In this day and age of credit card debt, car loans, and school loans, it is hard to imagine a world without debt. If you are young and have never taken out loans, you can get by without credit.

You might not have to worry about not having a recent credit history if you do not have any debt and pay all of your bills with debit cards. Also, you might not have any credit at all if you have not had a credit account in a long time.

Getting a mortgage will be hard if you do not have any debt and a credit score, even though not having any debt makes you a better credit risk. When you are planning your budget for buying a house, keep in mind that the lender may want a big down payment to make sure they are getting a good deal.

There are a lot of options available when you want to buy a house without credit check. Let us take you through buying a house with no credit check and other series of questions pertaining acquiring a house connected to credit.

How to buy a house with no credit check

Do you want to buy a house in South Africa but concerned about a credit check. Stress not, you can still make your dream come true.

To begin, what does a credit check really mean? A credit check is when a lender looks at your past financial records to see if you will be a good customer. They look at your credit score, past of payments, and the amount of debt you still owe. This is a normal part of the mortgage application process, but some people may not have established credit or may have a bad credit background, which can make it hard to pass a credit check.

Now, why would someone buy a house without checking their credit? There are several reasons for this. Some people may not have much of a credit background because they are new immigrants or young. Some people may have had bad luck with money in the past, which hurt their credit. Additionally, some people would rather not have their credit checked or do not want to go through the lengthy process that comes with applying for a standard mortgage.

How can someone in South Africa buy a house without having their credit checked? You could look into seller financing or rent-to-own deals. When you get seller financing, the seller is the loan, and you make payments to them over time. With a rent-to-own deal, you can rent a property and have the option to buy it later. This gives you time to build equity and get your finances in order.

You could also look into other ways to get money, like getting loans from family or private lenders. These choices might not need an official credit check and might give you more freedom with the terms and conditions.

What is the lowest credit score to buy a house?

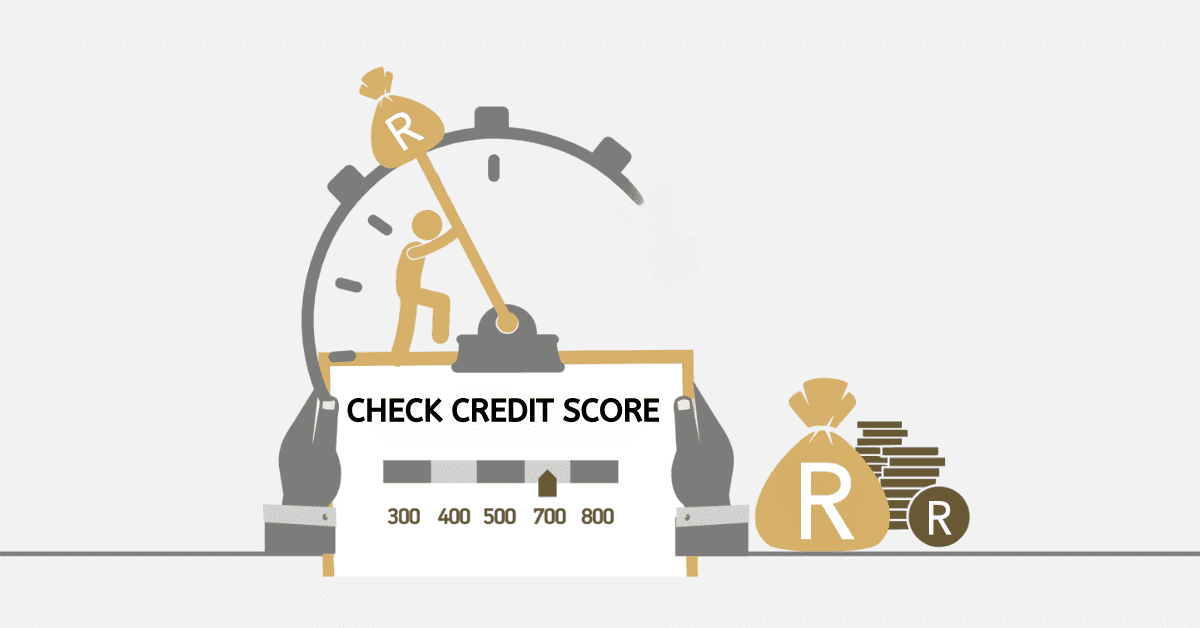

For many people in South Africa, purchasing a home is a dream come true; but, due to financial restraints, this ideal may appear to be out of reach at times. When it comes to obtaining a mortgage loan, your credit score is an important consideration. To answer your question, what is the minimum credit score required to purchase a home

Credit scores are utilized by South African banks and other financial institutions in order to determine the level of risk associated with lending money to individuals. Under most circumstances, a credit score of between 580 and 600 is considered to be the minimum required to qualify you to buy a house. On the other hand, having a score that is equal to or higher than this minimum does not ensure acceptance because there are other elements that play a significant influence, such as income, debt-to-income ratio, and employment history.

Can you buy a house if you are blacklisted?

If you are a South African and are curious about whether or not being blacklisted may influence your ability to purchase a home, the following information is essential for you to know. Having your credit report blacklisted can make it difficult to obtain a mortgage loan, but it is not impossible.

Take the first step toward improving your credit score by first gaining an awareness of the reasons for your blacklisting. Alternative financing possibilities, such as rent-to-buy programs or private lenders, should be taken into consideration.

Increasing your chances of being approved can also be accomplished by saving up for a greater deposit. Utilize the services of a professional mortgage broker who will be able to direct you through the procedure and assist you in locating lenders who are willing to accommodate your specific circumstances.

Do not forget that patience and perseverance are essential. Even if you are currently on a blacklist, it is still possible to purchase a property provided you are committed to the process and take the appropriate approach.

What is the easiest home loan to get?

For South Africans who want to buy their first home, SA Home Loans is an easy way to do it. SA Home Loans is the easiest home loan to get in South Africa because it is open to a wide range of people and is designed to be easy to use.

SA Home Loans makes the application process easier by only needing a small amount of paperwork and having low interest rates. No matter if you are a first-time buyer or looking to upgrade, their flexible payment choices can work with your budget. Also, SA Home Loans gives you personalized help throughout the whole process, so you know what your choices are and feel supported the whole time.

SA Home Loans also looks at things besides just credit scores, which makes it easier for people from a range of financial backgrounds to apply. South Africans who want to buy a home can trust them because they are dedicated to being honest and making sure their customers are happy.