Loans and other personal credits rely highly on credit rating, an arithmetical rendering of one’s creditworthiness. In South Africa, a rating beyond 680 is mainly marked as good, and the scale is from 330 to 830.

How is this score determined, then? Your payment history, total debt, account kinds, account number, account age, and total account balance are the main factors determining this.

Everything that may have an effect on your South African credit rating is going to be discussed deeply in this writing. How to boost your credit rating, why it may be low despite prompt payments, and what to do if you wish to maintain it that way are all subjects we’ll discuss. Let’s begin!

What Factors Affect A Credit Score?

The models used by TransUnion, Experian, or Compuscan credit bureaus differ when rating your score. However, they generally consider the following:

- Payment history. This shows how you settle your bills and debts on time. Settling them in good time increases your score, while late missed payments decrease it.

- Level of debt. Shows your total debt and how much of your available credit you’re using. Low debt and keeping your credit utilization under 30% can boost your score, while high debt and keeping your credit utilization way below or slightly above the maximum can lower it.

- Length of credit history. This details how long you’ve been dabbling in credit. The longer and more diverse it is, the more it will improve your score, while a short or limited one can lower it on its own.

- New credit. This indicates how often you have applied for new credit. The truth is that applying for credit sparingly can lift your score while doing it piled on top of one another can take it down a notch.

- Types of credit. This will be an indication that, indeed, you have the types of credit products. These can boost your score while reducing it if you have only one type.

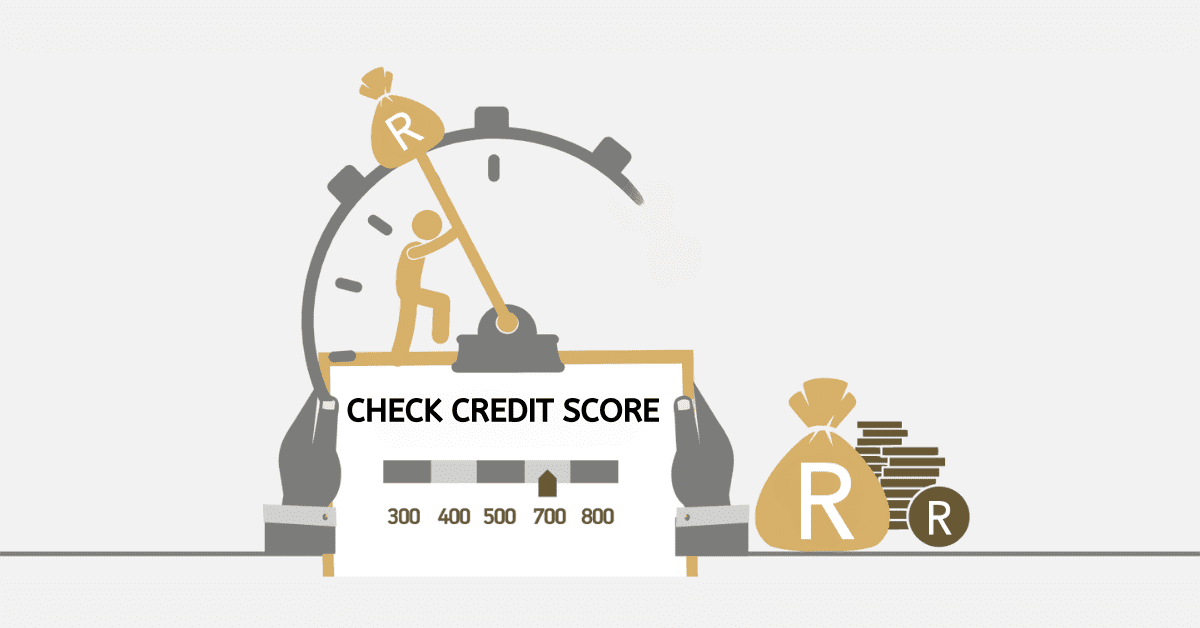

How To Boost Your Credit Score?

Aiming to give that credit rating an uplift? Below is how you may achieve that:

- Monitor your credit rating and statement. Check them regularly to spot and fix any errors or fraud.

- Be punctual with your bills. Clear them when expected and in toto, mainly regarding your credit card and credit accounts.

- Maintain a lid on the credit card balances. Attempt not to utilize over 30% of your accessible limit.

- Mix it up a bit. Build a diverse and positive credit history by using different types of credit responsibly.

- Don’t go overboard with credit applications and inquiries. Too many can lower your score. So, apply only when necessary.

Why Is My Credit Rating Low, And I Have Never Missed A Payment?

You may think that – having your loans cleared on time can make your credit rating appear good. But there are more details that add an impact other than that. There are other elements that may force your rating down, even if you’ve never delayed a payment. Below are some popular reasons why your credit rating can be low:

- You’ve applied to many credit products in a short time. This could make it look like you’re desperate for credit or over-indebted.

- You’re utilizing a massive chunk of your accessible loan limit. This is identified as having a high loan usage ratio.

- You have a limited or poor credit history. This would mean you don’t have a long history of using credit or only take out one kind of credit account.

- There are mistakes or fraudulence on your credit statement. These can lower your score or affect your ability to get credit.

How To Avoid Ruining A Credit Score?

Your rating is identical to a financial passport, which may unlock (or lock) doors to varied opportunities. Below are pivotal tricks to keep it in excellent shape:

- No missed or delayed payments. It can put your payment history in a bad light, and this factor contributes to 35% of your score.

- Never max the credit card or use the available credit limit for over 30%. This will increase your credit utilization ratio, constituting 30% of the score.

- Avoid applying too many credit products within a very short time. This initiates hard inquiries on your credit report, which, in turn, could lower your scores by 10%.

- Keep open those old or unused credit accounts. Closing these could decrease the length of your credit history — which makes up 20% of your score — and cause a hit in your score.

- Never neglect your credit report. It could contain errors or fraud that can tarnish your score. Periodical check-ups and disputes to eradicate errors can help maintain your score healthily.

What Is A Good ClearScore Score?

Your ClearScore is like a snapshot of your creditworthiness and reliability as a borrower but in three digits. It is worked out by Experian, which is one of the big 4 credit bureaux South Africa boasts. Your ClearScore score can be between 0 and 740, wherein 740 is top of class. If it is a score closer to 700 or more, one has a better chance of getting approved for business loans, credit cards, and mortgages. Of course, a higher score can also bag you better interest rates and deals on credit. According to the people at ClearScore, anything between 531 and 670 is considered good. That means you’ve got a positive and diverse credit history, and you’re managing your credit responsibly and living within your means.