We often look at credit scores from the position of a potential borrower. What happens if you are the potential lender, instead? Many people, from landlords to schools, also use a credit check as part of their screening processes. However, due to the National Credit Act, checking someone’s creditworthiness in South Africa isn’t something you can do for fun or curiosity- you must have both their permission and a valid reason to carry out the check. Today, we will walk you through some common questions around this issue, and what you need to know.

What is the Creditworthiness of a Person?

A person’s ‘creditworthiness’ means their ability to responsibly handle and pay off debt they take on from lenders. Think of it as a measure of their trustworthiness, specifically around loans and debt.

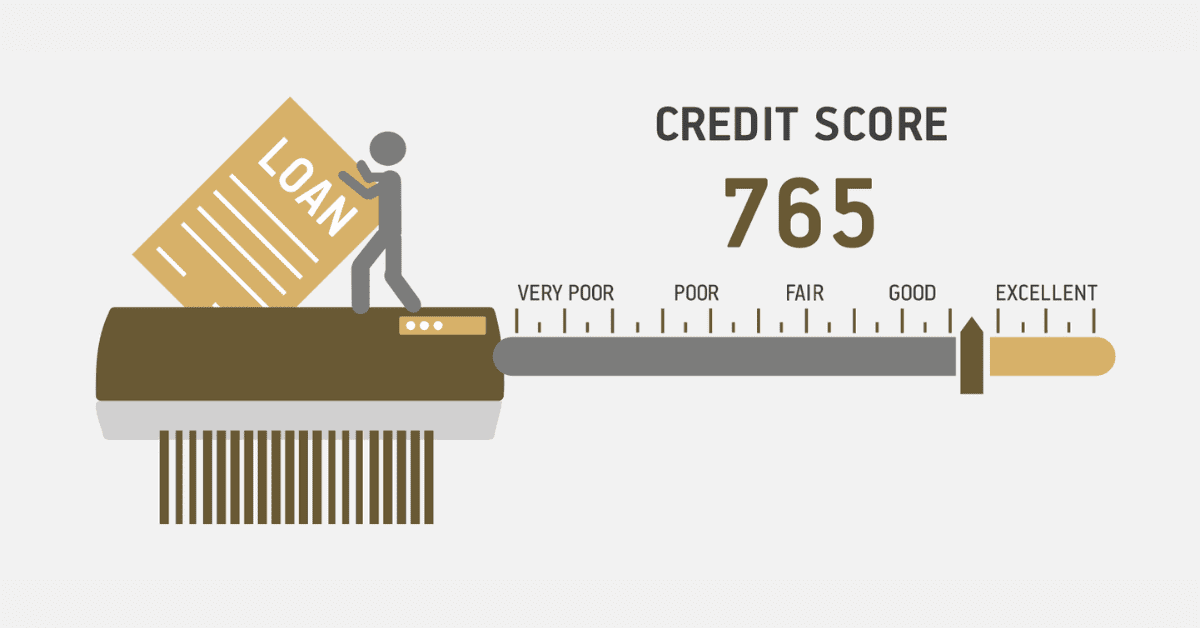

To assess this, financial institutions and lenders use something called a credit score. These scores aren’t compiled out of thin air, either, even if it feels like it! All financial institutions regularly report to the credit bureaus about your individual transactions with them. The bureaus then use respected actuarial science algorithms and formulas to compile a credit score from your behavior, such as how reliably you pay and how much debt (vs income) you already have. This can then be benchmarked against other borrowers to assess your overall creditworthiness and the risk to the lender in loaning to you.

How Do You Check Someone’s Creditworthiness?

To check someone’s creditworthiness in South Africa, you need two things: their explicit permission to do so, and a valid reason to be carrying out the check. So if you’re curious about what your spouse’s or cousin’s credit score is, you won’t be able to run a check just to satisfy your curiosity!

You will then need to have a profile with WinCredit or use a reputable third-party checking service that does. Armed with this WinCredit profile, your potential tenant/borrower’s ID number, and their written permission, you can then apply to do a credit check.

How Do You Check if You’re Blacklisted?

Blacklisting no longer exists as an actual institution in South Africa. It is a holdover term from the days when only negative credit behavior went onto your credit report. Today, under the NCA, both positive and negative behavior is reported. This change was specifically made to stop the menace of ‘blacklisting’ and the long time it took for people to get off this list.

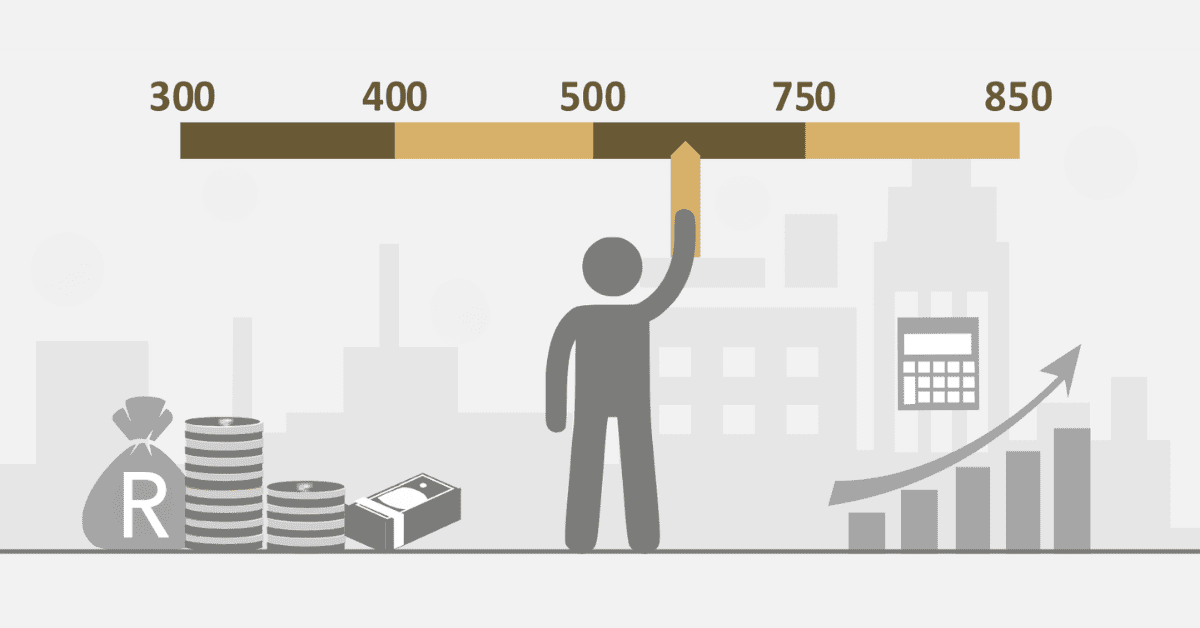

However, while blacklisting may be gone, the sad reality is many South Africans are over-indebted and have bad behavior around credit. You will still find very poor credit scores that functionally prevent you from taking on new debt- probably for a good reason!

However, it is now much easier to rehabilitate your credit score. All positive behaviors, such as settling outstanding/defaulted debt, addressing judgments, and paying your bills on time, will have a positive impact on your score. With time and diligence, you can raise your credit score and become more attractive to lenders.

Where Can I Run a Credit Check on Someone?

To run a credit check on someone in South Africa, you need the things we mentioned: their explicit permission to do so, and a valid reason to need the information. You will then need to be registered with WinCredit, a division of Windeed. Some third-party companies offer these checks, but you will need to verify they are legitimate.

Once you are registered with Windeed, you will need to activate the WinCredit option on your profile. This is a prerequisite of the National Credit Act, and cannot be (legally) bypassed. Once this permission is applied to your account, you can run a credit check on someone else. Don’t forget you still need their ID number, full name, and explicit permission to carry out the check! Provided you have all of that, and your reason for the check is legitimate, you can then request a credit check on the other person. Legitimate reasons would be something like being their potential new landlord and wanting to assess their credit history. Remember, you can’t just make curiosity credit checks in South Africa!

This is, after all, sensitive financial information you are requesting. You wouldn’t like your personal financial details aired out for everyone to see without a good reason, and so shouldn’t expect to be able to inflict it on others ‘just because’. Even if it is your spouse or child, financial information is still a private matter.

If you have a legitimate reason to need to check someone else’s creditworthiness, there are steps in place to help you do so. Even if you aren’t a large lender like a bank. However, always bear in mind that you will need a legitimate reason to perform the check, and the person’s written permission to conduct it.