates. eFiling makes it easier for taxpayers to keep up with their tax responsibilities and avoid getting fined for not doing so. By signing up for tax directives, you can make sure that you are paying your taxes and helping South Africa grow and develop.

How long does it take to get a SARS tax directive?

Taxpayers are urged to apply for their tax directives well before the deadline in case there are any delays that are out of their control.

When asking for a tax directive, it’s important to give complete and correct information to ensure the process goes smoothly and quickly.

How long it takes to get a SARS tax directive depends on a number of things, such as how complicated the request is, how many requests SARS gets, and how well the system works.

Most tax directives from SARS take two business days to come out. Unless SARS has to do it by hand, in some cases, it can take at least 21 business days to be issued.

What does it mean if SARS issued a tax directive?

Tax directives are an official instruction from the South African Revenue Service (SARS) that determines the amount of tax that an employer is required to deduct from an employee’s salary, pension, or other taxable income. These deductions can be made from the employee’s salary, pension, or other taxable income.

They are devised to assist taxpayers in meeting the requirements of their tax obligations and ensuring that SARS collects the appropriate amount of tax revenue. Tax directives are meant to offer employees and employers alike clarity and direction regarding how to comply with various tax laws and regulations.

This is the primary objective of tax directives. Tax directives serve not only as a means for SARS to enforce tax laws but also as a method for the organization to ensure that the revenue collected is utilized in an effective and efficient manner.

They help to ensure that the tax system is fair and equitable by ensuring that everyone pays their fair share of tax based on their income.

This ensures that everyone contributes to the system in a fair and equitable manner. Taxpayers in South Africa can aid the nation’s economic growth and development by adhering to the country’s tax directives and following them to the letter.

Why did SARS decline tax directives?

There are a number of reasons why SARS can decline a taxpayer’s request for a tax directive, such as the taxpayer’s failure to comply with applicable tax laws and regulations, the existence of outstanding tax debts, or the use of incorrect calculations.

It’s important to make sure that all tax returns have been filed and any tax debts have been settled before applying for a tax directive because they will only be issued to individuals who are in compliance with their tax obligations.