When you apply for a loan, the lender checks your credit score to determine your creditworthiness. Different credit ratings are applied to certain types of loans. For instance, mortgage lenders utilize a special mortgage credit score that is different from other credit scores applied on other loans. Therefore, prospective homebuyers need to understand the unique mortgage credit score used by mortgage lenders to obtain the best loan deal to buy a home. How then do you identify an ideal mortgage score used by lenders? This guide explores everything you want to know about checking your mortgage credit scores

How Can I Check My Mortgage Credit Score?

Checking your mortgage credit score is vital since it determines the following factors:

- The type of home loan you qualify to get.

- The interest rate you’ll be charged by the lender.

- The size of home you can afford.

- Premiums for homeowners.

Understanding how to check your mortgage score is the first step you should consider before embarking on your journey to acquire a home loan. Major credit bureaus like Experian provide free credit scores and credit reports on the “My Credit Check” portal. This platform is easy to use. All South African citizens with valid IDs can easily access their credit scores from this portal. Other registered credit bureaus in South Africa provide comprehensive credit scores that are commonly used by mortgage lenders. You can access your free credit report and credit score from any of the four credit bureaus operating in the country including TransUnion, XDS, Experian, and Compuscan.

Which Credit Score Is Used for a Mortgage?

Most credit bureaus use FICO scores for mortgage loans. This scoring method takes into account a comprehensive financial history of a client. Under the FICO scoring system, the consumer’s account must be open for about six months before a credit score is issued. This scoring method is also believed to be more accurate than VantageScores, which are commonly found on free websites.

VantageScore provides a credit score based on credit history compiled from credit activity during the first month. This scoring system utilizes data such as utility bills, rental payments, telecom billing information, and other public records to compile profiles for various consumers. As a result, most mortgage lenders prefer FICO scores to determine one’s eligibility for a home loan. A FICO credit score of 60 is considered good enough by banks to approve a home loan application in South Africa. A decent score is anything above 661 since it guarantees you approval of your mortgage application.

Does a Mortgage Show Up on your Credit Score?

With a good credit score, you are likely to qualify for the best mortgage rates. When your mortgage application is approved, it can hurt your credit score temporarily until you prove your capability to repay the loan. When you apply for a mortgage, the lender pulls a hard credit check or inquiry to check your eligibility to pay back the money. However, your credit score will soon recover once you maintain consistency in repaying your loan. Maintaining your debt-income ratio at a reasonable level is another strategy you can consider to build your credit score after obtaining a home loan.

When you obtain a home loan, it is considered responsible debt, so all you need to do is make timely payments every month. During the first six months of obtaining a home loan, you must avoid making other major purchases using credit because your application will be rejected. Your credit is likely to drop from the process of applying for a mortgage, so take your time to allow the credit score to recover. Missing a credit payment for one month can impact your credit score.

To safeguard your credit score, make sure you sign a mortgage with a favorable interest rate. A longer-term loan can help keep the monthly principal amount on your loan down. Check if the lender offers this facility when you apply for your home loan. Paying your mortgage and other bills on time is the most effective strategy that can help you maintain a good credit score during the mortgage repayment period.

Where Do Mortgage Lenders Check Credit?

Mortgage lenders in South Africa check consumer credit from any of the four main credit bureaus operating in the country. These bureaus include Experian, TransUnion, Compuscan, and XDS. Most mortgage lenders use more than one credit bureau to enhance the accuracy of data for different customers.

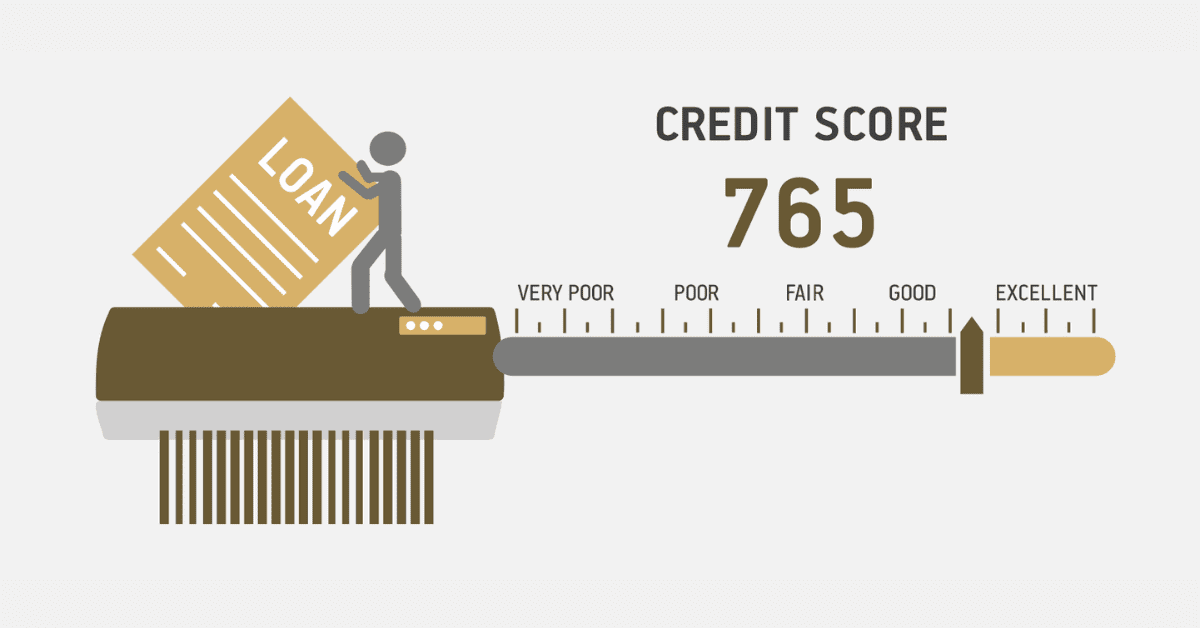

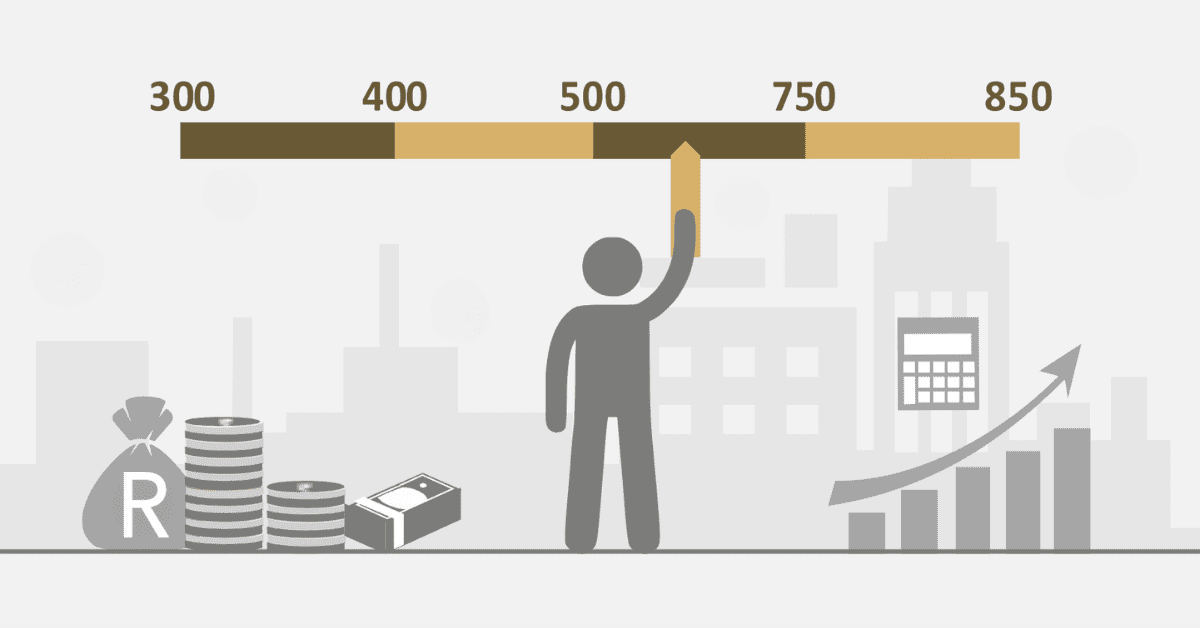

How Much Should Your Credit Score Be to Qualify for a House?

Any credit score that can lead to approval of your home application is considered good. With a good credit score, you’re likely to get a home loan with a favorable rate. In South Africa, one needs a credit score of at least 610 to be considered by the bank for a home loan. However, a good credit score depends on the credit bureau used by the lender. For example, any score between 611 and 628 is considered good according to Experian’s credit scoring system. A credit score of 660-750 is considered ideal for a mortgage. The following is a breakdown of credit scores in South Africa,

- 781 – 850. Excellent.

- 661 – 780. Good.

- 610 – 660. Fair.

- 500 – 610. Poor.

- 300 – 499. Very Poor.

If your credit score is poor, your mortgage application is likely to be declined by lenders. Applicants with poor credit scores are believed to pose a high risk to lenders. However, even with a fair credit score of 610 – 660, your application may still be rejected. If you experience such a situation, you can try another bank, but this is not advisable. Multiple loan applications will hurt your credit score because the lenders will perform hard checks on your account.

Although banks use different lending criteria, they prioritize applicants with good credit scores. Some might have favorable terms and conditions, so you must conduct diligent research before applying for a loan. It is recommended that you focus on improving your credit score before applying for a home loan.