Mortgages are crucial in homeownership as they are loans secured by real estate. Lenders, typically banks or mortgage companies, rely on credit scores to determine an individual’s creditworthiness.

Your credit scores, which can range from 300 to 850, provide insight into your financial responsibility.

Lenders carefully analyse credit records to assess credit utilisation, payment history, and any outstanding debts.

Having a credit score of 700 or higher greatly increases your chances of getting approved for a mortgage.

Low-credit-score individuals may have to deal with higher interest rates or may face difficulties in securing a mortgage. People can improve their credit and make smart decisions about homes when they understand this two-way link.

Follow us, as we continue to shed some light on mortgage lenders and credit scores. We will take you through how mortgage lenders determine an individual’s credit score.

How do mortgage lenders determine credit score

Mortgage lenders look at credit scores to see if a person is creditworthy and to set the terms of the loan. They use credit reporting agencies like Equifax, Experian, and TransUnion to make credit histories. These histories are made up of things like payment history, credit utilisation, and length of credit. These histories help lenders figure out if the borrower is financially responsible and if they will be able to make mortgage payments on time.

If you have bad credit, it may be harder to get a mortgage with good terms. If you have good credit, you might get lower interest rates or even be rejected for mortgage approval. Borrowers can successfully get a mortgage if they keep an eye on and maintain their credit scores on a regular basis.

There are two types of lenders when it comes to credit agencies: those that score credit and those that just look up credit. For the first group, they will add a program to their online application system that will get the necessary information from the credit bureau along with any other information about the application.

After taking this information into account, the algorithm makes a score that either meets the lender’s minimum standards or doesn’t. Lenders that check credit, on the other hand, will get the report from the agency to look it over and decide if they want to move forward with the application. That being said, the main difference is that there is no system-generated score for people who use credit references.

How is my mortgage credit score calculated?

Anyone who wants to get a mortgage needs to know how mortgage credit scores are calculated. About 30% of these numbers go to payment history and 35% to credit utilisation. A perfect payment experience with on-time payments will greatly improve your credit score.

On the other hand, any payment made more than 30 days after the due date can have bad results.

Credit utilisation, which makes up 30% of your number, is based on how much debt you have compared to how much credit you have available. Keeping your credit utilisation rate below 30% is best for getting good results. The length of your credit history is worth 15% of your score. The longer your credit history, the better it is for your score. You should not close old accounts unless you have to, because it can be a simple way to improve your credit score.

The credit mix, which makes up 10% of your score, shows how well you can handle different kinds of debt, like credit cards and monthly loans. Lenders like it when people take care of their financial responsibilities in a variety of ways. Finally, requests make up the last 10%. Your credit score goes down a little each time you apply for new credit, which shows how important it is to be smart about when you apply for new credit. By carefully handling these parts, you can build a strong mortgage credit score and improve your chances of getting a good home loan.

What credit score do mortgage lenders use?

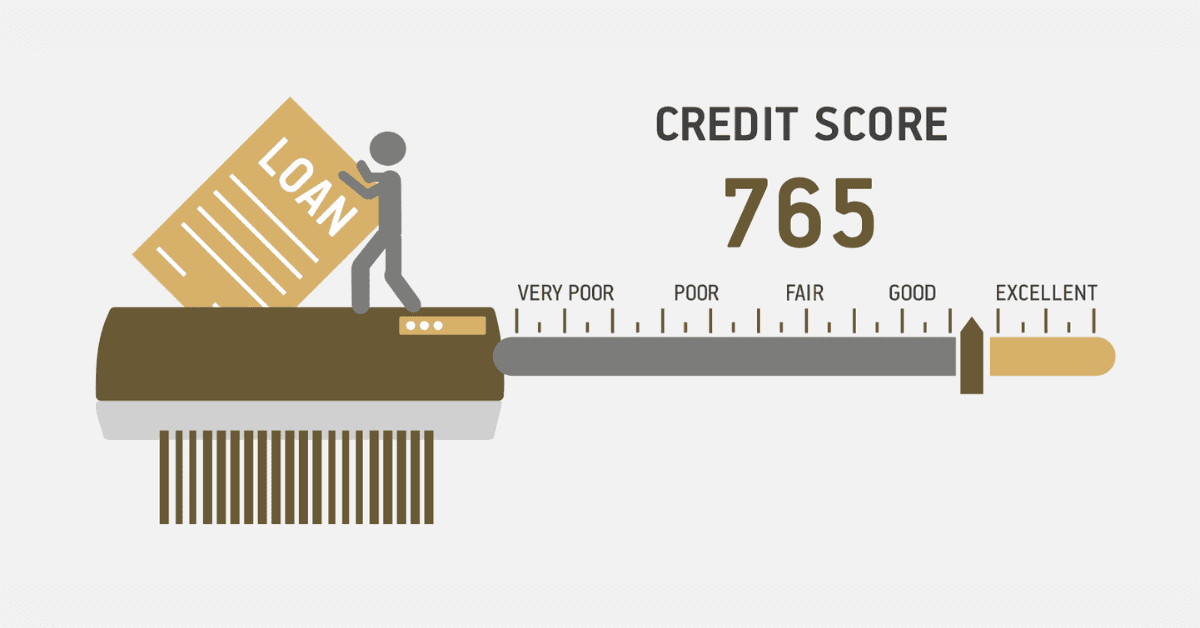

Mortgage lenders use a special version of your FICO score to decide if you are a good credit risk.

If you want to get a mortgage, you should know that your credit score on the application might not be exactly the same as the one you’re used to. In fact, it might be different from what you see when you check your credit or even when you start the mortgage process.

A FICO score is used by most lenders.

Equifax is where the FICO Score 5 gets its credit report. It’s an old way of scoring credit that’s still used in the car and mortgage business.

In addition to the usual things lenders look at, they will also look at your medical records, where you’ve lived, and your work background. And the FICO Score 5 is stricter about collecting debts that haven’t been paid.

The FICO Score 2 and the FICO Score 4 are two other scoring tools that mortgage lenders often use. The FICO Score 2 credit report comes from Experian, and the FICO Score 4 report comes from TransUnion.

A lot of mortgage lenders will check your credit report from all three companies. Lenders are more careful with mortgages because they are bigger, longer-term loans. They will look at your credit report carefully.

How can I improve my credit score for a mortgage fast?

If you are looking to improve your credit score for a mortgage here are a few details you should know.

Improving your credit score quickly for a mortgage requires careful planning and execution. First, make sure to carefully review your credit report and address any discrepancies you find. Reduce your credit card balances to decrease your credit utilisation ratio.

Establish automatic payments to guarantee prompt bill payments. If it’s possible, try to negotiate with your creditors to settle any outstanding debts. This can have a positive impact on your financial situation.

It is advisable to refrain from opening new credit accounts, as doing so may cause a temporary decrease in your credit score.

Moreover, consider becoming an authorised user on someone else’s credit card that has a positive history.

By taking these proactive measures, you are showing responsible financial behaviour, which can lead to an improved credit score and increase your chances of securing a favourable mortgage rate.

How many times will a mortgage lender pull my credit?

Mortgage lenders see the need to request your credit card history to review your ability to repay your mortgage.

The number of times a credit may be pulled can differ and may depend on the applicant.

In general, credit may be pulled at least 3 times. Before the process approval period, your credit may be pulled.

If needed, it is sometimes pulled in the middle, so you should always be aware of your credit and the things that could affect your scores and chances of getting approved.