What on earth is a credit score? You aren’t the first person to ask! While credit scores are a little fictitious and don’t properly demonstrate the full picture of your financial health, they are important. Without a good credit score, you will struggle to access anything based on credit- including big-ticket purchases like cars and mortgages. Today we are breaking down the basics of credit scores and how they are evaluated.

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness, taking into account your credit history and financial behavior. This is used to assign you a three-digit number which lenders use to evaluate you as a potential credit user and how much risk they take on loaning to you. In South Africa, the highest possible credit score is 850, but you don’t have to have such perfect credit to look like a ‘good bet’ to a lender! Most people can access all the credit they need as long as their score is higher than 650 or so.

Your credit score takes into account many factors, including payment history, credit utilization, length of credit history, types of credit used, and new credit applications.

A high credit score signifies responsible financial management from your side and increases the likelihood of your approval for loans, credit cards, and favorable interest rates. Conversely, a lower credit score may limit your access to credit and result in less favorable terms due to perceived higher risk.

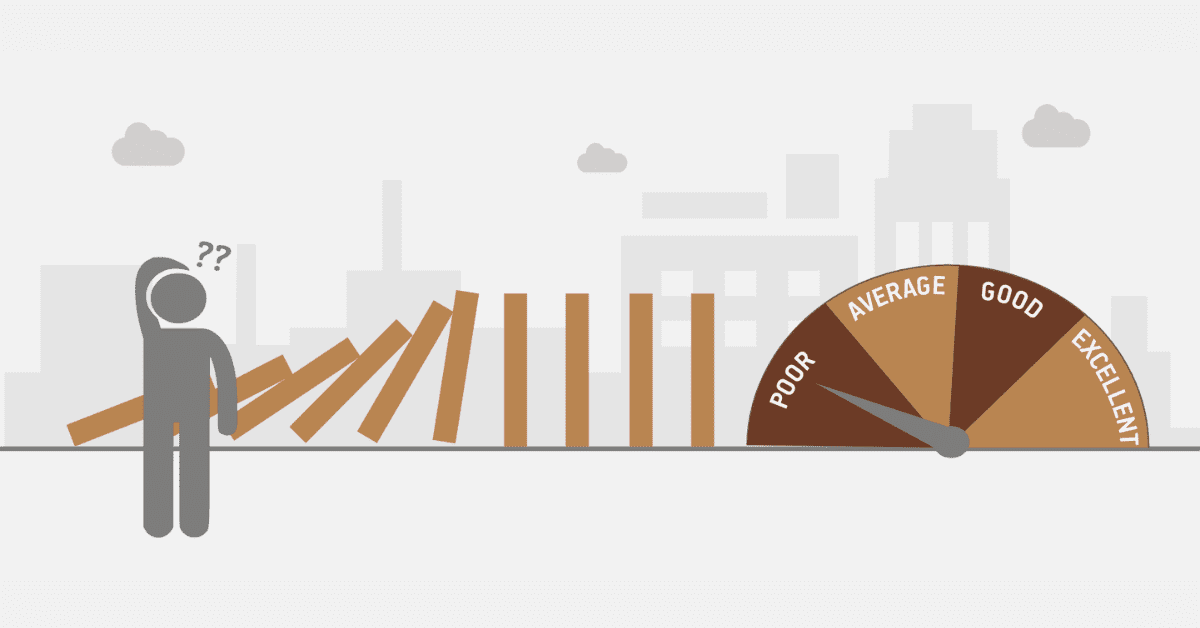

What are the Credit Score Ranges?

Because credit scoring and the data each bureau receives are not completely unified, it can be more useful to think of your credit score as a range or band. You don’t have to have the maximum credit score possible to qualify for credit. Lenders are looking for people who are a good risk. In other words, people they believe can responsibly handle the line of credit and who will manage to settle payments easily. Each lender and bureau is slightly different, but here are the common credit score ranges in South Africa:

- Less than 300: Either you have really bad credit or none at all

- 300-579: This is the poor credit score range in SA. Regrettably, this is also where the national average of 560-580 lies!

- 580-669: This is considered a fair credit score, so it isn’t great, but isn’t bad either. Most people with credit scores in this range will have little trouble accessing credit, but may not get the best terms.

- 670-739: This is considered a good credit score range in South Africa

- 740-799: Now your credit score is ‘very good’. Well done!

- 800-850: This is the excellent credit score range in SA. If you are here, you are an exceptional credit consumer.

South African credit scores top out at 850, so you cannot get higher than that.

What Factors Impact Your Credit Score?

Your credit score isn’t a random number the credit bureaus gave you, even though it sometimes feels like it. Many factors go into assembling your credit score, all based on how you behave with credit, and how you have historically behaved with it. How each factor will affect your credit score is rather personal, so two similar people, with similar habits, can still have vastly different scores.

Overall, lenders and the credit bureaus want to see financial responsibility. They want loans within your ability to pay, they don’t want them to be overused or maxed out, and they want to see regular payments made on time. Remember that credit scores are just about credit and its use, and not other aspects of your financial health. So cash in the bank, assets, or cash purchases will not impact your credit score at all.

According to TransUnion and Experian, two of the largest credit bureaus in South Africa, this is how factors of your credit score are weighted:

- Credit Utilization (30%): How much of your open lines of credit do you actually use? If every credit line you have open is almost maxed, your score will be a lot lower than someone who isn’t using that much credit. Yes, you need to have it and not need it, and we know that seems unfair! Keeping your credit balances at 50% or lower of the credit on offer will reflect well on you.

- Payment History (35%): Lenders want to know that you pay and that you do it on time and consistently. Defaults, late payments, and court judgments against you will reduce your credit score.

While these are the two major factors that impact your credit score, there are some others. The length of your credit history is worth about 15% of your score. This shows that you have used credit well for a long time. This is particularly appealing to long-term lenders, like car and house loans.

There are two lesser, but still important, factors that impact your credit score in South Africa:

- Types of Credit (10%): It’s not the most important factor, but having several different types of credit will look better than only using one. This doesn’t mean having more accounts but refers to the type of credit. Long-term, short-term, secured, unsecured, major and minor… you get the picture. Having a store card, a mortgage, a car loan, and a credit card will look better than having 6 credit cards. Even if the balance is effectively the same.

- New Credit (10%): If you are applying like mad for credit everywhere, lenders will take note. And they won’t like it. While ‘soft’ inquiries have no impact on your credit report, lenders who have you under consideration for a loan generate what are called ‘hard’ inquiries. In other words, it wasn’t a quick check, it was a serious intent to offer credit. If many of these pitch up on your report in a short time, lenders worry that you may be in financial difficulty and hoping to grab credit quickly while you still can. If you’re planning several credit purchases, like a mortgage and a car, in a short time, it can pay to space them out instead.

What is a Good or Bad Credit Score?

In South Africa, you are considered to have a bad credit score if it is under 580. You have a good (or even better) credit score if it is 670 or higher.

There you have it! While credit scores seem mysterious, they are just a methodical picture of your behavior with credit to date. Now it is time to brush up your credit score!