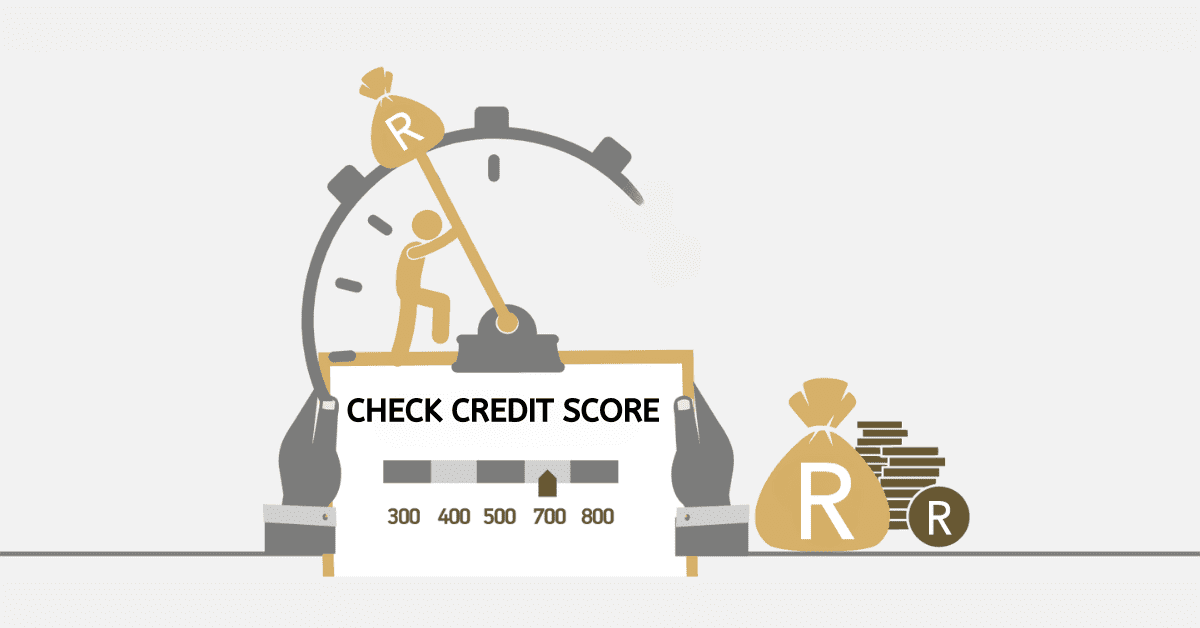

Are you getting ready to buy a home in South Africa? For most of us, that means approaching a mortgage lender (or rather, several) in the hopes of getting approved for a bond. After all, only very few people can cover the costs of a home in cash! If you see a shiny new set of house keys in your future, then it is time to pay serious attention to your credit score.

Why Does My Credit Score Matter For a Home Loan?

Lenders of all types use your credit score, and the information on your credit report, to assess how trustworthy and reliable you are with credit. Credit bureaus are authorized financial institutions that collect a variety of data on your credit behavior. They then assemble this information into a score and profile that lenders can use to decide if you are a good risk for their needs.

This number isn’t something they suck out of their thumb, either! Your past behavior- good and bad- is critical to how appealing your credit score will look. Mortgages have some of the most demanding credit criteria. After all, this is a massive expense and one of the largest amounts most individuals will ever loan. So it makes sense that their standards are high.

What is the Minimum Credit Score for a Home Loan?

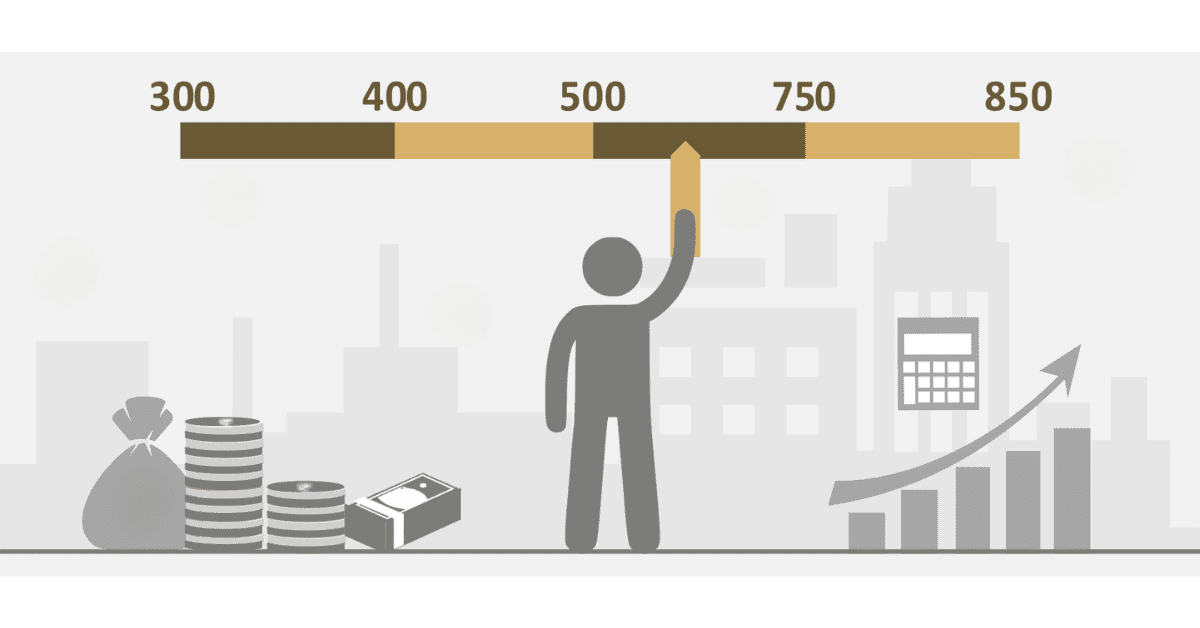

In South Africa, mortgage lenders want to see a minimum credit score of 640 to easily get approval for a home loan. While some people with close scores in the 600 may get lucky and get approved, it is unlikely they will get favorable terms or interest rates. And anything lower than 610 is highly unlikely to be approved at all.

Can I Qualify for a Home Loan with Bad Credit?

In short, no. You won’t qualify for a home loan with bad credit. No lender is going to volunteer many hundreds of thousands of Rand to someone they have no faith will repay it. They will lend to people they believe have the means and responsible nature to manage such a large line of credit. The good news is that a bad credit score can always be improved. It isn’t a lifelong thing.

If someone is promising you a home loan on bad credit, be very, very suspicious. It is more likely to be a scam or a predatory loan shark than a legitimate deal.

What is the Minimum Salary to Get a Home Loan?

To get a home loan, credit score is only part of the equation. You also need to have the salary to cover the loan repayments without financial strain. In South Africa, many banks and lenders get people’s hopes up by promising an ultra-low starting salary range for mortgages- sometimes as low as R3,500 a month! In reality, that may qualify for a loan, but it would be a tiny one. And houses in South Africa don’t come cheap! So in practical terms, that offer is useless.

Comparing average mortgage repayments and property values in the various provinces is more meaningful. According to some very reputable research, these are the salary ranges that will realistically buy a house in the different provinces.

The Western Cape, unsurprisingly, has some of the highest property values around. You will need about R22,600 per month in salary to unlock the R700,000 plus mortgage you need for property here. This is similar in Gauteng, where you need about R20,600 per month to qualify for R600,000, the minimum you will pay for most freestanding properties. The Eastern Cape has the lowest property values, starting at around R380,000. This would need a salary of about R12,600 a month. You will pay less for homes in estates and complexes, or flats, but this should give you a strong ballpark to aim for. Realistically, you need at least R13,000- R15,000 to qualify for a meaningful mortgage.

As you can see, the salary you need for a mortgage in South Africa is more dependent on the size of the loan (i.e. the price of the property) than anything else. So you will need to make sure your dreams and reality align.

How Much Must Your Credit Score Be to Buy a House in South Africa?

As we looked at above, it is advised to have a credit score of at least 640 to buy a house in South Africa. If you want to make certain you will be approved, aim for at least 670. The higher your score, the better. Remember, credit isn’t a pass/fail style of thing. Lenders will also use your credit score to decide what interest rate and terms they will offer you. A higher credit score will typically unlock better rates. And over the decades you will have the mortgage, even a small improvement in interest rate can save you a lot of cash!

While your credit score is not the only factor that will go into your mortgage application, it is an important one. A mortgage is typically one of the largest and longest-term debts an individual will ever take on. So mortgage lenders want to know you are a good risk, with a track record of paying your bills. They will also look at how much credit you currently have open in comparison to what you are earning. Even with a good credit score, they are unlikely to approve you if your lines of credit are near-maxed, your payments are regularly late, or your debt-to-income ratio is bad. So instead of looking at it as a way to ‘game the system’, rather take a positive and proactive approach to improve your credit track record overall, and let the victories follow. You will soon be enjoying your new home!