Before we take you through Gcredit, let us look at the genesis of Gcredit. Gcredit is a term that originated for Gcash; an online platform that serves as a payment gateway.

But what at all is Gcash?

Gcash is becoming more popular as one of the leading solutions in the fintech field. Gcash has gained the trust of millions of users and has become a popular choice due to its user-friendly design and robust security features.

One of the primary factors contributing to Gcash’s success is its user-friendly interface, which makes it incredibly easy to navigate and utilise. Gcash not only simplifies digital transfers, but it also offers additional features and benefits. Additionally, it aids individuals in achieving financial success. One of the greatest advantages of Gcash is its ability to bridge the gap between individuals who lack bank accounts or access to banking services and those who have them.

Having understood the concept and technological solution of Gcash, we will look more into Gcredit. Once there is Gcash, there is Gcredit. This blog post will educate us on how to increase Gcredit scores and a few related questions about Gcash and Gcredit.

How to increase GCredit score

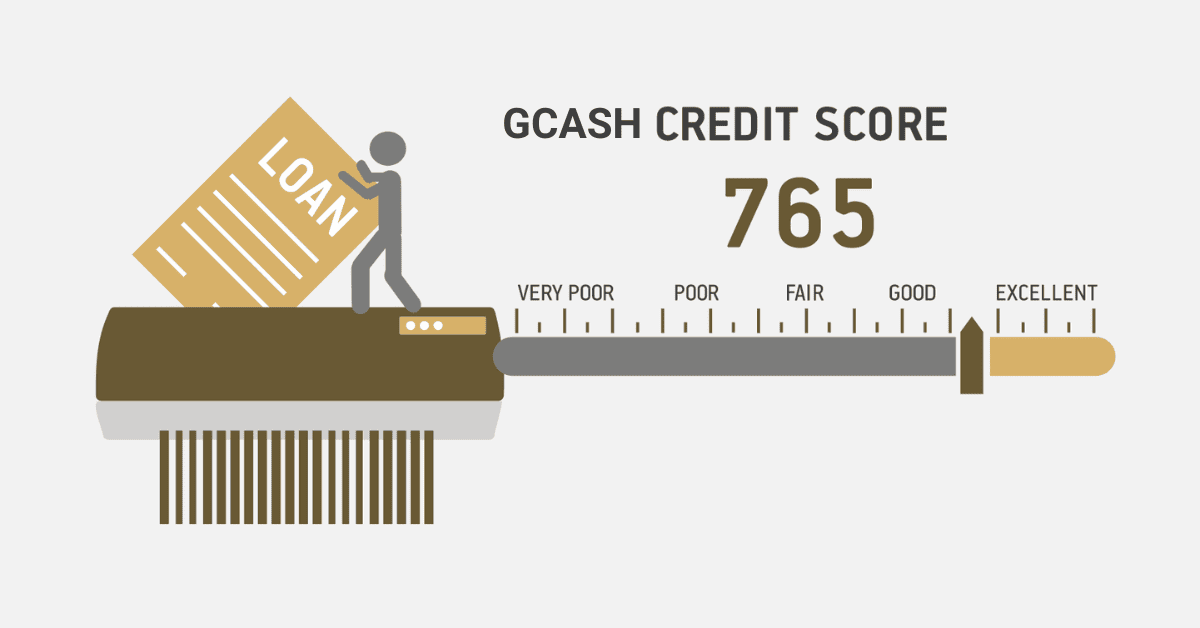

Gcredit score is related to Gcash; once you have Gcash, it is obvious and certain to have seen Gcredit on the platform. Considering the popularity of Gcash, more information is centred on Gcredit. There is no denying that GCash is incredibly popular in the Philippines as an e-wallet. It offers convenient online and on-site transactions. The app simplifies the process of paying bills and shopping online by eliminating the need for physical cash. Now that GCash has introduced lending products, users are excited to boost their GScore to qualify for loans.

To know how to increase your Gcredit score, here are some tips to help you with.

If you want to increase your Gcredit score, there are several helpful tips to keep in mind. One important tip is to make sure you pay your dues or debts on time.

It is always a good idea to use GCash for all your online payment transactions. These practices can contribute to a better Gcredit score rating.

Regularly loading funds Gcash can also help increase your Gcredit score. It is considered that once funds are added to your account, there is the notion of regular usage of the Gcash platform. Once this is done, you can always use it for all your transactions whether paying bills, buying on an e-commerce platform, making payments etc.

When you make timely payments for your GCredit, it also helps to improve your GScore. If you consistently miss the due date for payments, you will not be able to access future loan products unless you have fully paid off the amount you owe.

To boost your trust rating, consider utilising your maximum GCredit limit.

It is important to develop a habit of regularly depositing money into your GSave account. This will help ensure your financial security in the future.

What is the highest credit limit for GCredit?

The widespread use of digital payment methods and online banking has made it increasingly common to conduct business transactions without the need for physical cash. The convenience of using cards instead of cash has revolutionised the way we manage our finances. It holds in various scenarios, whether you are out shopping at physical stores, sending money to your family, or friends and paying bills.

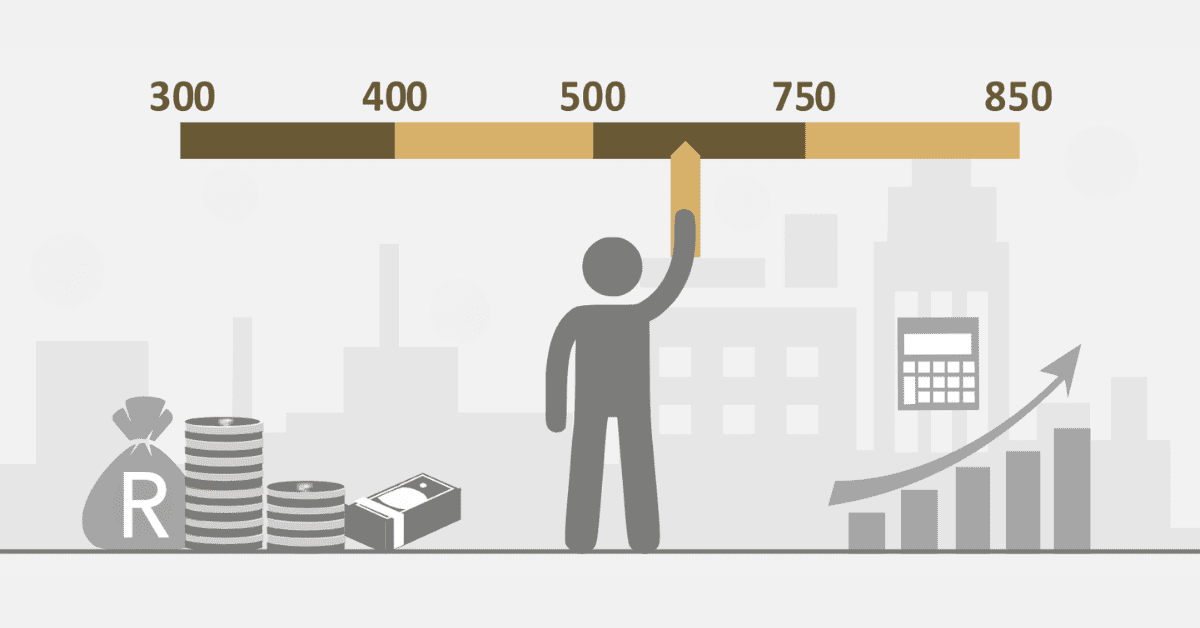

Having a credit line that suits your needs is extremely important, whether it is for personal expenses, business endeavours, or unforeseen emergencies. The maximum credit limit offered by Gcredit is 500,000 PHP. Having a higher credit limit can provide you with increased freedom and purchasing power.

What is the required GScore to unlock GLoan?

Gone are the days when individuals had to endure lengthy queues at banks or carry huge sums of cash in their bags and wallet.

With the help of Gcash, many individuals do not carry huge sums along with them but have their money secured on the Gcash platform.

What makes Gcash really attractive is the Gloan feature. The Gloan feature allows you to lend money from Gcash with little or no interest.

Many people who wonder about the requirement to unlock the Gloan should note that there are no standard criteria for this. There is no peculiar metered out for Gcash users who seek for Gloan. If you want to qualify for Gcash, just maintain a healthy wallet, keep making transactions and load your Gcash whenever your balance is low.

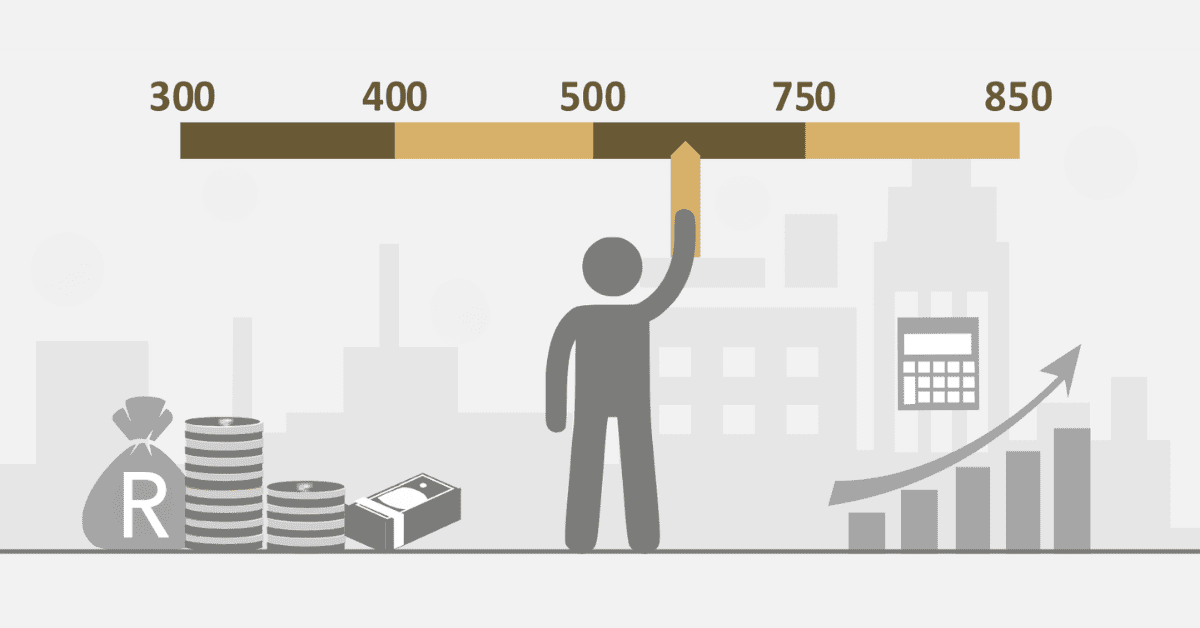

What causes GScore to go down?

There are several factors that can cause your Gscore to go down. Some of these reasons may be external and internal. However, a Gscore decrease can affect your Gscore and accessibility to other Gcash features.

Late payments of more than 30 days on credit cards or loans can have a significant impact on your Gscore.

Additionally, when you purchase an expensive item whether you pay for it immediately or not, you can decrease your Gscore. This is because the app detects high utilisation of funds in your account.

Furthermore, when you have unpaid non-credit accounts that are sent to collection agencies, it can affect your Gscore.

When you apply for new credit, have your credit limit reduced, or close credit cards, it can potentially cause your Gscore to go down.