Credit score calculation usually involves the concept of probability, a statement in number value or percentage that defines how much possibility of something happening. For example, when a coin is flipped, considering that there are two equal options, such as head or tail, the chances that the coinage faces the top would be 0.5, which makes 50%.

A borrower can default on a certain amount of debt in credit scoring. This, in essence, refers to the probability of default (PD). Higher credit scoring will be assigned to persons who have a lower PD and vice-versa. The PD is created based on certain factors such as income, employment status, assets, liabilities, credit history, and financial behavior of the borrower.

How To Convert Probability Into Credit Score

Translating probability to a credit score is essentially a mathematical formula that relates the probability of default to the credit score range. Different credit bureaus will have different formulas, but one such possibility could be:

Credit score = {Max score} – ({Min score} X log_{10}{PD})

For example, with a probability of default of 0.05, the maximum credit score being 1200 and the minimum being 0, the credit score would be:

Credit score = 1200 – (0 X log_{10}{0.05})

= 1200 + (1.301 X 0)

= 1200

According to the above formula, a perfect loan rating of 1200 goes to a borrower with a 5% chance of default. However, the formula may not exactly echo the credit scoring models the credit bureaus apply, as they may use other factors and weights to come to the final credit score. Hence, credit score checks would be best done through the credit bureaus directly rather than this formula alone.

What Is The Odds Ratio In Credit Rating?

Imagine a game of chance where probabilities would be placed on the happening of an event against its not occurring. This is the nature of the odds ratio and is the crux of a crucial concept in credit scoring. This can easily be calculated as the chances of default, meaning if the likelihood of levant is 1% (0.01), then the default probabilities are 0.0101. In this way, if out of 100 borrowers, one will be the levant, then 99 will not.

The computed value of the chances gives the likelihood ratio: probabilities of default (0.0101)/possibilities of non-payment (0.9899) = 0.0102. That is, the likelihoods of levant are 0.0102 times the chances of non-payment.

An odds ratio describes the relative risk of default from one group to another in the credit-scoring landscape. For example, where employed individuals have an odds of default of 0.02 and the unemployed 0.1, the ratio is 0.2. That is evidence that it makes borrowers 80% less likely to default and further shows that employment can act as a buffer against default.

What Is The Credit Rating Probability Of Non-Payment?

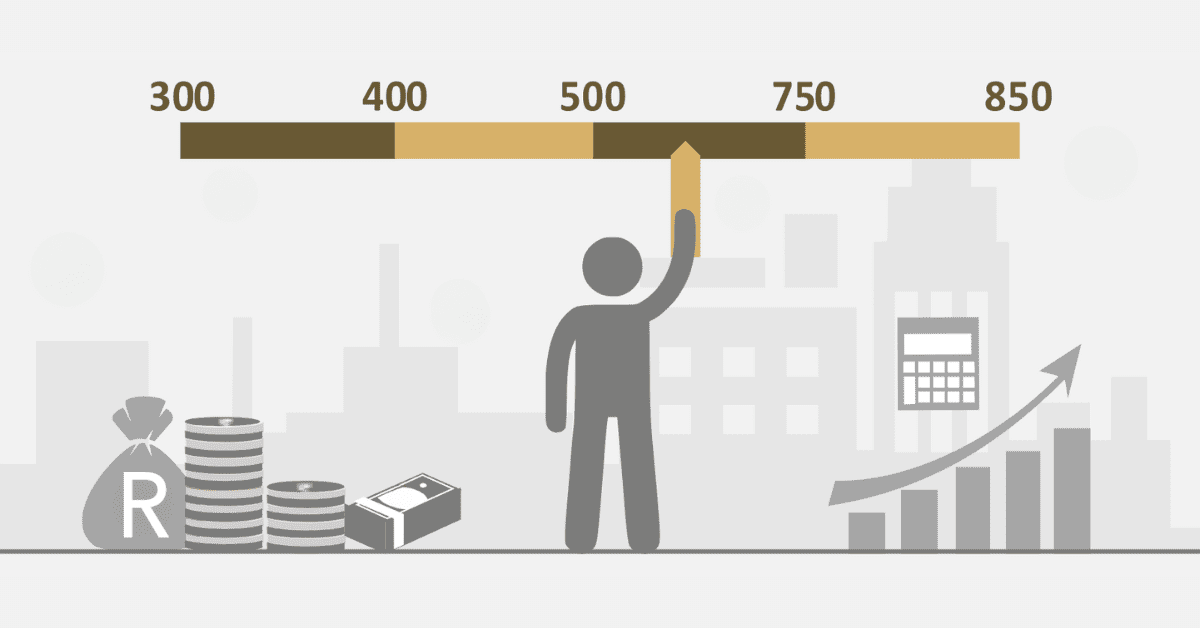

The loan rating probability of default is a kind of crystal ball that estimates the likelihood of a borrower not making a payment based on historical data from an overdraft bureau. That is if records of some agencies are such that out of 1000 borrowers with an advance rating of 600, 50 defaulted, then the loan rating probability of non-settlement for a 600-reading borrower is 50/1000, or 0.05, or 5%.

This probability serves as the guiding force for lenders and borrowers. For the lenders, this is the only way to point them to approving the applications for the credit, interest rates, and terms. For the borrowers, it reveals how their credit rating reflects their chances of being allowed to have credit and how much it will cost them to borrow.

But this probability alone is not the sole factor upon which a credit decision is based. Lenders take in other factors like income, employment, and collateral. Moreover, this probability of default credit score can change over time and also different bureaus sometimes provide slightly varied data sources and calculation methods. Therefore, it would be smart to check your credit score and the possibility of default from the credit bureaus rather than rely on some general estimate.

How Does Probability Affect Credit Scores?

Probability does have a direct and indirect effect on credit scores, where the latter shapes the credit scoring models used by credit bureaus. These mathematical models give a credit score to a borrower based on his credit history and other attributes. These use probability to estimate the likeliness of default by a borrower based on the historical data of the bureau. The higher the probability of default, the lower the credit score, and vice versa.

Indirectly, the probability affects the credit behavior of borrowers. It is such actions and decisions people get engaged in concerning credit, such as applying for credit, repaying bills, managing debt, and so on, that create behavior, which in turn contributes to credit history. This is explained by probability, which tells that the borrowers could have predicted the effect of their actions on the credit score and the probability of default.