Have you ever thought about how complicated it is that your credit score affects the loans you can get? This subject often leads to misunderstanding and the spread of false information. Let us find out more.

Your credit score is like a record of your finances; it is a number that shows how creditworthy you are. Lenders look at this crucial factor when deciding if you can responsibly handle your debt. What happens to your credit score when you get a loan?

Many things can change how a loan affects your credit score. Lenders usually do a full check of your credit report when you apply for a loan. This request may lower your credit score for a short time because it gives a quick look at your current financial situation. But the effect is usually small and short-lived.

We will talk more about how loans affect credit scores as we go along.

What effect does a loan have on your credit score?

Loans are important ways to get money that can help you pay for things like buying a house or car, starting a business, or paying for unexpected medical bills. In other words, how do loans change your credit score?

Your credit score is a very important factor in figuring out if you can get loans and other credit goods. The types of loans and credit cards you can get and the interest rates you will be charged depend on your credit score. You might not be able to get a job, rent an apartment, or pay less for insurance if your credit score is low.

It is very important to have a good credit score. There are credit repair pros ready to help you right away if your credit is not good or if you do not have enough.

Getting a loan can have different effects on your credit score, depending on how you handle it. It could be good or bad. Here is a complete list of these effects:

- Your credit score is based on how well you have paid your bills in the past. Making loan payments on time can help your credit score by showing that you can be trusted to pay back debts. Not making payments or meeting loan responsibilities, on the other hand, can really hurt your credit score.

- Lenders like to see a mix of different types of credit on your report , like payment loans and revolving credit. You can improve your credit score by adding a loan to your mix of credit. This shows that you can responsibly handle different types of credit.- ADVERTISEMENT -

- If you take out a loan to pay off other debt or make a big buy, it could affect your credit utilization ratio. This number shows how much of your available credit you are using compared to how much you have available. Your credit score can go up if you pay off debt with a loan and lower the amount of credit you use.

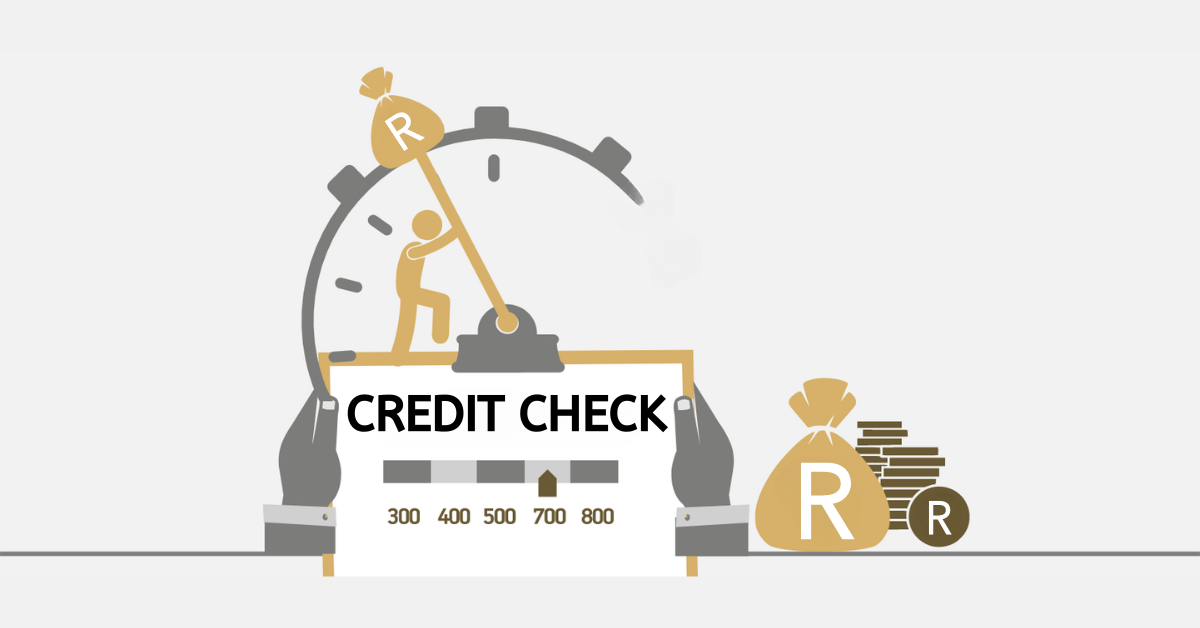

- Lenders usually do a hard inquiry on your credit report when you ask for a loan. Having a lot of questions in a short amount of time can lower your credit score for a short time. Credit scoring models generally treat multiple inquiries for the same type of loan as a single inquiry when they are comparing loan terms quickly. This means that it has less of an effect on your score.

- If you apply for a new loan, the average age of your credit accounts could go down. This could cause your credit score to go down a little, especially if you do not have a very long credit history. Continuing to make payments on time on the loan can help build a good payment history over time, which could make up for any initial drop in score caused by the new account.

Does my credit score go down when I get a loan?

Truthfully, it is not the loan that causes a dip in your credit score but rather something that most people find frustrating.

When you apply for a loan, your lenders do a quick background check on your credit history. This is to determine your financial discipline and the possibility of repaying the loan.

It is normally considered an inquiry, which could be soft or hard.

When a hard inquiry is done on your credit before a loan approval, it does not go well, your credit loses some point.

However, getting a loan does not let your credit score go down.

How long does a personal loan stay on your credit report?

A personal loan is one of the easiest loans to help you build your credit score. When you apply for a personal loan and receive the approval with all the terms, the loan gets to be part of your credit history and credit report.

It can take a year to a decade for a personal loan to stay on your credit report. Even if you finish paying your personal loans, it may take a decade or more to leave your credit report.

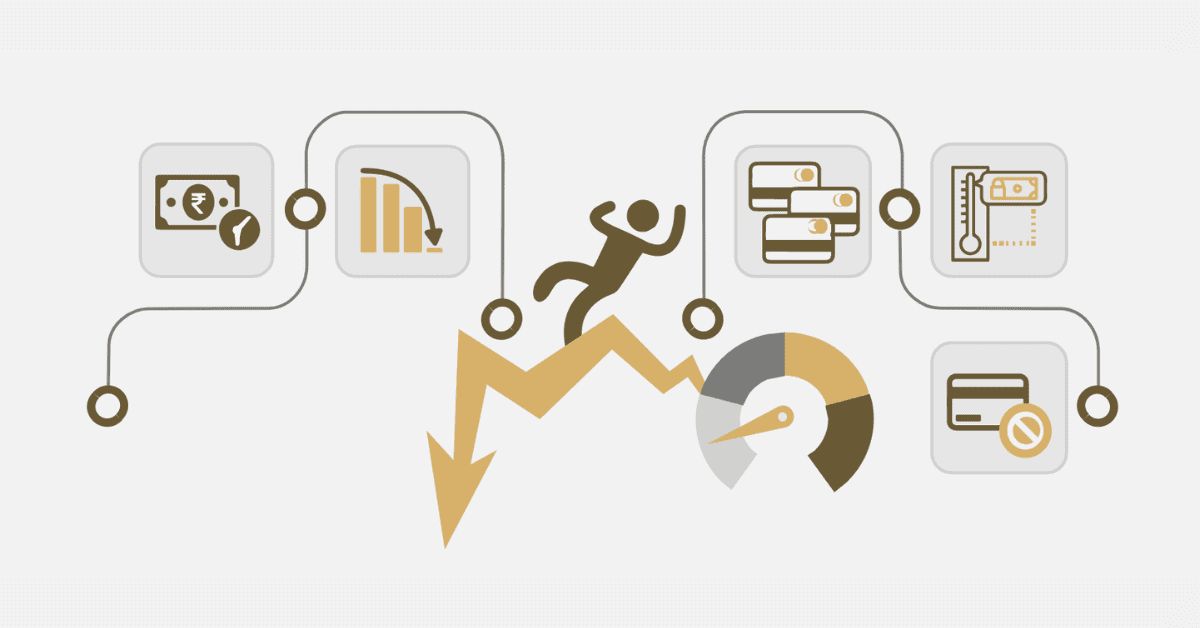

Why is my credit score going down if I pay everything on time?

Even if you make timely payments, your credit score could go down for several reasons. One thing to think about is your credit utilization, which is the ratio of your credit card balances to credit lines. If your accounts go up, even if you make payments on time, it can hurt your credit score. Also, applying for new loans or credit often can cause hard questions, which can temporarily lower your score.

Lastly, if the credit bureaus change the scoring model or formulas they use, it could affect your score. To help with these issues, you should keep an eye on your credit report, pay off your credit card bills quickly, avoid opening too many new accounts, and dispute any mistakes you find.