Despite all the talks that will circulate credit scores, there are favourable terms that most individuals seek. Now what does it mean to have a favourable credit score?

The credit score is part of the financial system built to control and monitor the spending of individuals.

When the credit score

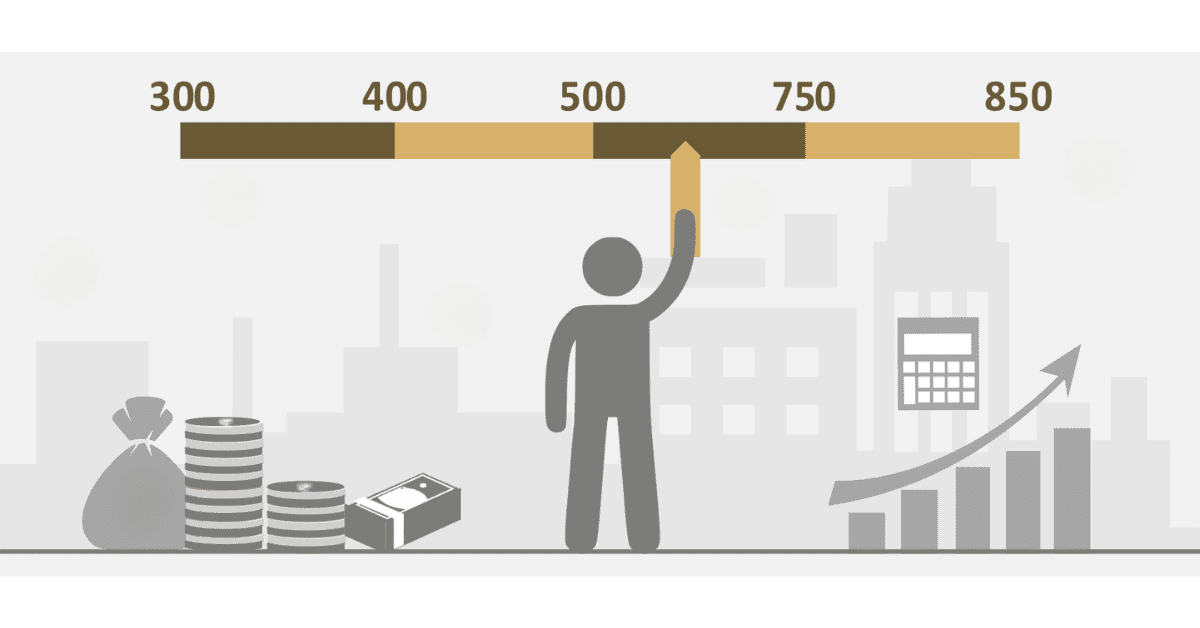

The credit score figures for individuals begin from 300 and rise to 850. This means if you have a credit score, you should expect your numbers to be within this range.

But what does it mean to be close to the 300 figure or the 850 figure? Is it considered to be average, poor, good or favourable?

Understanding these terms helps you understand what you can expect from lenders and also the terms that may be metered out to you when you want to seek a loan.

Some may say once your credit score is favourable, it means it is within the average bracket. But we must first understand what it means to have an average credit score, poor credit score or good credit score. What defines these remarks?

Let us find out more about favourable credit scores and some conditions that come with it.

What does “favourable” in a credit score mean?

The word “favourable” is often used to describe situations or conditions that are good, useful, or advantageous in a certain situation. When it comes to credit, a “favourable credit score” is a number that shows how creditworthy a person is by showing how likely they are to pay back loans. It can also be said that a favourable credit score is a good credit score.

Credit scores usually fall between 300 and 850, with higher numbers showing that you are more likely to pay your bills on time. Since this is the case, a favourable credit score is usually near the top of this range.

Getting such a score shows that you have good money habits, like paying your bills on time, not using your credit too much, having a variety of credit accounts, and a part of using credit wisely. These numbers help lenders and financial institutions figure out how risky it is to lend money to a person.

There are many benefits to having a good credit score. For starters, it makes it easier to get loans, credit cards, and mortgages, often with better terms and lower interest rates. Better borrowing terms are given to people with higher credit scores because lenders see them as less risky. This can save them a lot of money over time.

A favourable credit score can also affect things in life that are not related to money. Your credit score can also affect how much you pay for insurance and how much of a deposit you need for utilities.

It is important to remember, though, that a favourable credit score is not the only thing that affects your financial health or success. People with lower credit scores may still be responsible for their money and be able to handle their issues well. A person’s financial stability is also affected by things like their income, savings, and the ratio of their total debt to their salary.

To sum up, a favourable credit score is more than just a number; it shows a pattern of responsible money management and lets you access many chances and advantages. Maintaining a balanced view is important, and it is important to remember that credit scores are only one part of total financial well-being.

What does a favourable credit score do for a credit user?

Credit users can get a lot of benefits from having a favourable credit score. As a result, more people can get loans and credit cards with cheaper interest rates and higher credit limits.

It shows that you are responsible with your money, which could help you get a loan faster. People can get better insurance rates, rental agreements, and utility service terms if they have a good number.

It can also make it easier to get special financial products and benefits, like rewards schemes and premium credit cards. Overall, having a favourable credit score gives people access to more chances and better financial terms. This leads to more financial stability and more freedom in managing their money.

What does an unfavourable credit score do for a credit user?

Once the word unfavourable is attached to your credit score, it clearly defines the condition of your credit score.

When you have an unfavourable credit score there are so many limitations. These limitations hinder you from getting access to goods terms.

For a credit user, you do not get low interest, easy loans, or flexible payment terms when you have an unfavourable credit score.

Can you have a good credit score and still get denied a loan?

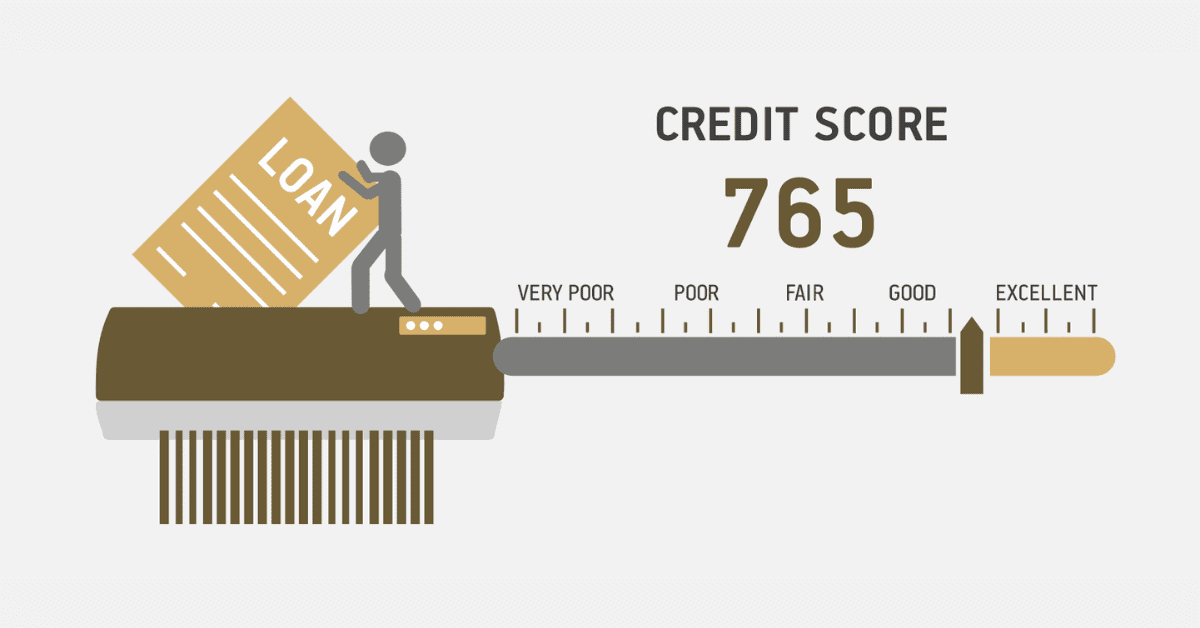

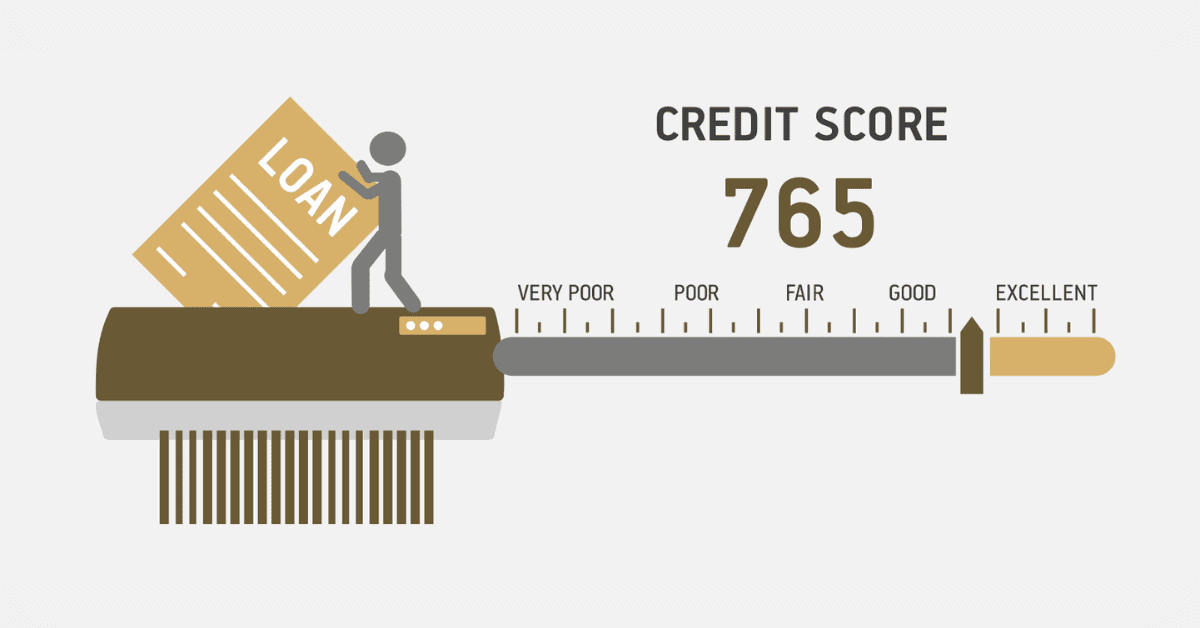

Although a good credit score tells a lot about your ability to repay loans, it is still possible to be denied approvals for loans.

Sometimes lenders use their discretion and deeply assess your credit score to find loopholes and deny you loans.

Also, when you have too many existing debts, even though your credit score is good, lenders can still deny you loans. It gives them the notion, that your ability to pay these loans on time can be affected by your current loans.