So you wish to rent a house in South Africa? It could be the road paved with gold or hard, poverty-filled lessons. Being a tenant mostly means jumping through hoops, checks, and references before the place can finally be called home. One such hoop is the credit check. Like a financial magnifying glass, it zooms into your financial history and your worthiness to repay borrowed money. But wait, who pays for this check, the landlord or the tenant? So, what exactly are landlords looking for? And how should tenants optimize their chances of acing the credit check and moving into that dream rental property?

Don’t worry – we answer all these questions head-on in this article and provide helpful hints and tips for landlords and tenants.

Who Makes Credit Check Payments: The Landlord Or Tenant?

It is worth mentioning that the Rental Housing Act 50 of 1999 permits credit checking on tenants of a rental house by landlords and letting agents but with the tenant’s written consent. This will then feature the tenant’s credit grade, settlement record, outstanding arrears, and any other information connected to this credit statement.

This financial investigation can cost between R20 and R50 per check in the normal dissection of the landlord to the tenant or the landlord himself. Tenants must get a credit record copy and result clarification. If denied for purposes revealed from the credit assessment, the details featured on the statement may be questioned, and request that they correct or delete any mistakes or outdated info.

How To Complete Credit Checks For Potential Tenants In South Africa

Those wishing to carry out credit assessments on their soon-to-be tenants must:

- Obtain prior written consent from the tenant allowing for a credit check, usually done by some standard form or clause accompanying the lease application.

- Decide on a credit reporting agency to work with, e.g., TransUnion, Experian, XDS, Compuscan, or specialist bureaus like TPN or PayProp.

- Authenticate your identity as the landlord or letting agent, offering your name, contact details, proof of identity, and address.

- Provide the tenant’s full personal and financial details, including his name, number of identity documents, current and previous residential addresses, employers, and landlords.

- Give the demanded credit check charges, which differ from bureau to bureau and rely on the type of statement.

- Complete the credit analysis and take out the credit record that reveals the credit grade of the tenant, his/her settlement report, outstanding arrears, and other pivotal info.

- Assess the record and make an informed verdict, weighing other aspects, such as earnings, job history, rental record, and references. The tenant should be advised of your decision, given a copy of their credit report, and a results explanation doc.

What Checks Are Done For A Rental Property?

It’s not the only credit check in place to determine potential tenants by landlords or letting agents. They have checks in place to ensure the suitability of tenants:

- Identity Check: Positively identify the tenant and check the immigration status of the tenant with identity documents, passport, visa, or work permit. This is a legal requirement for the right to rent a check.

- Employment Check: It establishes the tenant’s employment status, income, and stability by going through payslips, bank statements, tax returns, or employer references. This way, one can tell if the tenant is in a good position to pay rent.

- Rental Check: It assesses the rental history of the tenant, behavior, and reputation with the help of references provided by past and present landlords, his/her rental agreements, and receipts. Also assesses whether the tenant is responsible for property maintenance or not.

- Personal Check: These check the character, lifestyle, and preferences of the potential tenant based on personal references, social media profiles, hobbies, and interests. Then, it shows how a tenant will be compatible with the person one is staying with and whether they can maintain the property and understand the neighborhood.

Do You Need A Credit Score To Rent In South Africa?

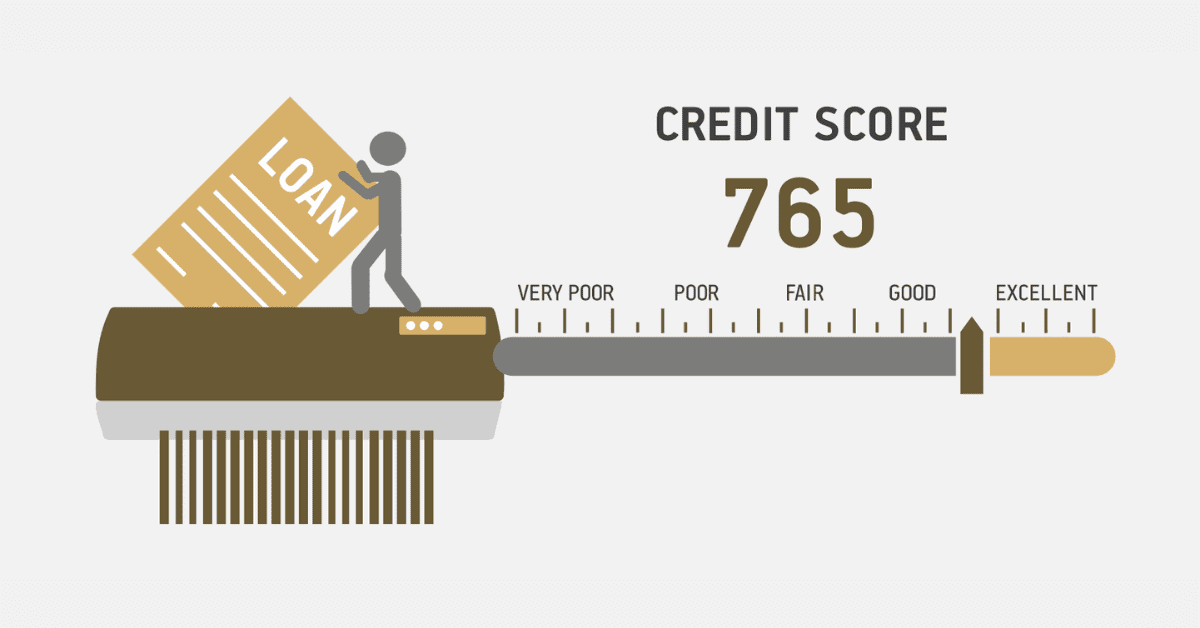

In South Africa, while a credit rating isn’t requisite to renting a house, an excellent one may boost your rental prospects and conditions. A credit grade mirrors your creditworthiness and financial behavior. Landlords and letting agents use it to gauge the risk-reward ratio of renting to a tenant. A good score suggests timely rent payments and property care, easing approval for a rental property, negotiating lower deposits or rent, and access to benefits. Conversely, a bad score can complicate approval, lead to higher deposits or rent, and impose restrictions.

However, other aspects like earnings, employment records, rental reports, references, and individual matters also impact rental verdicts. Therefore, you may still access a rental property even with a bottom-level score, a stable earning, an excellent rental record, and a legitimate explanation for a bad rating.

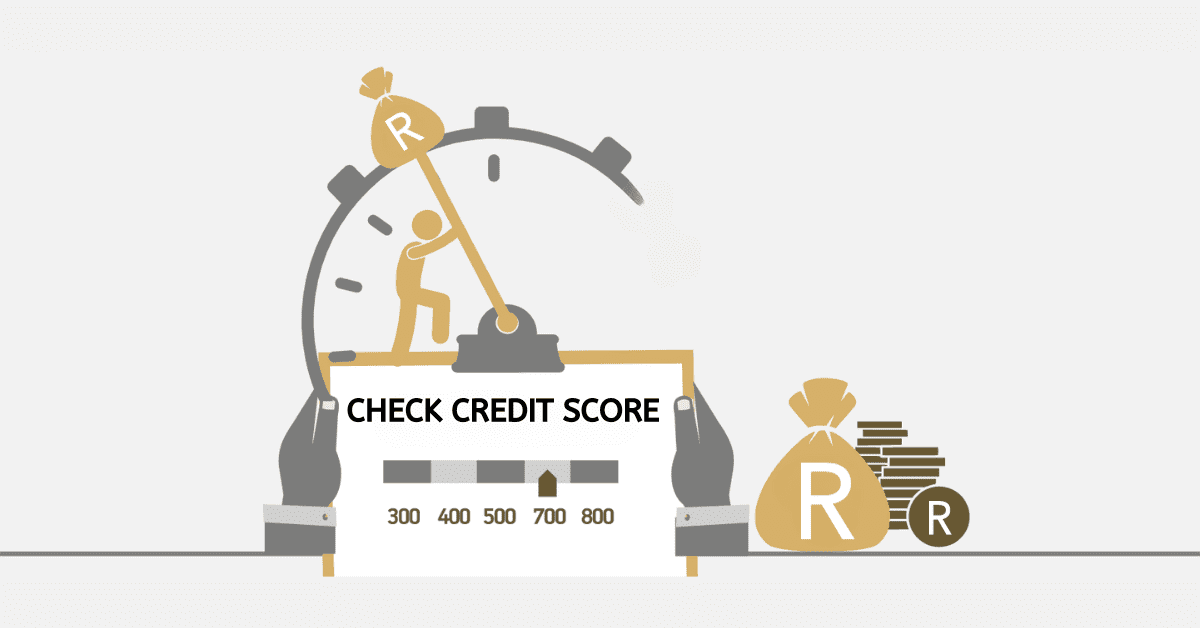

What Is A Good Credit Score To Rent In South Africa?

In South Africa, a definitive credit grade for renting isn’t noted in stone, as landlords and letting agents have varied criteria. Generally, a rating of 650 or above is considered good, and 700 and beyond is excellent. Such scores can enhance chances of rental approval, lower deposits or rent, and better terms. However, a good or excellent score isn’t a rental guarantee.

Landlords and agents also consider income, employment history, rental history, references, and personal circumstances. Hence, tenants should rely on their credit score and overall rental application. Regular credit report checks and steps to improve credit scores, like timely bill payments, debt reduction, and disputing report errors, are advisable.