Looking to buy a car but wondering what you could leverage on. Did you know your credit score could help you get a car? Well, there are more questions about credit scores and car purchases. To some extent, what is the relation between credit score and buying a car?

Do you need a credit score to buy a car; and if you do how many credit scores do you need to buy a car?

In South Africa, a person’s credit score holds significant importance in the financial realm. It serves two important purposes: enabling smooth transactions and empowering individuals to have control over their financial future. The three-digit score is a number that represents a person’s creditworthiness. It shows how they handle payments, their overall financial responsibility, and their credit history. Financial institutions and lenders place great importance on credit scores when evaluating the potential risks of lending money or extending credit to clients.

Let us share with you about credit scores and car purchasing. You will be able to understand and know the amount of credit score you need to buy a car.

What credit score do you need to buy a car?

Having good credit opens up various financial benefits such as the ability to obtain loans, and credit cards, and enjoy low-interest rates, among other advantages. When it comes to significant expenses such as buying property or cars, financing plays a crucial role in the decision-making process.

However, if your credit score is not good, lenders might hesitate to offer you credit or may charge you higher interest rates to offset the huge risk they are taking.

When it comes to buying a car, having a good credit score is extremely important.

Ideally, a minimum credit score of 600 is preferred when it comes to securing a car loan. Your credit score is extremely important when it comes to assessing your creditworthiness and the interest rate that you might be eligible for. Lenders use this score to evaluate the level of risk involved in lending you money. If your credit score is 600 or higher, it suggests that you have a fairly positive credit history. Based on the information provided, it appears that you have effectively handled your past debts and have a relatively low likelihood of encountering difficulties in repaying future loans. Having a good credit score can make you more attractive to lenders when they are considering car loan processing and approval.

How to improve your credit score before shopping for a car

The credit score plays a crucial role in making financial transactions more convenient by offering a standardised way to assess creditworthiness.

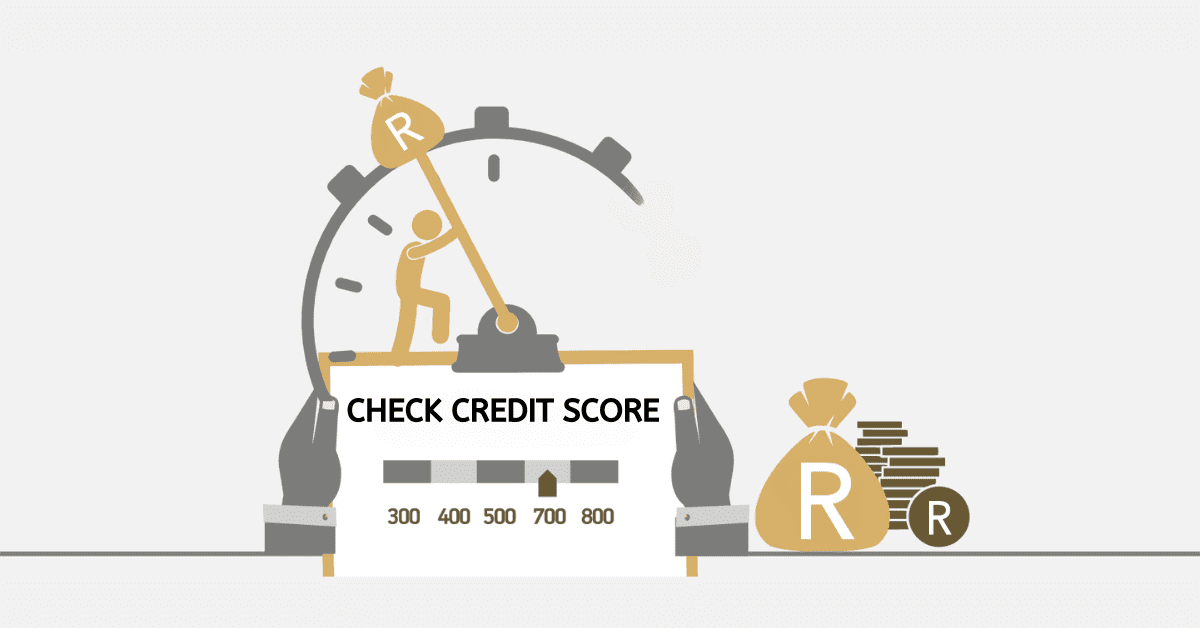

It is a smart move to work on improving your credit score before you start looking for a car in South Africa. Having a higher credit score can make a big difference when it comes to getting favourable financing terms and interest rates.

Here are some tips to help you improve your credit score before purchasing a car.

- Paying your bills on time is crucial when it comes to determining your credit score. It is a key factor that should be consistently maintained. Make sure you never miss a due date by setting up reminders or automatic payments.

- Make it a goal to reduce the balances on your credit cards. Having high credit card balances compared to your credit limit can affect your credit score. It is a good idea to aim for a credit utilisation rate of less than 30%.

- It is important to be mindful of how you use your credit. It is important to only borrow money that you can handle and to refrain from using up all the available credit on your credit cards.

- Ensure to assess your purchases and credit report to understand its dynamics. This gives you a much better insight into your spending habits and how it can positively or negatively affect your credit score.

Credit scores, car loans, and interest rates

There is a close relations between credit scores, car loans and interest rates. The relation is mostly inverse and has a bigger influence on all. But ultimately, the credit score is a constant variable and can control interest rates on loans.

A credit score is a measure of how creditworthy an individual is. It takes into account various factors like their payment history, the amount of debt they have, and how much of their available credit they are using. Credit scores have a significant impact on whether someone is eligible for car loans and the interest rates that come with them.

Having a higher credit score can often result in lower interest rates, which in turn makes it easier for individuals to afford financing their car purchases. Credit scores are utilised by financial institutions as a means of evaluating risk, where higher scores suggest a reduced likelihood of default.

Therefore, it is essential to maintain a good credit score to secure favourable loan terms. If you are a South African looking for a car loan, it is important to handle your finances responsibly. This will help you improve your credit score and give you access to more affordable financing choices when buying a car.

Can a car loan improve your credit score?

There is a lot more to this question than you can imagine. A credit score is a key requirement to secure a car loan. While many may wonder if a car loan can improve the credit score, the fact of it is that a car loan does not improve the credit score.

However, once you secure a loan to buy a car, you are put on timely payments. These timely payments could be weekly, bi-weekly, monthly or quarterly. In most cases, monthly payments are considered by most banks in South Africa.

Securing this loan does not improve your credit score but the on-time payment set by the bank can help your credit score. Once you pay your loans on time without defaulting, your credit score gets better over time. Considering the metrics and calculation on credit score, these huge amounts being used to pay for the car gives the notion that you are financially disciplined.