In most cases, when a well-to-do person dies, what people think about after their death is the money left behind. In worst cases, the money comes first as soon as the person dies.

All these are part of the irrational and rational thoughts of many individuals.

In South Africa, debt is a common thing for many with credit. People die every day and what is left behind is unknown.

Of course, losing a loved one or close one could be sad, but can be frustrating when debt is inherited. Hence the need to check the person’s credit and also the bank statement to reconcile who has been left behind.

There are a lot of things that happen after death in terms of the deceased credit, bank account, bank statement etc.

Let us walk you through what happens after death. Whether funds can be accessed easily or whether there is a need to dig into the finances of the deceased.

How to check a deceased person’s credit

There are a couple of things that could draw your attention to checking a deceased person’s credit. But the ultimate reason that could drive you harder is when the person has a lot of debt sitting on his or her credit.

Credit is not like a savings account where you could have it withdrawn from the account. Someone could inherit someone’s credit but gets worse if there is huge debt on the account.

To check a deceased person’s credit, you must write to the credit bureau requisition for the credit information.

But before it can be done you must have the death certificate, full name and other identification documents of the deceased.

In simple terms, write a letter to the credit bureau requisition for credit information of the deceased. Ensure to add the vital documents to make your request easier.

The credit bureau, upon verifying and checking the validity of the document should respond to you with the information requested within a few working days.

What happens to debt after death in South Africa?

A question that might have come to your mind? When it comes to death and everything that goes with it, we know that we do not like to talk about it. We can not avoid it, though. It is a fact of life that we need to plan for financially. For most people, going into debt is also something they can not do away with. Most people need help getting money to buy a house, send their kids to school, or get a new car.

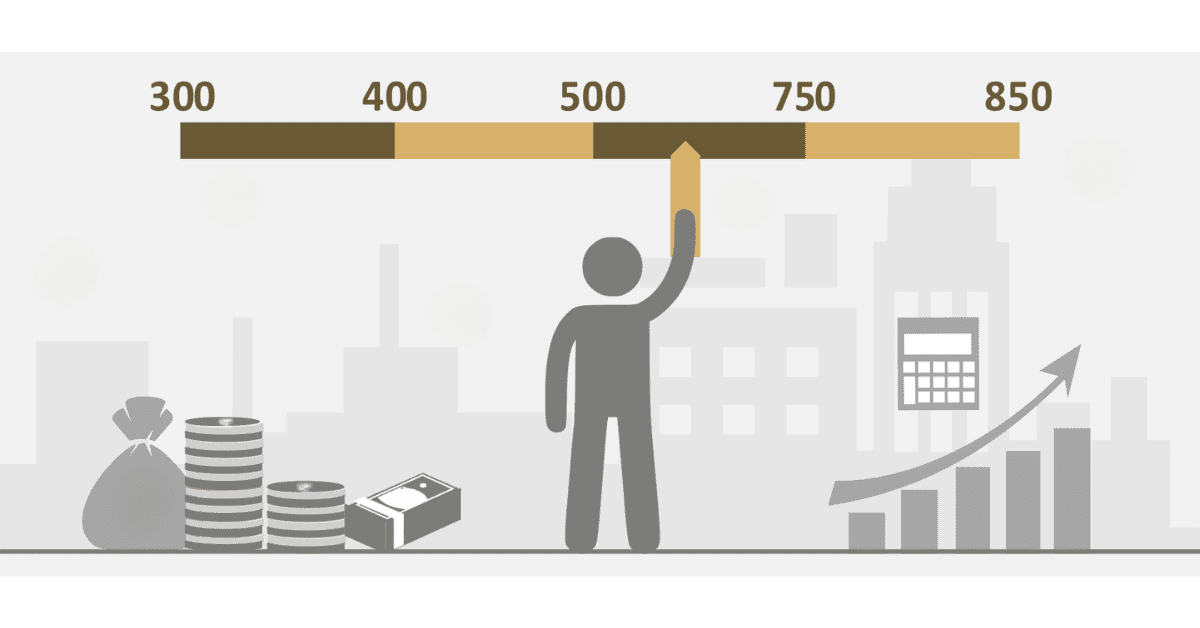

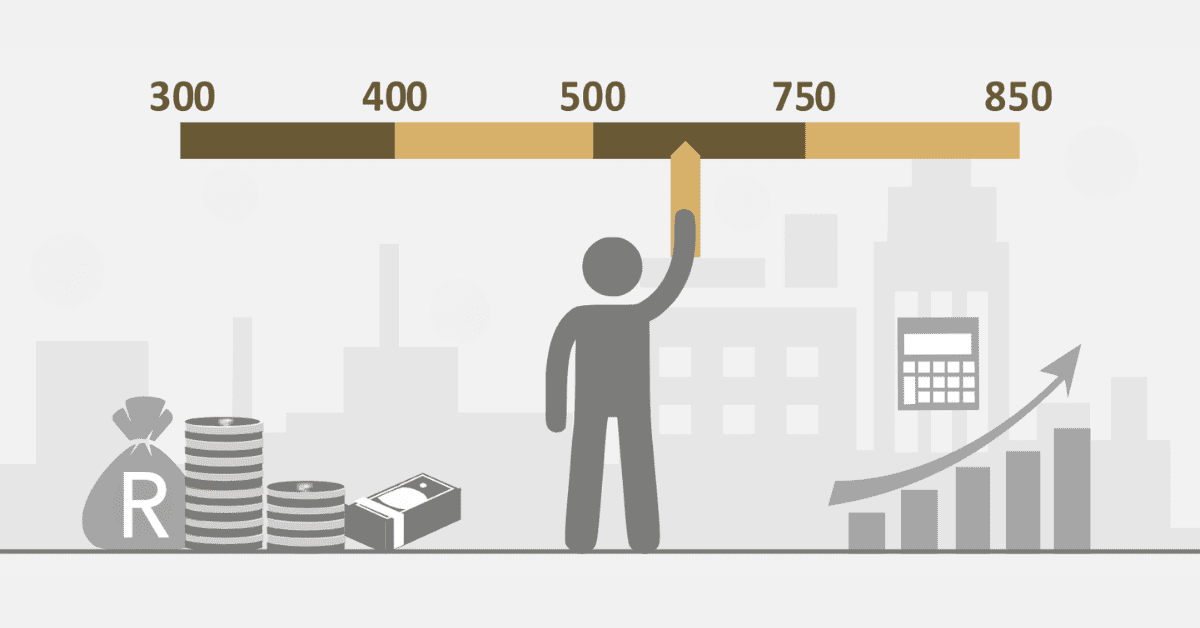

The National Credit Regulator says that millions of South Africans cannot live without credit and are going further behind on their debt payments, which means they have too much debt. There are 23 million credit-active consumers in the country, and more than 42% of them can not regularly pay their debt. Overall, this means that most people are in debt for their whole lives. So, this brings up the question of what happens to your loan after you die. To take care of our own money, we should be able to talk about this question with our families, friends, and communities.

What to do is not easy to answer, and it will depend on the case. You should talk to a Financial Adviser for professional help. The point of this piece is to make you think about this and start working with your family to make sure you are already financially in case something bad happens.

There is something called a “deceased estate” that includes all of your assets, income, and debts after you die. The Master of the High Court chooses an agent to take care of the estate’s business. Your executor’s main job is to find and collect all of your assets, pay off your debts, and give what is left of your estate to your beneficiaries.

In this case, having a Will and Testament is very important. If you do not have one, the rules of intestate succession will decide how your property is distributed. But if you have one, the executor must follow your instructions.

Can I request bank statements from a deceased person?

What happens after death can be more of a philosophical question. But the issues that come up after someone dies can be dramatic. When someone dies, there are a lot of questions that do come up. Including checking bank accounts, getting insurance money or finding bank statements.

If you find yourself in a position where you want to request a bank statement of a deceased person you need to understand the process. It is always not straightforward.

Once someone dies, his or her bank account goes into a state of lock; this means accessing it becomes very difficult.

However, it is possible to request a bank statement of a deceased person. The process of doing this can be tedious especially when you do not understand.

The process of getting the bank statement becomes better if it is a joint account. As part of being the account holder, you can have access to any information on the bank account.

Can you withdraw money from a deceased person’s account South Africa?

Losing someone in your family can be tragic but losing a loved one can be depressing. When you think about the death of a loved one and what life has to offer, there are so many unanswered questions.

There is always that question that comes after the deceased has been buried and this has to do with accessing the deceased’s funds. Whether it is a bank, trustee, or other earnings, it genuinely becomes a concern of the family.

If someone has passed away in South Africa, you can withdraw money from their bank account; however, this is only possible if you are the executor of their estate or if the executor has granted you power of attorney. It is the person who is named in the will of the deceased to take care of their business and distribute their possessions. This individual is known as the executor.

In the absence of a will, the executor will be selected by the court. A settlement must be reached on the estate before any money can be taken out of it. It will be necessary for you to wait if you are not the agent or if you do not have power of attorney.

To withdraw funds from the bank account of a deceased individual, you will be required to present the bank with specific documents, such as a certified copy of the death certificate. To the extent as the law is concerned, the death certificate is evidence that the individual has passed away.

On the document, the individual’s name, date of birth, date of death, and the reason for their passing are all set down. This document, which originates from the Department of Home Affairs, is required for a variety of purposes, including the administration of the estate of a deceased individual.