Once you are considered a non-resident, you will still be subject to paying tax on income earned in South Africa. If you emigrate tax, foreign income will no longer be taxable. If you want to change your tax residency status, you should notify the South African Revenue Service (SARS). Keep on reading to learn how you emigrate tax from South Africa.

How Do I Emigrate Tax From South Africa?

If you want to emigrate tax from South Africa, you no longer need to lodge a formal application to the South Africa Reserve Bank (SARB) to do so. However, SARS would need to verify if the taxpayer is no longer resident in the country and ensure all applicable CGT exit charges are remitted.

The taxpayer is required by law to notify SARS when they choose to become a non-resident. When you become a non-resident, a deed disposal will arise for the Capital Gains Tax (CGT) functions where the taxpayer is considered to have disposed of their worldwide assets on the day they make the decision. The assets that will remain in South Africa are excluded from the deemed disposal of the taxpayer’s wealth.

To cease tax residency with SARS, the taxpayer should follow the channels below.

- Capture the date on the ITR12 tax return where the taxpayer checks the box with their residence status. SARS will send a letter to the taxpayer requesting them to provide supporting documentation to corroborate their claim.

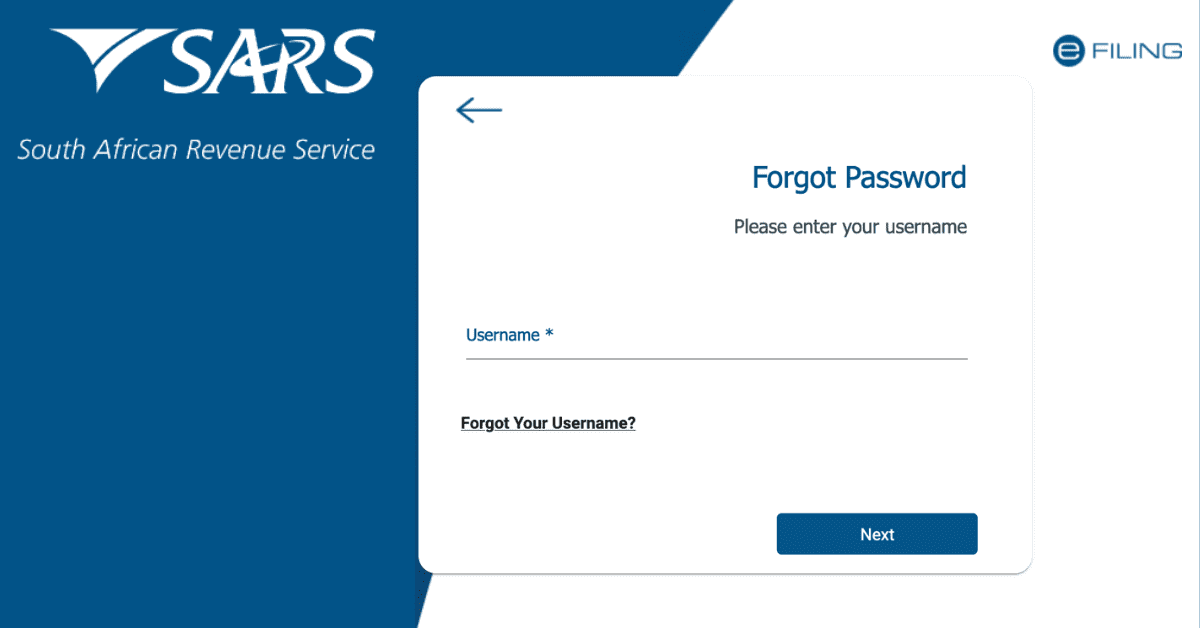

- The taxpayer can also cease tax residency through the Registration, Amendments, and Verification Form (RAV01) available on eFiling. You should capture the date you cease to be a resident under the “Income Tax Liability Details” section. You also need to complete a non-resident declaration form which you must submit with other relevant supporting documents on eFiling. You must capture the applicable date and inform SARS on your next ITR12 tax return.

You should supply the following documents if you want to cease tax residence according to physical presence tests.

A taxpayer who ceases residency due to an application for a Double Taxation Agreement must provide standard documents together with a certificate of tax residency obtained from a relevant Foreign Revenue Authority. Without such certificates, you can get a letter from the Foreign Revenue Authority outlining that you are a tax resident in that particular country.

If you cease residency according to the ordinarily residence test, you must provide a motivational letter and appropriate supporting documents listed below.

- A signed non-resident declaration indicating that you qualify to cease your tax residency.

- A copy of the travel diary and passport

- A letter of motivation stating the reasons for disclosure.

- Type of Visa applied

- Proof of permanent residence, if applicable

- A certificate of tax residence in the foreign country

- Details of business interests and property in South Africa

When you comply with the above processes, you will get a SARS letter of confirmation of non-residence.

How Much Money Can I Take Out of South Africa if I Emigrate?

If you are emigrating, you are likely to take your money from South Africa. It is vital to understand the exchange control limits on different methods that can be used to transfer funds out of South Africa. You must seek authorisation from SRB if you want to carry an amount exceeding R25 000. If travelling within the Common Monetary Area (CMA), you can carry unlimited South African currency.

You can transfer your funds abroad via the Single Discretionary Allowance or Foreign Investment/Foreign Capital Allowance. You can move your funds abroad via a Special Allowance when the amount exceeds both allowances, but you need to seek prior approval from SARB.

The South African Foreign Capital Allowance is for South African residents who are temporarily abroad and are allowed an annual allowance of R10 million. This facility is available for individuals with 18 years or older, who have a green bar-coded ID, and who have a Tax Clearance Certificate obtained from SARS. With the Single Discretionary Allowance (SDA), you can move R1 million out of South Africa per calendar year.

How Do I Break Tax Residency in South Africa?

According to the physical presence test, if you are considered a tax resident in South Africa, you cease to be a resident if you are outside the country for 330 consecutive days. You must declare your change of tax residency status in South Africa. A person who is resident for tax in South Africa is considered by way of physical presence or way of “ordinarily residence.”

How you have been a tax resident in South Africa determines how you will cease to be a tax resident. Once you cease being ordinarily resident, your tax residence also ceases. This can be proved by the following factors:

- Type of visa you have to a foreign country

- Proof of permanent residence in another country

- A certificate of tax residence from the foreign country

- Details of properties and business interests you still have in South Africa

- Family details, whether they are still in South Africa or not

- Information about your visits to South Africa

You will no longer be taxed in South Africa once you cease to be a tax resident. You can declare your cessation as a tax resident of South Africa by informing SARS via the Registration, Amendments, and Verification Form (RAV01) on eFiling. Capture the date you cease to be a tax resident.

How Do I Permanently Leave South Africa?

If you obtain permanent residence and tax residence in another country, you can permanently leave South Africa since you will no longer have any tax obligations in the Republic.

You must complete the tax emigration process with SARS to get a Non-Resident Tax Status Confirmation Letter. Without getting this letter, it means your tax residence status has not yet changed. If you still need to leave South Africa, you must submit a new application.

What is Required to Financially Emigrate from South Africa?

The process to financially emigrate from South Africa is lengthy and admin-intensive, so you must make an informed decision. You also need to know the difference between financial emigration and emigration.

If you emigrate to another country to work there without notifying the South African Reserve bank (SARB), you will remain a tax resident liable to pay tax. You are considered to be a resident who is temporarily abroad. However, financial emigration involves changing your tax residency status with SARB to a non-resident.

When you financially emigrate from South Africa, you will need to obtain a tax clearance certificate. However, you are not required to surrender your South African identity or citizenship. If you financially emigrate, you can still come back and live and work in South Africa. However, if you come back within five years, you can face financial consequences.

To undertake the financial emigration process, you must partner with a South African Commercial bank that can help you. You need to complete the MP336 (b) form, which must be submitted to your bank together with your certified copies of passports, ID, birth certificates, tax clearance certificates, and letters of confirmation.

You should provide your certificate of naturalisation, citizenship, or permanent residence in the country you intend to move to. If you have fixed property, you must provide original title deeds. The entire process usually takes about six to eight weeks.

You will need to apply for an emigration Tax Clearance Certificate from SARS. You must include a statement of your assets and liabilities in your application for emigration tax clearance. You must also include your insurance policies, retirement funds, business interests, trusts, donations, loans, property, inheritances, and income.