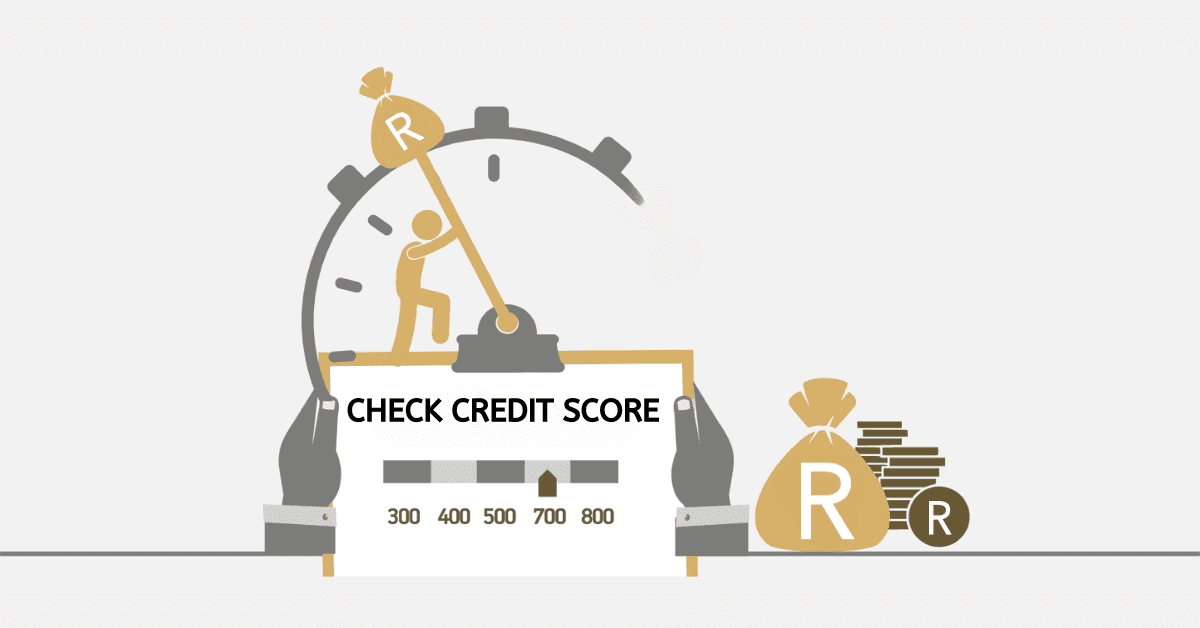

A credit score is a number that tells you how creditworthy someone is. It can be anywhere from 300 to 850. You will have more financial choices if your score is higher. For example, you may be able to get loans with lower interest rates, have more credit, or get a mortgage with better terms, a phone contract. Having a good credit score is important if you want to get credit cards, auto loans, or homes.

Two other things that might be changed are insurance rates and rental approvals. It is important to keep an eye on your credit score and make sure it stays in good shape so that you can get good financial deals and build a strong base for personal and economic growth.

Knowing about this opportunity, am about to learn about the possibilities of obtaining a phone contract with a credit score. You will also learn about the required credit score for a phone. Contract. Let us get into it.

Credit Score Needed For A Phone Contract

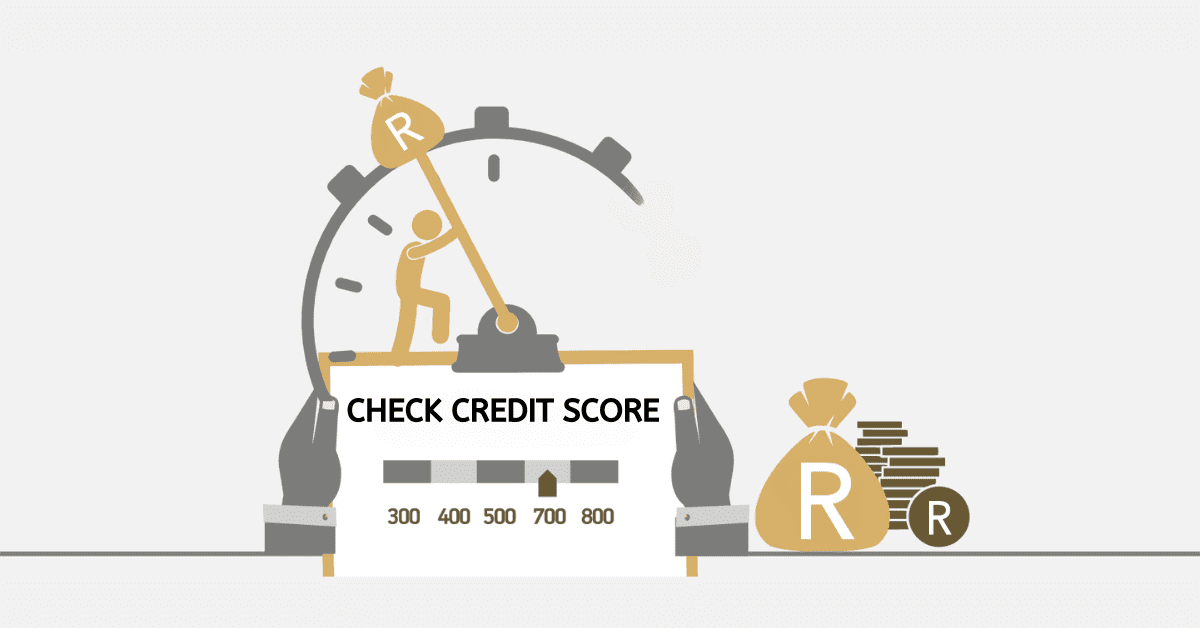

To get a phone plan, you usually need a credit score above 600, but each operator may have different requirements.

Operators may not look too closely at your credit score, but they do look at your credit background as a key part of figuring out if you are eligible.

A credit score is a number that shows how creditworthy you are by showing how responsible you are with money and how well you have paid your bills in the past.

If your credit score is above 600, that usually means you have good credit, which gives service providers faith in your ability to keep your promises.

Operators usually use credit scores to figure out how likely it is that a customer will not pay their monthly bills. They may, however, also look at other things, like work experience and income. Some providers may be flexible, giving people with lower credit scores more options, such as prepaid plans, or asking for a bigger down payment at the start.

Indeed, having a good credit past can be a guarantee for operators, showing them that you are likely to keep your promises.

What are the requirements to get a phone contract?

The requirements to get a phone contract are similar to the necessary information one may need to make an application successful.

This needed information is indicated to facilitate and process your phone contract. As part of the requirement you need your Identification card or document, proof of address, bank statement, bank details and other peculiar documents to identify your eligibility.

Can I get a phone contract with bad credit?

It is very possible to get a phone with bad credit. However, the reality is that getting the phone will not be associated with your credit but with another party. There are buy-to-rent companies that provide individuals with bad credit the opportunity to own a phone.

There are certain requirements that each network has that you must meet in order to get a cell phone contract. People with less-than-perfect credit scores are lucky because they have a lot of choices. For instance, you can ask for a deal on the iPhone 12. Because of your score, you might only be able to get a deal with an iPhone SE or even a SIM-only deal.

This gives you the benefits of a contract without the phone or computer that comes with it. Customers can choose from a variety of mobile deals from Telkom, Vodacom, and MTN through Mondo. This gives customers more choices and increases their chances of getting a cell phone deal.

What’s the easiest contract phone to get?

There is nothing like an easy spot to get a phone contract. Every network operator relies on certain parameters before issuing a phone contract deal to anyone.

However, what may be easy could be hard for another person. The concept of “easiest contract phone” is relative.

It is always ideal to do your own checks on the other side from the various phone operators and third-party companies to get a good deal.

Can I get a contract phone while blacklisted?

It can be hard to get a contract phone if you are on a blacklist. If you have a history of payment problems, providers may not want to give you a deal. Some companies, on the other hand, may offer prepaid or SIM-only plans that do not check your credit and require payment in advance. But before you apply for a contract phone, you might want to pay off any bills you still have and raise your credit score. Being responsible with money and thinking about other options can help your chances of getting accepted for a phone contract in the long run, even if it is hard at first.