The competition in South Africa to catch a rental home is fiercer than you would encounter on a safari. Yes, even landlords and their agents behave like skilled trackers who, using credit checks, set out to spot the most reliable tenants in the herd. These checks are their binoculars, helping them gauge financial risks and ensure a steady rent flow.

But the terrain can be as treacherous for landlords and tenants to negotiate as the African bushveld. And that’s why we’ve put together this guide – your very own compass in knowing how to check the credit score of a potential tenant in South Africa.

We’ll also get into sticky issues of legality in running credit checks without permissions, the hit a bad credit record can land upon your quest to rent a home, and the mysterious journey that comes with discovering someone’s credit score.

How To Check The Credit Score Of A Tenant

The prospective tenant’s credit score is an integral aspect of the tenant selection process in South Africa. In this regard, the process will commence by obtaining the prospective tenant’s written permission. The tenants’ rights have to be respected, especially in privacy issues and, most importantly, law requirements.

You can then take up services from TPN Credit Bureau or Windeed, for example, their consumer profile search powered by Experian upon having the tenant’s consent. These platforms do provide detailed reports on residential or commercial applicants. For instance, TPN Credit Bureau does provide an 8-in-1 Credit Check with Credex® Score. All this information is combined into one report on your tenant, presented in one easy-to-read TPN Credex® Score report. This check includes a TPN RentalCheck, Transunion, Credit Repayment, Deeds, Directorship, Affordability, Verified Employment, and Qualifications on File.

The charges for these services differ. For example, the Windeed service charges R37.35 per search. Remember to cater for such costs under your budget when renting your place.

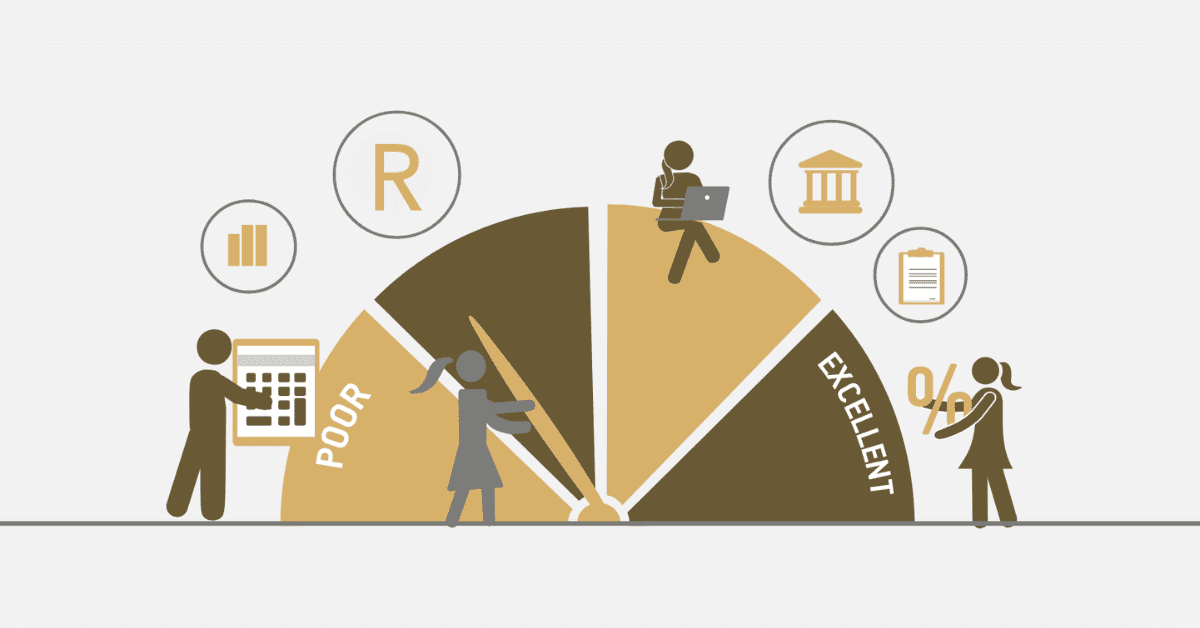

You should remember that a credit check does not mean just checking a credit score but provides a snapshot of financial behavior, such as payment history and current debt levels. Such information can help establish the regularity and timeliness of the tenant paying the rent.

But that should not be the only basis of your decision-making. Also, consider the renter’s rental history, stability in employment, and references. This will help get a far more well-rounded perception of the tenant and how good or bad a tenant he or she might be for living on your property.

So, in short, to check a South African tenant’s creditworthiness, one would need consent, use a reliable service, and understand the results in consideration of other related information.

Is It Illegal To Run Credit Checks Without Approvals In South Africa?

The legal regime under which credit checks are being done in South Africa is dictated by the Protection of Personal Information Act 4 of 2013 (POPIA) and the National Credit Act. For the way personal information is processed and credit reporting, these laws oversee that only those with a specific purpose based on a need can pull your credit.

Under these regulations, running no credit check is illegal unless a person has given prior written permission. This means anyone or any company not covering themselves with your permission or accepting terms and conditions. This means the law shows that an individual knows about a credit check and has given their consent.

For instance, if an organization intended to process the information of prospective customers for a credit check before agreeing with them, it would be obliged to give notice of that intention to the Information Regulator. It would require authorization to process information for the purpose. It applies to businesses whose main operation is credit reporting (Credit Bureaus) and agencies whose loan information is not their main agenda (Ancillary Credit Reporting).

But we have exceptions. Some of the entities might not need your permission to check your credit. The FCRA reported some of those situations in response to a court order or federal grand jury subpoena.

In conclusion, while credit checks form an important part of financial and risk assessments in South Africa, they must be done within the legal framework to protect the individual’s rights against violations of their privacy.

Can I still Rent a Property if I have a Bad Credit Rating?

In South Africa, having a bad credit record does not mean one will not get a lease agreement. More landlords are undertaking credit checks on tenants to understand their financial risk, so this situation is not new. Firstly, check your credit record. South Africans are entitled to receive one credit report, free of charge, in one year, which will help you to be able to detect mistakes or errors that may exist and take action according to that. Secondly, consider looking for a guarantor or co-signer with a good rating and can vouch for your fiscal honesty. Last but not least, be genuine about your monetary situation. Explaining past financial mistakes might convince landlords to overlook a weak credit score. Remember, while renting with a bad statement is difficult, it’s not impossible.

How Do You Find Out About Another Person’s Credit Rating?

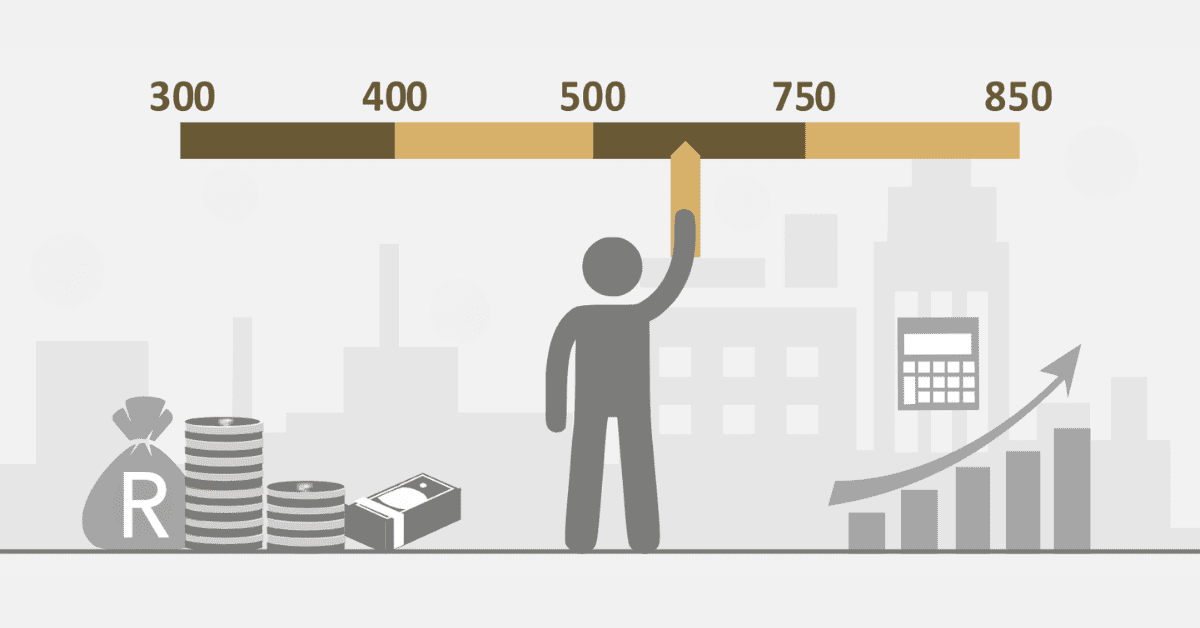

In SA, info about an individual’s overdraft scores can be located in registered loan bureaus such as Experian and TransUnion. This is made available at no cost through these bureaus. For an individual to access this information, consent from that individual is required. An individual can access such information through online portals such as My Credit Check. Those provide a detailed credit report of the individual, which includes the payment history and the debt level. Remember, each bureau may have different scoring models, so scores may vary.