Filing for bankruptcy is often a tough decision since it damages your credit score and involves a complex legal process. However, the good news is that the impacts of bankruptcy will not stay on your credit report forever, but for a maximum of 10 years. The effects of bankruptcy will decrease over time, and there are several options you can consider to improve your credit score. Read on to learn how to improve your credit score after bankruptcy.

Is It Possible to Rebuild Credit After Bankruptcy?

Yes, you can rebuild your credit score after bankruptcy, but this is not an overnight event. By exercising financial responsibility, you can establish a good credit history in the long term to regain your status. Although achievable, you should remember that this process requires commitment.

How to Improve Your Credit Score After Bankruptcy

When trying to improve your credit score after bankruptcy, you should monitor your credit report to ensure all details are correct. Everyone is entitled to get a free report from credit bureaus in South Africa. Understanding your credit report will give you insight into the factors that might affect your score. For instance, errors can negatively impact your credit score, and other issues like identity theft. Make sure that your report is clean to repair your damaged credit score.

Your Chapter 13 bankruptcy will stay on your report for seven years, and the Chapter 7 bankruptcy lasts for ten years on your report. When you file for bankruptcy, your credit score is likely to lose up to 200 points depending on the type you choose. When the bankruptcy is cleared, ensure that it is removed from your report.

Practicing healthy financial habits after bankruptcy can go a long way in helping you rebuild your credit score. You can achieve this by making consistent and timely payments on things like bills and insurance premiums. Revise your credit card usage to avoid falling into the same trap again. Maintain a low credit balance, or even avoid using the credit card if possible.

Building a realistic budget can play a pivotal role in helping you avoid credit. With an emergency savings fund, you can cover unforeseen expenses like medical bills and auto repairs without obtaining a loan. Once you master the art of staying out of debt, you will be able to build your credit score and reverse the impacts of bankruptcy.

Getting a secured credit card is another option that can help you improve your credit score after bankruptcy. The main advantage of this method is that it is backed by a deposit fund, so you cannot exceed the balance on your credit. This card also helps you make timely payments to help you build positive credit. Alternatively, you can borrow against the secured deposit in your bank.

Enlisting the services of a co-signer is another method you can consider to improve your credit score. The co-signer acts as a surety, and they agree to repay the loan if you default on your repayment. However, you need to be careful when you choose this option. Make sure you can repay the money borrowed to avoid straining your relationship with the co-signer.

How Long Does It Take to Improve Your Credit Score After Bankruptcy?

Rebuilding your credit score is usually a long process, but the time it takes depends on your financial situation. Bankruptcy will stay on your credit report for seven to 10 years. When bankruptcy is still on your report, it might be difficult to obtain new credit, but the good thing is that you can repair your credit score. As time moves, the impacts of bankruptcy also decrease. It can take anything from 12 months to 18 months to start witnessing positive changes after the discharge of your bankruptcy. RTNER OFFER

Does Bankruptcy Affect Your Credit Forever?

Bankruptcy does not affect your credit forever. When it is discharged, you will no longer be liable for that particular debt. However, bankruptcy can stay on your credit report for seven to 10 years. During this period, it might be difficult to get a new loan because lenders will regard you as a high-risk borrower. If you take your time to rebuild your credit score, you can still apply for a new loan once bankruptcy is cleared from your report.

Your financial status will be reset to normal when bankruptcy is cleared from your report. Therefore, you need to be patient when building your credit against the background of bankruptcy. In other words, bankruptcy allows you to reorganize your financial status and improve your credit score. This means that it will not affect your credit forever.

Can I Get a Loan After Bankruptcy?

Yes, you can get a loan after bankruptcy. There are different methods of clearing bankruptcy, and the duration may vary. Bankruptcy will appear on your credit report for up to seven or 10 years. During this period, you will not be able to apply for certain types of loans, particularly from large financial institutions like banks. When the debt is repaid, your credit score will gradually improve, and bankruptcy will be eventually cleared. When your credit report is clear of bankruptcy, you will be free to apply for a new loan.

What Will My Score Be After Bankruptcy?

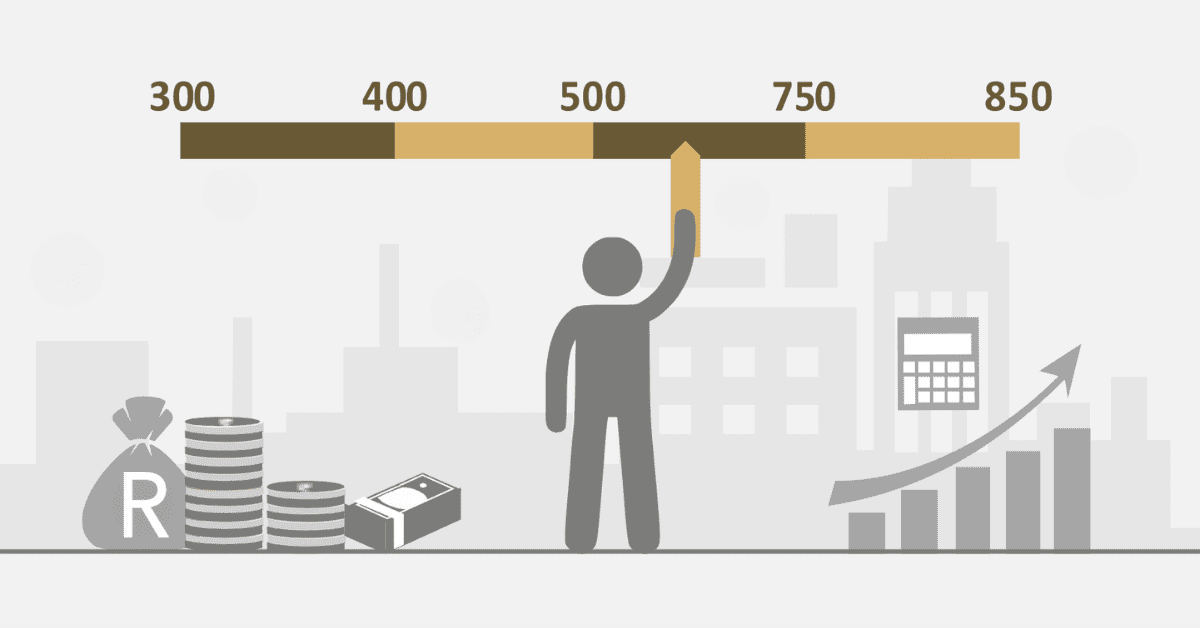

When you file for bankruptcy, a credit score of 700 and above will lose about 200 points according to the FICO scoring method. When your credit score is already low when you file for bankruptcy, it is likely to lose between 130 and 150 points. Fortunately, you can rebuild your credit score if you implement the appropriate measures to restore your financial status.

Filing for bankruptcy comes with consequences, such as a poor credit score that denies you the privilege of getting a loan from other financial institutions. However, bankruptcy does not stay on your credit forever. These tips can help you improve your credit score after bankruptcy so you can apply for credit again.