In order to make filing the various returns and tax types due to SARS throughout the year easier, the SARS eFiling platform allows you to submit most of the common types of tax forms through their digital platform. Rather than trusting the unreliable SAPO mail service or having to go into a SARS branch every time you wish to file a return, you can access these forms online and fill them in quickly and seamlessly from the comfort of your home or office.

You can also apply to add new tax types to your account (and the forms which come with them) and perform other transactions, make payments, or maintain the tax details for yourself or your business online. It’s a safer and more convenient way to remain tax compliant at all times. We’ve compiled this guide to the various forms available on eFiling and how to access them to help you.

What can you do on eFiling?

Once you have a registered profile on SARS eFiling, you can add relevant tax types to your profile and access the forms that come with them. You can fill these in online and submit them digitally in minutes- many options will also pre-populate with information SARS has received from other entities.

For example, on a personal income tax return, SARS will pre-fill the information received from registered financial institutions regarding your Tax-Free Savings Account or Retirement Annuities and Pensions. This makes your tax filing considerably easier and helps you stay compliant with SARS. You can also initiate payments, receive statements, and maintain your contact details for a seamless experience. On the eFiling platform, you can do the following:

- Enquire about debt outstanding, make payments and cancel them

- Enquire about outstanding returns and generate them

- Determine your Tax Compliance Status

- Get your Notice of Registration (IT150)

- Perform VAT, CIT, PAYE, and Trust Notice of Registration

- File your Income Tax Return

- Update personal details (including Bank Details)

- Request a Statement of Account from SARS

- Register for Income Tax

- Submit the Supporting Documents for an audit

- Lodge a Dispute if there’s something incorrect in a return

- Perform Tax Product Registration (incl. Getting a Tax Number Registration)

- Perform Tax Directive Management

- Lodge a complaint with SARS

- Determine your Refund status

- Check your Audit status

- Perform Username Retrieval and Password Reset

As you can see, using eFiling for your tax-related matters can make paying taxes and filing forms considerably easier. You may even be able to avoid calling SARS or going to a SARS branch entirely unless you encounter issues or have unique circumstances to resolve.

List of All SARS eFiling Forms

Here is a comprehensive list of all forms available from eFiling. You will notice many of these cannot be downloaded from the SARS website anymore for manual submission, as they prefer you to use the eFIling platform for a better experience.

- CEB01 – Customs and Excise Billing Declaration

- DTR01 – Information to record your Dividends Tax Transaction(s)

- DTR02 – Dividends Tax Return

- EMP201 – Monthly Employer Declaration

- EMP501 – Employer Reconciliation Declaration

- EMP601 – Tax Certificate Cancellation Declaration

- EMP701 – Reconciliation Declaration Adjustment (only applicable for adjustments made between 1999 – 2008)

- IRP6 – Return for Payment of Provisional Tax

- IT12EI – Return of Income Exempt Organization

- IT14SD – Company Income Tax Supplementary Declaration

- ITA34 – Notice of Assessment

- ITR12 – Income Tax Return for Individuals

- ITR14 – Income Tax Return for Companies

- ITR14L – Income Tax Return for Long-Term Insurance Companies

- NOO – Notice of Objection

- NOA – Notice of Appeal

- RAV01 – Registration, Amendment, and Verification Form

- TDC01- Transfer Duty Declaration

- TT03 – Turnover Tax Return

- VAT201 – Vendor Declaration

- VDP01 – Voluntary Disclosure Application Form

- WT002 – Return for Withholding Tax on Interest

Obviously, not every user needs to access all of these forms. Some are specific to additional tax types you may need to pay- like PAYE, VAT, or Customs tax. Others are specific to organization types, like insurance companies or specific circumstances, such as if you need to object to an assessed tax amount. So don’t feel overwhelmed! Chances are you will only need to deal with a handful of these forms. You can always add new tax types or request new forms as you need them.

What documents are needed at SARS for tax returns?

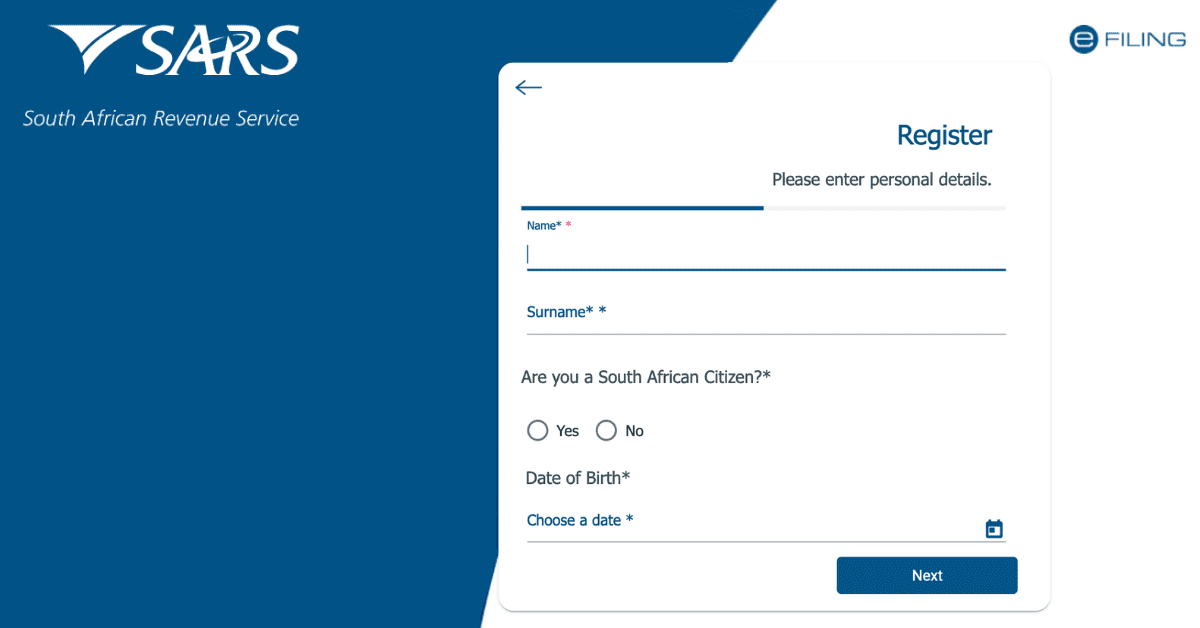

For most day-to-day SARS eFiling users, the most important tax type you will pay is your income tax return annually. This will be your initial tax type assigned when you first register with eFiling. Of course, SARS cannot simply register you without proof of who you are! So you will need to provide them with a set of supporting documents to support your registration. These can be provided digitally on the eFiling platform when you register. You will need the following:

- Proof of Identity: Ideally your ID Document. Passports, temporary IDs, driving license, or asylum seekers certificates are also acceptable. You will need to take the original document and a copy if applying at a branch.

- Minors will need a birth certificate copy and a copy of the parent/guardian’s ID. Parental death certificates will be needed if both parents have died.

- If you use a legal guardian, a letter confirming this or a court order will be needed.

- If your ID differs from your married name, a copy of the marriage certificate may be needed.

- Proof of banking details and address

If you are registering a company and not an individual, you will need the following:

- Proof of CIPC registration

- Proof of business address

- ID of an approved public officer to enact SARS-related activities on the company’s behalf

- Proof of business bank account

What documents are needed for eFiling?

What documents you need for eFIling depends on the tax type you are trying to load or the service you are trying to use. The eFiling system will clearly tell you what is needed at the time you perform these changes. In general, you will always need the following:

- ID proof/ CIPC registration (for companies)

- Proof of address and bank account

- Tax registration number

These are also the documents used when you first apply for eFiling.

Where do I get a SARS form?

SARS forms are easily available digitally from the eFIling system. Some of these forms can also be downloaded online at the SARS website (www.sars.gov.za). SARS branches will also have forms available onsite.

While the list of forms and abbreviations can be a little intimidating at first, you will soon feel confident using them once you apply for eFiling.