SARS eFiling has made filing tax returns simpler than ever.

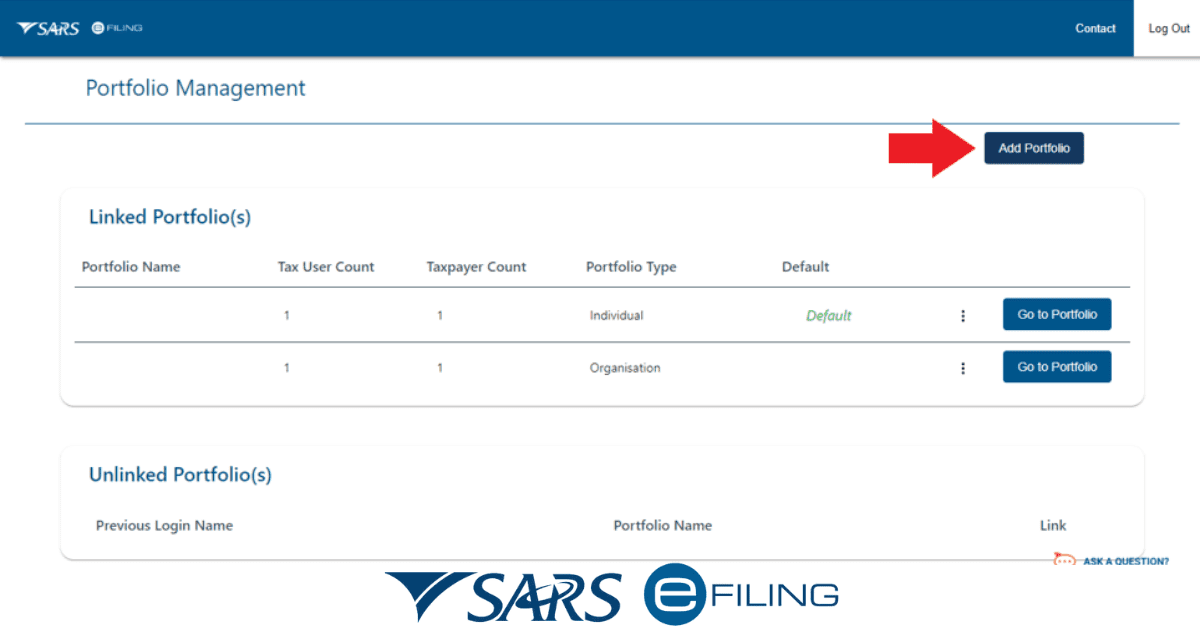

The Portfolio Management feature on eFiling allows eFilers the ability to use a single login to transact between their existing Portfolios. Once a portfolio is verified and linked to a Primary User

What is a portfolio on SARS eFiling?

Registered eFilers can act in different roles on eFiling. These roles are more commonly known as ‘Portfolio Types’. Once a portfolio is verified and linked to a Primary User, that person will be able to access, transact and manage all the portfolios linked without needing to log out or change users.

There are three main types of portfolios on SARS eFiling. These are:

- Individuals – A person that acts on behalf of themself to administer their own individual taxes.

- Organisation – Is a representative of a tax-paying entity acting either as their representative taxpayer or an appointed representative with a signed Power of Attorney in place.

- Tax practitioner – A person that is registered with SARS, a Recognised Controlling Body, and has a signed power of attorney to act on behalf of another taxpayer

How do I change my portfolio type on eFiling?

To change your portfolio type on eFiling, here’s what you need to do:

- Login to your SARS eFiling profile using your username and password.

- Click on ‘My Profile’ on the menu on the left pane.

- A drop-down list will appear. Click on ‘Portfolio Management.’

This will take you to your Portfolio Management page. You will be able to view all the linked and unlinked portfolios related to your profile.

- Click on the 3 dots (ellipses) to the left of ‘Go to Portfolio.’

- Click on ‘Change Portfolio Type’ from the dropdown list.

- Click on the down arrow next to ‘Portfolio Type.’

- Select the option you want to change your portfolio type to.

- Click ‘Save.’

What are SARS tax types?

In South Africa, there are various taxes that we pay. Albeit that we do not pay all of these taxes all of the time, it’s worth knowing what they are.

Below is a comprehensive list of SARS tax types:

- Air Passenger Tax

- Capital Gains Tax

- Corporate Income Tax

- Custom Duties

- Diamond Export Levy

- Dividends Tax

- Donations Tax

- Estate Duty

- Excise Duty

- Income Tax

- Mineral and Petroleum Royalties

- Pay As You Earn (PAYE)

- Provisional Tax

- Securities Transfer Tax

- Skills Development Levy

- Stamp Duty

- Transfer Duty

- Uncertificated Securities Tax

- Unemployment Insurance Fund (UIF)

- Value Added Tax

- Withholding Tax on Interest

Without the revenue generated from these taxes, the government will be unable to function. Taxes are used to fund social and economic programs, as well as public services such as schools, hospitals, and security.

How do I get a SARS eFiling profile?

To get a SARS eFiling profile, you will need to create an account on eFiling and register for Filing.

Registered taxpayers can file returns, make payments to SARS, and get access to many other benefits via the online platform.

To register for eFiling:

- Visit the SARS eFiling website at www.sars.gov.za.

- Click on ‘Register.’

- Complete your personal details and click on ‘Next.’

- Complete your contact and login details and click on ‘Submit.’

If the details entered are successfully matched by SARS, you will receive a One-Time-Pin (OTP) and be redirected to the OTP screen.

- Enter the OTP.

- Click on ‘Submit.’

Once your OTP is entered successfully, the eFiling Login Screen will display.

If SARS is unable to finalize your registration, they may request additional information. A message will display, prompting you to provide supporting documents to complete the process.

- Upload all the documents requested.

- Click ‘Continue.’

When SARS verifies your details, the status on your screen will change to ‘Request Successful,’ and you will receive confirmation via email and SMS.

- Click on ‘Complete Registration.’

- You will receive an OTP.

- Enter the OTP.

How do I add a new user to eFiling?

If you are wondering, “How do I give access to a new user? It can be done using the following steps:

- Log into SARS eFiling.

- Search for the required taxpayer.

- Click on ‘Organisations’ on the menu tab.

- Click on Request Tax Types.

- Click on ‘Create New.’

- Click on ‘I agree’ and then ‘Continue.’

You will then need to input all the details of the taxpayer that you want to add to your portfolio.

Once complete:

- Click on ‘Request.’

- Click on ‘OK.’

A message will be displayed confirming the request and is pending approval from the individual. The taxpayer will have to approve the transfer request for the process to be completed.