We all need money to meet our daily demands for survival. Although most people in South Africa go to work, they earn money enough to cover their household needs for a certain month. Most are left with little to save, which can affect their plans to fulfill their aspirations. This is where loans come into play.

There are different types of loans offered by financial institutions such as banks and meant for big purchases like buying homes, starting businesses, or purchasing vehicles. To be eligible for these loans, it is advisable to have a good credit score. However, you can also apply for quick personal loans without credit via loan apps. Getting the credit you need in South Africa is easier nowadays because of loan apps. However, there are certain things you should know about this method of accessing loans. Read on to learn everything you want to know about the best loan apps without a credit score.

Best Loan Apps Without Credit Score

If you are looking for a quick loan without credit checks, there are several loan apps you can consider. When you choose the right app, you will get instant funds with no credit score. All you need to do is to complete an online application, enter the amount you want, and your employment history. However, choosing the appropriate loan app to use can be daunting since there are numerous players in this sector. The following are the best loan apps you can consider to get a quick loan.

GetBucks

GetBucks is probably the best loan app that helps you access quick cash without credit checks. The app uses fast online and SMS applications that make the application process seamless. It takes a few minutes to complete your application form, and you will also get instant approval.

Online Loan App

This is a safe loan app trusted by most South Africans. It offers loan amounts that range from R500 to R80 000. You can repay your loan over 91 days, but you can pay earlier if you want. The app works with a bank card, and you can use it in different retail stores.

Izwe Loans App

This app provides quick and convenient payday loans. In less than an hour, you can get a loan of up to R500. Borrowers are expected to repay the loan within the end of the end of the next pay cycle.

Yalu

This is another popular app among South Africans. You can borrow up to R5,000 for three months. The app is specifically meant for people without access to loans from traditional banking services. The application process is quick and easy.

SA Cash Loans

SA Cash Loans App gives loans of about R8,000, and borrowers are given six months to repay the money. If you need a quick loan without completing a long application, this app is for you. The process is fast and easy. Once your application is approved, your money is immediately deposited into your account.

Can I Get a Loan Without Credit Score?

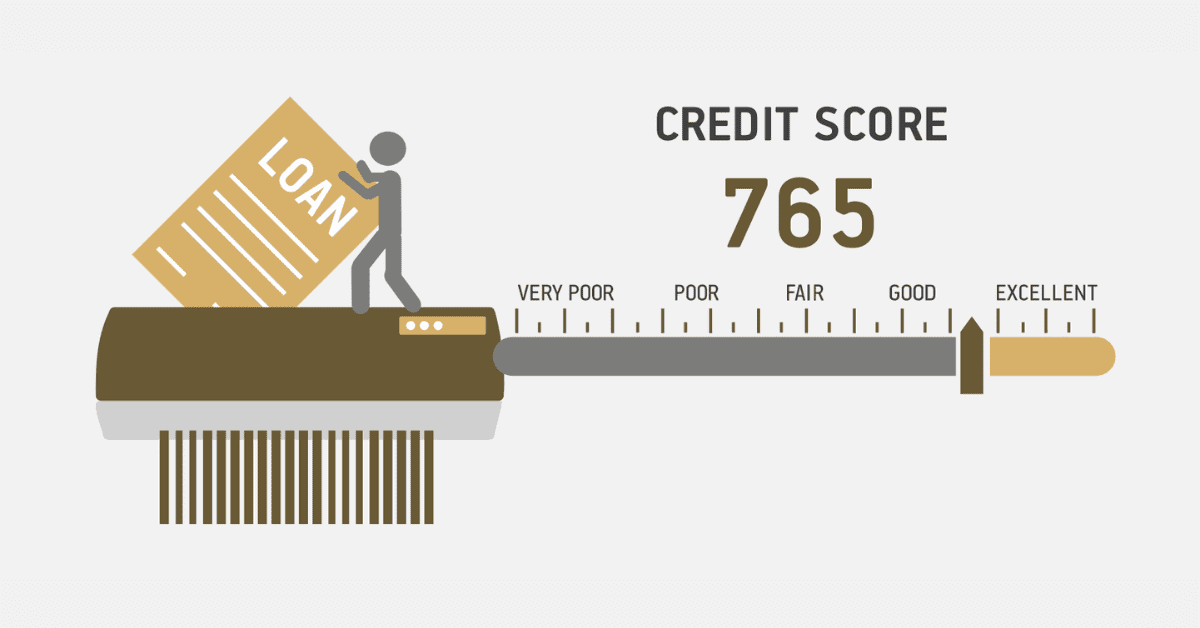

Yes, it is possible to get a loan without a credit score as long as you can convince the lender that you will repay the money with interest. There are different lending options for people with poor credit histories or low credit scores. With a low credit score, you can apply for a short-term credit called payday loan.

As the name suggests, a payday loan is a short-term cash loan that allows you to borrow up to R2500. This loan is specifically meant for employed people in need of cash to cover their immediate needs. Lenders do not conduct credit checks once you prove that you have a reliable source of income. This loan is usually repaid within 30 days or a few months depending on the lender.

Lenders also offer personal loans to borrowers with bad credit but want large sums of cash. These loans are repaid over a long period. While it is possible to get a loan without a credit score, you need to be careful. Some loans come with high-interest rates, so you may end up creating a debt cycle for yourself. Consider these loans if you need the money.

How to Get a Loan Without Hurting Your Credit?

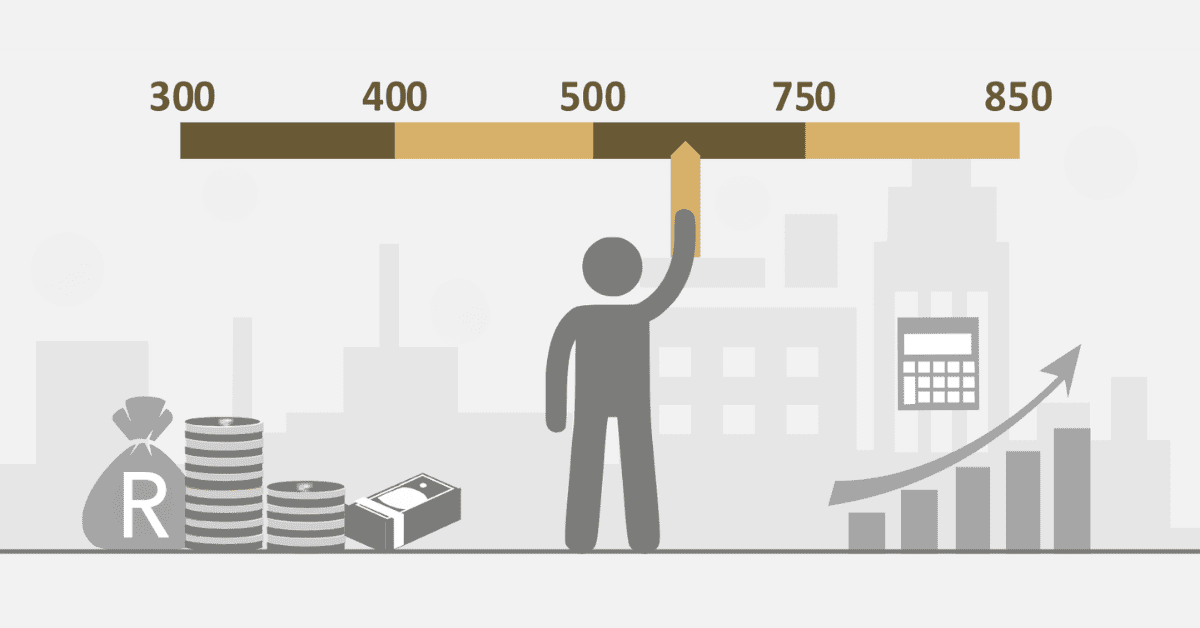

When someone has bad credit, it does not necessarily mean their history is bad as well. If your credit score drops due to unforeseen circumstances like job loss, you can apply for a loan without further hurting your credit when your situation improves.

To avoid hurting your credit, you need to conduct some research to identify the best lenders that suit your needs and current circumstances. Lenders will check your credit report when you apply for a loan and this will impact negatively your credit score. Hard inquiries on your credit history may indicate that you have no stable financial health. It is recommended that you first boost your credit score before applying for a loan.

What’s the Easiest Loan to Get With Bad Credit?

The easiest way to get cash with bad credit is to apply for a payday loan. This type of loan is meant for employees with bad credit history but in need of short-term loans that can be repaid within the end of the next pay cycle. Lenders of this type of loan do not conduct credit checks, and the application process is quick and easy. Alternatively, you can choose an appropriate loan app in South Africa where you can get cash advances without experiencing the hassle of going through a rigorous application process.

If you need quick cash in South Africa, you can consider using a loan app. This method of accessing cash does not include credit checks, which makes it ideal for people with poor credit scores. While instant loans can provide quick relief, they may come with strict repayment terms that can complicate your financial situation. Therefore, it is recommended that you should conduct research first to get a loan with the best terms.