Late payments on your credit report can dent your credit score. These are payments made post your credit agreement’s due date or grace period. Depending on their severity and frequency in South Africa, they can linger on your report for up to five years. Late payments, which can occur due to unforeseen circumstances, reflect poorly on your payment history, potentially triggering penalty fees, higher interest rates, and lower credit limits, exacerbating your financial situation. You might consider removing late payments from your report, particularly if they’re inaccurate, outdated, or unavoidable. However, this isn’t always straightforward due to certain rules and procedures.

How to Delete Delayed Payments from Credit Scores

To clear late settlements from your credit grades, you’ll begin by processing a credit statement from one of the four primary South African agencies: TransUnion, Experian, Compuscan, or XDS. One free report annually from each of these bureaus is what you’re entitled to. Go through your report for any late payments to remove and also for inaccuracies.

If possible, dispute with the bureau backed up on evidence where necessary. Unfortunately, not all late payments, even those that are accurate, could be removed. It’s conducted in such a way the National Credit Act stipulates that bureaus will be given an opportunity to store information depending on its status and type. If the removal falls within this category and time, late payment will be removed only under a valid reason, like fraud, identity theft, or a creditor dispute.

What Do You Say to Your Credit Card Agency to Clear Late Payments?

If you have a legitimate cause to expunge a delayed settlement from your credit statement, or if it’s old-fashioned, you can request its clearance from your credit card agency, the original lender. Here’s how:

- Call the customer service number on your card, asking for a representative to handle your request. Identify the late payment you wish to remove, providing its date, amount, and status.

- Explain your removal request, backing it up with evidence. Attach relevant documents if the late payment resulted from fraud, identity theft, a dispute, or hardship.

- Request the company to remove the late payment within 30 days and update your score. Ask for a confirmation letter and updated report once done.

- Maintain politeness throughout the conversation, keeping a record of the call.

Alternatively, you can write a letter to the company, mirroring the call’s format and content and including your contact det ails. Sign, date, and maintain a photocopy of that letter.

Are Late Payments Hard to Remove?

Removing late payments from your credit report hinges on factors like accuracy, age, frequency, reasons for late payments, cooperation of the bureau and creditor, and supporting evidence. Inaccurate, outdated, or fraud-induced late payments are easier to remove than accurate, recent ones or those due to negligence. However, you can still request the removal of accurate late payments as a goodwill gesture, particularly if you have a good credit history and improved payment habits. You could propose making a payment, setting up automatic payments, or writing a positive review for the creditor in exchange for removal.

Ultimately, the decision lies with the bureau and creditor; they’re not obligated to comply. Be ready for potential turndown and the possibility of staying with late loan clearances on your record until they expire.

How Long Do I Have To Wait For My Credit Scores To Recover After Delayed Payments?

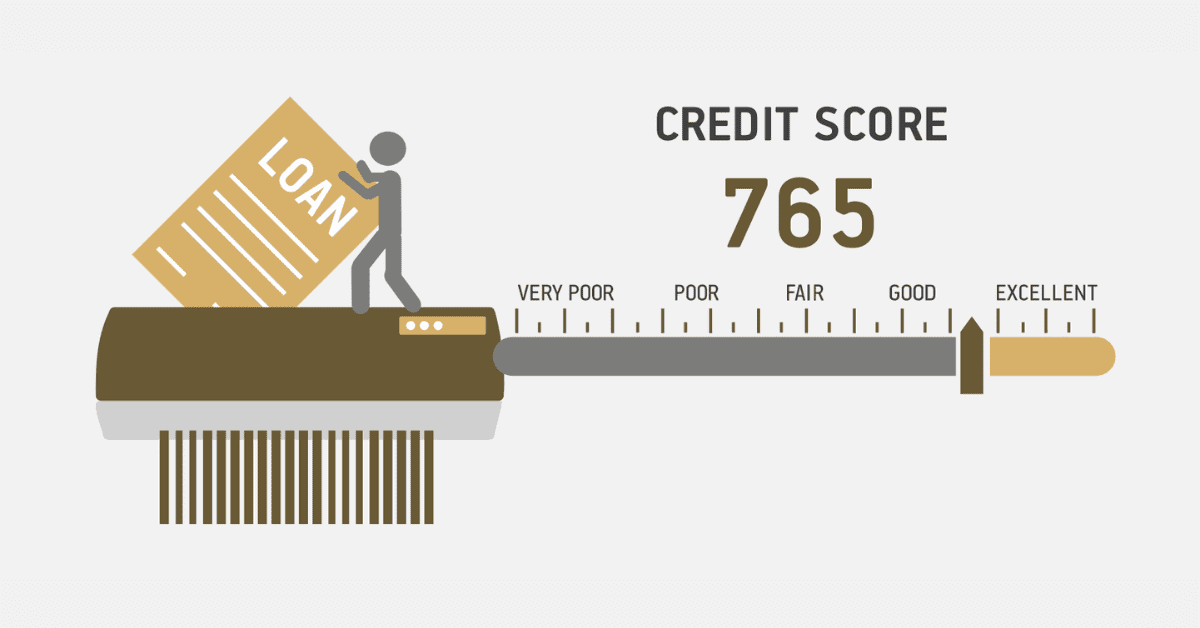

The impact of a delayed loan settlement on your credit grade rests on aspects like severity, frequency, recency, arrear type and figure, and overall loan record. More severe, frequent, and recent late payments and larger, significant debts negatively affect your score. Experian, a major South African credit bureau, states a single late payment can drop your score by up to 110 points. However, recovery is possible:

- Pay off late payments promptly and avoid future ones. Timely, consistent payments rebuild your score.

- Maintain a low credit utilization ratio. Keeping it below 30% improves your score.

- Diversify your credit types. Handling various credit types responsibly boosts your score.

- Apply for new credit sparingly. This shows good credit management.

Recovery time varies from month to year, depending on the late payment duration.

How Much Does a Delayed Payment Impact Credit Scores?

Late loan clearances can be very bad for credit ratings. The amount it contributes to lowering your score depends on how severe, frequent, and recent the late payment was, the debt that was not paid, the amount owed, and your credit history. A single 30-day late payment can drop your score by 110 points. Scenarios indicate that a 30-day late payment on an R10,000 credit card bill can see a 780 score plunge to 90 to 110 points, and a 680 sees a 60 to 80 point drop. Avoid late payments to maintain a healthy credit score.