Credit exists in South Africa for the right reasons and this is because of an internal policy created. Credit exists to provide means for people who cannot afford to make one-time purchases. Also, it looks to reduce the flow of money in the system.

Fiscal and monetary policy are part of credit systems in South Africa. And it is a good course for individuals to have credit.

Many people believe having credit is a way to control their finances and their desires. Although that speaks of that it also creates discipline in the financial sector. These are done through checks and assessment of credit.

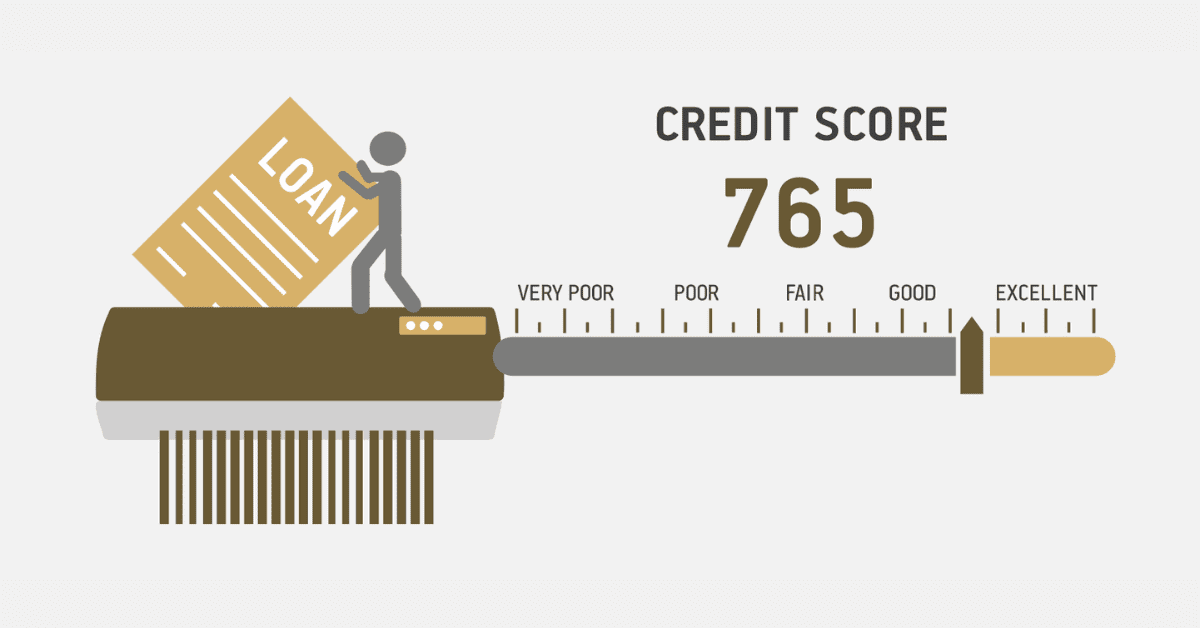

When you prepare to go in for something with credit, there will be further checks on your credit. These checks are done on your credit score and history to ascertain your creditworthiness on that purchase.

These credit checks take time, but how long does it take for a credit check to be done in South Africa? Let us find out more about how long it takes to check credit for a car, job, mortgage, phone etc.

How long does a credit check take for a car?

If you have credit and you are looking to buy a car, you must be prepared to have your credit history checked.

Buying a car can be considered a high expense, even though you may not pay all the money upfront. It is considered a high expense because it is not a quick purchase, where you pay a couple of Rand in 6 months and then you are through.

When you have credit, it could take you more than 2 years to pay it off with credit. The other side expenses that come with it alone can swallow your income. Of course, all incomes are not the same, but nobody smiles at spending money on his or her car.

Think of the oil change, filter change, insurance, tyre change etc; these are all part of servicing the car. You only get luck if you are trying to buy an electric car.

Nevertheless, we are not here to talk about cars and their expenses but how long it takes to have your credit check when you plan to buy a car.

When you plan to buy a car, your credit is thoroughly checked if you are capable of paying the car back. If you are buying a car worth R200,000. The creditor will have to look at your credit history and see if you have any existing debt that can cause a default in your payback. This means your credit will be checked and this usually takes about 5 to 7 working days. These checks are done with the credit bureau as well, to consider the purchase.

How long does a credit check take for a job?

Why would one check your credit before giving you a job? The notion behind this may seem obscure but an employer needs to do a credit check before offering your job.

Not all employers do this but employers may offer roles with some financial responsibility, like a cashier or an Accountant.

The employer must be given the consent before doing a credit check. The credit check takes not more than 3 working days. This is not to view your credit score but to see if you have no existing huge debt on your credit.

How long does a credit check take for a mortgage?

There is an important step in the home-buying process that can cause a lot of stress: the mortgage credit check

Most of the time, it takes between a few minutes and a few days to get a mortgage. How long it takes varies on several things, such as the lender’s process, how complicated your financial history is, and how many applications they are currently handling.

For example, let’s say you want to buy a house and need a R900,000 debt. The lender will start the credit check as soon as you send in your application and all the required papers.

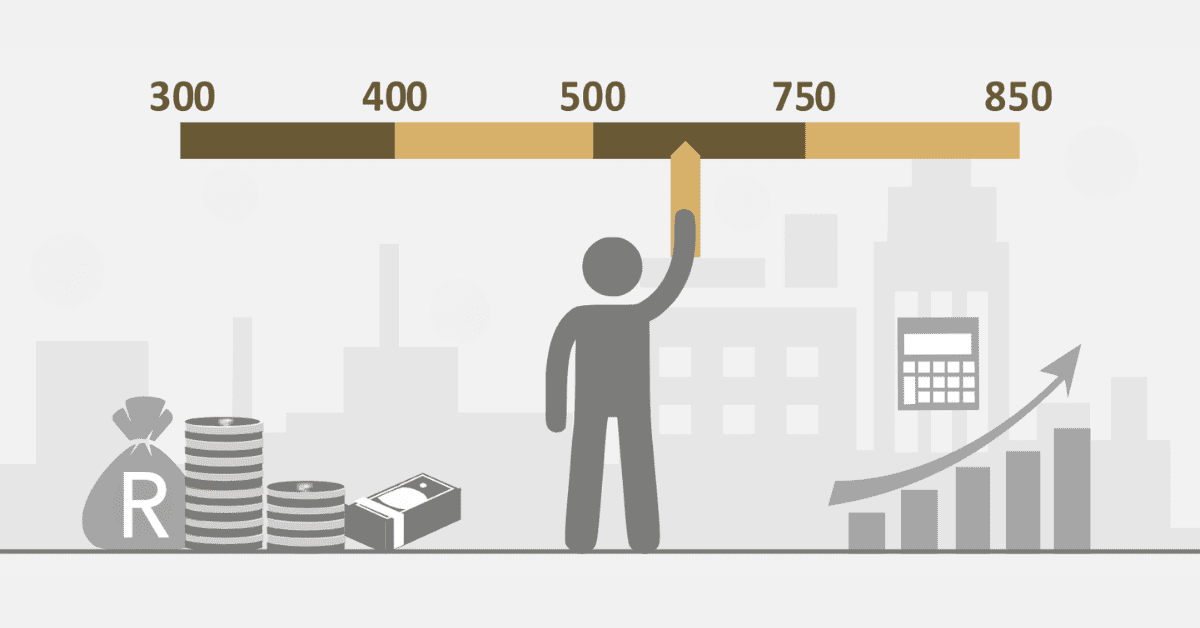

To do this, they will look at your credit score, credit records, debt-to-income ratio, and other details. The process might be pretty quick, maybe even finished in a day or two, if your credit score is high and your financial past is clean.

There may be problems, though, like mistakes on your credit report or differences in your financial papers. This could make the process take longer while the lender works to fix them.

It is important to be flexible and keep the lines of communication open with your lender. You can also speed up the process by making sure that all of your financial papers are correct and up to date before you send in your mortgage application.

How long does a credit check take for a phone?

When you apply to get a phone on credit, it is just like seeking a loan to buy the phone. However, in this case, the phone is given to you based on certain terms. These terms include the cost of the phone, insurance, interest, taxes, payment plan and many more.

Before anyone could get a phone with credit, what is required as a check must be done. This is considered to be a credit check, which could be a soft inquiry or a hard inquiry.

This is done by the service provider to confirm your ability to pay the price of the phone within the agreed time. Your credit history will speak more about your creditworthiness when the service provider decides to check your credit.

When it comes to mobile phones, it usually takes less than 7 working days to have this check done. In some cases, it can take 3 working days. All these depend on your credit score and the kind of phone you want.

Credit checks are done when there is an authorisation for the credit user to the service provider.

How long does a credit check take for renting?

A credit check, which is also called a credit inquiry, is a report that landlords use to find out certain details about a renter’s credit background. The report could show the potential renter’s exact credit score, a range of credit scores, or a different way of looking at some of their financial information.

When you plan to rent, the landlord needs to do a quick background check. This is to verify a few details about your finances.

usually, credit checks done for renting do not take more than 2 days unless there are issues. If you have your application and documentation right, the credit check should not take more than 2 days.