If you have a bad credit score in South Africa, it is sometimes referred to as ‘blacklisting’. This is an archaic word that was used in the days when South African credit bureaus only tracked negative payment history. Today, after several reforms to the National Credit Act, the bureaus track both positive and negative payments. This means you can never truly be ‘blacklisted’ anymore.

Instead, your credit report is rolling and dynamic, updated monthly at the bureaus. Items will appear and fall off your report on individual timelines now, not as one single event. This makes rehabilitating your credit history a lot easier- provided you are proactively working on better credit behavior! Today, we will unpack everything you need to know about getting a credit card with a poor credit score, as well as some updated facts about ‘blacklisting’

Can I Get a Credit Card if Blacklisted?

Can you get a credit card if you are ‘blacklisted’? That is highly dependent on how bad your score is, how you are addressing it, and other factors. So the answer is a strong maybe, which is a lot better than no!

Today, ‘being blacklisted’ is used as a term for someone with a poor credit score. As we noted above, the original use of blacklisting no longer applies, and rehabilitating poor credit is significantly easier. Lenders also take a more nuanced approach to bad credit customers. It is still a useful shorthand term but you must understand the shift in meaning. Remember, it works in your favor! Negative credit no longer lingers like a black cloud, but will soon be pushed away by your newer, better behavior.

While you are working on that dismal credit score, obtaining new credit is challenging. Especially as you need credit- specifically good credit- to obliterate the effects of bad credit. However, there are lenders out there who specifically work with bad credit borrowers. Additionally, you can use prepaid credit cards, which are less of a risk to the lender, and smaller accounts with less stringent standards, to give your credit profile a boost in the hopes that more traditional lenders will take the risk. Your options will be more limited, and you won’t get favorable rates and terms, but you certainly have a chance.

How Long Does Blacklisting Last in SA?

Now you know that ‘blacklisting’ is no longer a thing in South Africa, you hopefully feel a lot better. You have an agile credit score that is regularly updated, good or bad, instead of one big blacklisting event that lasts a long time. This means even the smallest positive behaviors will help offset older bad credit and start your score on an upward trend. You should see changes within 3 months. You won’t jump to immediate good credit again, but this is still great news!

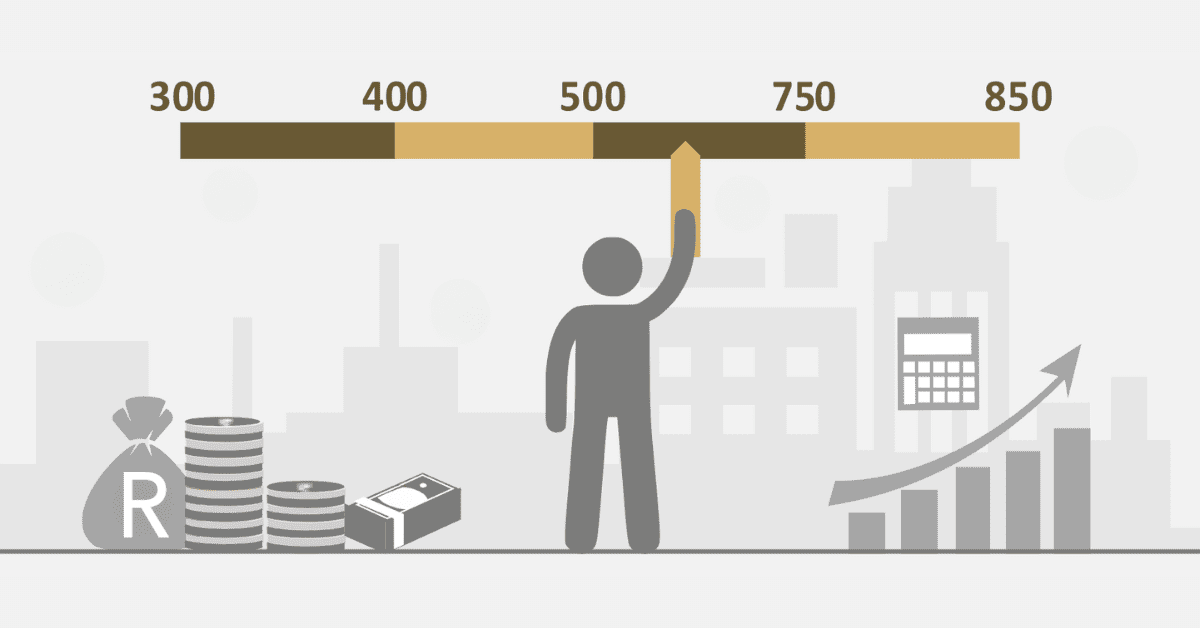

Your bad credit score won’t last forever if you work on improving how you use credit. Individual events are weighted uniquely (according to stipulations in the National Credit Act) on your credit profile. They also only remain for specific periods. Most general data will move off your report within 1 to 2 years. It will also have less relevance as it ages, especially when better, fresher credit behavior is added.

That said, serious issues like bankruptcy and defaults will linger for up to 5 years and will have more of an impact. Nor will the defaulted debt you owe disappear from the report unless you correct it. In South Africa, one of the most important factors is your monthly payment history- it accounts for about 35%-40% of the total score! Luckily, it is also one of the easiest to correct. Some lenders will be a lot more lenient if they see a full year of regular, timely payments, even if there are 2 years of poor payment before it.

Can You Get Approved for a Credit Card with Bad Credit?

While having bad credit can make it challenging to get approved for a credit card, it’s not impossible. Some lenders specialize in individuals with less-than-perfect credit histories. These cards may come with higher interest rates, lower limits, or additional fees- but hey, it is a credit card!

There are also prepaid credit cards. Additionally, demonstrating responsible financial behavior, such as making timely payments on existing debts and reducing outstanding balances, will greatly improve your chances of getting approved. Every point you can push your credit score up is a step closer to rehabilitated credit, even if it takes time.

How Do I Clear My Blacklist Status?

There is no blacklist status to clear in South Africa anymore, and that is fantastic for those with bad credit. Nothing but continual responsible behavior with credit will move your score up. There is no cheat code to immediately fix a bad credit score. However, you don’t have one big, dramatic blacklisting to try and get rid of. Even small positive changes to how you use credit will start pushing your score up. If you maintain them over time and build on them as your debt becomes more manageable, you will soon have a credit score you can be proud of.

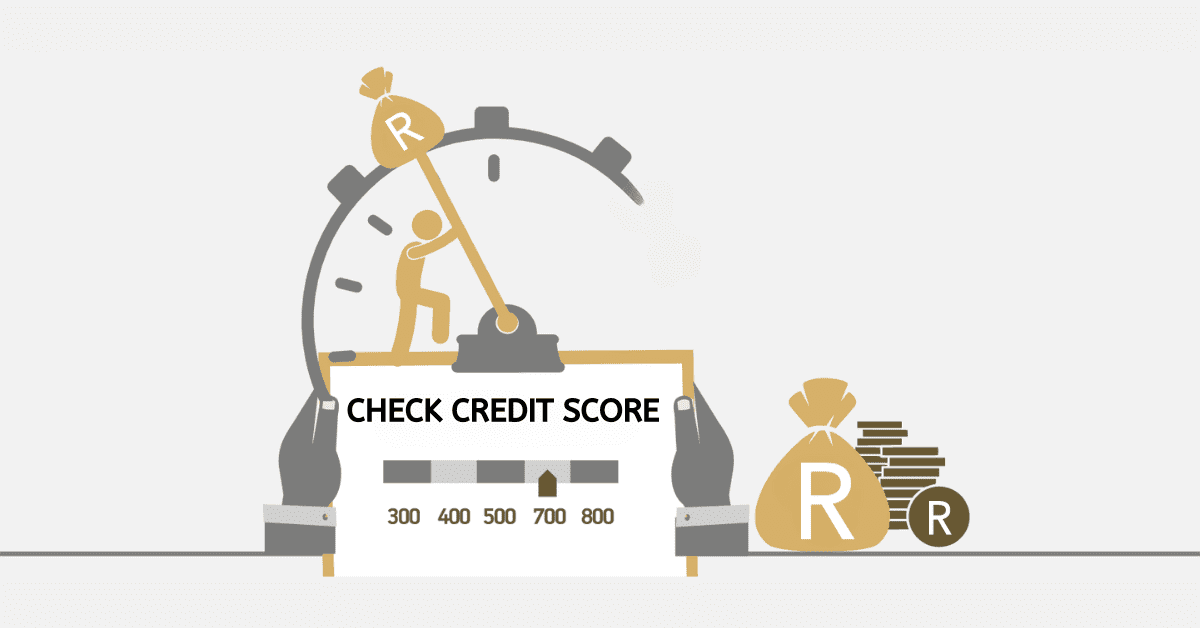

This means that fixing your bad credit status in South Africa requires you to address the underlying issues that led to your terrible score in the first place. Start by obtaining your credit report from at least one of the major credit bureaus in South Africa, such as TransUnion or Experian, and checking it for inaccuracies, fraud, and other discrepancies. Not everyone will find these- most of us get a bad credit score from our own behavior, not mistakes or criminals! If you identify any errors, however, you can dispute them with the bureau.

Now, it’s time to get real about your own bad behavior and fix what is broken. If you have outstanding debts, take steps to settle or repay them. Remember that defaults have one of the biggest, and longest-reaching, effects on your score. This means negotiating payment plans with creditors, settling your debts outright, or seeking assistance from debt counseling services if you are drowning under obligations. Then, you need to ensure you pay on time, every time, every month. No exceptions!

If you work on fixing your past financial issues and demonstrating responsible financial behavior moving forward, you will gradually improve your creditworthiness and boost your credit score.

What Happens After 5 Years of Being Blacklisted?

After 5 years, most of the negative information on your credit will fall away. You can’t hunker down and not use credit for 5 years, then emerge and start the bad credit cycle all over again, however! While your credit score is perfectly fixable with smart, proactive, and positive credit behavior, it won’t magically fix itself even after the negative actions fall away- it will tick down to eventually being no credit record at all without fresh, positive data!

Unfortunately, nothing but better behavior will fix the inherent issue- but at least you can control and work on that. You don’t have to wait to see the positive impacts for a ‘blacklisting’ to go away, you can start fixing your credit at any time!