If you have taken your credit report from different bureaus, you’ve likely noticed that your credit score is never the same between them. These small differences rarely amount to more than a few points either way. Do those points matter? Do you need the ‘most accurate’ credit score? Does that even exist? Today we look at these questions and more.

Where to Find Your Most Accurate Credit Score

Provided it is coming from a recognized and registered credit bureau, every credit score is an accurate credit score! Don’t get too hung up on small differences between bureaus, they really don’t matter.

These only happen due to differences in the financial model and algorithm they use to determine your creditworthiness. All credit bureaus (eventually) receive the same data, but the timing can vary between them, too, in turn impacting your exact score at a specific moment. Your score through third-party providers may also be different due to them using two (or more) bureaus as a source for their data and aggregating the results.

Instead, watch out for macro-trends in your credit profiles. You should particularly watch out for large discrepancies between one bureau and others- this may be an indication of mistakes or fraud on one bureau’s report, which you can track down by taking a full credit report from them and another bureau and scrutinizing it carefully.

What Credit Score Do Lenders Use?

What credit score an individual lender uses depends on their internal relationship with the bureau. Many financial institutions work with only 1 or 2 of the major credit bureaus and primarily use their data. If you specifically want to know what bureau a lender will be running your credit check through, don’t be shy to ask! Most S.A. lenders use at least one of the so-called ‘Big 4’: TransUnion, Experian, Compuscan, and XDS.

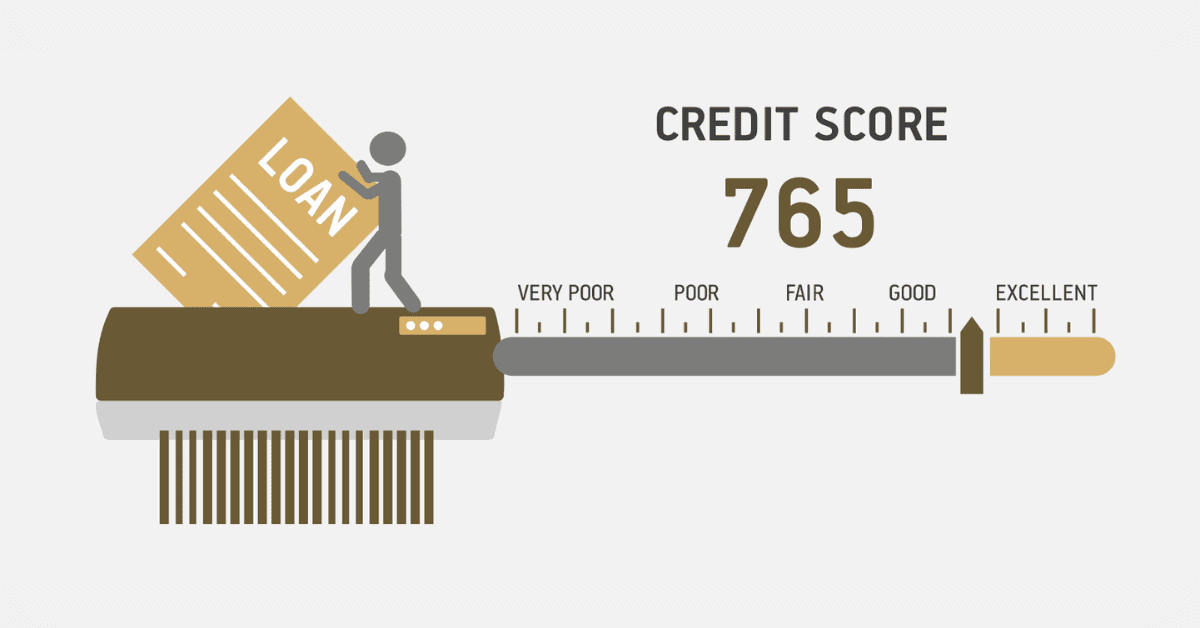

Why is my Credit Score Going Down When I Pay on Time?

If this is happening to you, you are not alone! There is a misconception of sorts that your credit profile and your overall financial ‘hygiene’ are intrinsically linked. They are not. It is perfectly possible to have millions in the bank and have no credit record at all because you have only ever paid in cash! You can also be very cash-rich and have a terrible credit report if you have skipped out and defaulted on debt. Conversely, someone can have an amazing credit score and be struggling to service the debt that comes with it.

So firstly- congratulations! Paying on time is a great financial habit to have, and will positively impact your credit score in most cases. However, keep in mind that your credit score is also impacted by credit use. If you are paying down a loan or balance, and not using credit lines at all while doing so, you will eventually see a small decline in your credit score due to your lower credit balances and the fact you aren’t ‘doing anything’ with the credit you have. So your credit score will go down, even though you are paying on time.

That doesn’t mean you should rush out and use credit just to boost your credit score! If you have been struggling under debt load and closing or reducing a credit line makes your overall financial planning more manageable, then let your score take the small hit. Always remember, however, that credit scores don’t track good financial behavior, just responsible use of credit, and the two do not always correlate.

Which App Gives You the Most Accurate Credit Report?

In South Africa currently, the most trusted and regulated third-party credit score tracking options are either in-person or third-party websites like ClearScore and Kudough. There is no trusted, recognized app to get access to your credit report except the apps associated with these well-known names.

However, many of our banks now offer you a limited report or score you can use, and that will give you a general sense of your creditworthiness in the eyes of lenders. You will, of course, need to be using banking services from that bank.

We do expect some great developments in this space, however, as mobile services are incredibly popular in S.A. Experian has already launched GeleZAR to help micro-entrepreneurs access information around smart credit use. Hopefully, we will soon see direct credit report apps offered by the bureaus themselves, which would allow for accurate, reliable, and above all safe tracking of your credit report through mobile devices.

Be very careful installing any third-party app that claims to offer this service, as you would be revealing very sensitive personal data scammers would love to have. Remember, credit and lenders are not immune to fraud! Stick to authoritative sources like ClearScore, your bank or the bureaus directly (if/when they offer apps), or choose your third-party provider exceedingly carefully. Make sure the app is legitimate, too, and not a fraudulent spoof.

Why is my Credit Score Different on Different Sites?

Differences in your credit score across bureaus happen due to several factors. The most important of these to understand is that each credit bureau, while tracking the same lending information, uses its own approach to the algorithmic interpretation of that data through actuarial science. This means there are different credit scoring models in use. While the ‘general’ credit bureaus will have similar results, there can be unique twists in how data is weighted within those models. There are also niche credit bureaus focused on specific industries or types of lender, and these very often weigh things differently depending on their specific focus.

Credit scores will also differ between the bureaus themselves and third-party tracking options (like bank apps, or ClearScore). This mostly happens because each of these sites uses data from different bureaus, and often aggregate that data from several sources. ClearScore, for example, uses data from Experian as its main source, but will often be a little different to your ‘true’ Experian score as it also uses data from a smaller bureau. Variations in the data used to calculate credit scores and the frequency of updates to your credit report will also have an impact. The bureaus don’t receive the same data at the same time, as most lenders have a few ‘favored’ bureaus they prioritize. Additionally, some sites may offer ‘educational’ or simulated credit scores rather than the actual credit scores used on your official report.

This is why we emphasize that you should not get too caught up in the specifics of one bureau’s score, but rather use your credit report to track your overall creditworthiness, the general perception lenders have of you, and what is impacting your score. A 5-point difference here and there isn’t going to affect your access to credit, but a 200-point difference will! So don’t sweat the small stuff when it comes to your credit score. Instead, use it as another tool to help move your financial goals forward.