Buy-to-let is gradually gaining dominance in the South African property market due to an alternative methodology for the traditional way of purchasing a home, more so for those not readily qualifying for a mortgage. Such an arrangement gives a buyer the right to move into a house first as a tenant, multiplying toward the purchase of that property after an established point in time. It’s a whole new proposition in its sense and a step toward owning for customers who are on their way to building credit or saving for a down payment.

Does Rent To Own Have A Credit Check In South Africa?

This is a method by which some South Africans climb the ladder of owning a home without necessarily going to a bank and applying for a home loan upfront. This gives a potential homeowner a chance to live in a house they might want to own in the future. While an ordinary mortgage application will dig through your credit history and take time before most pre-approvals are made, this is not the case for a definite positive in a rent-to-own contract.

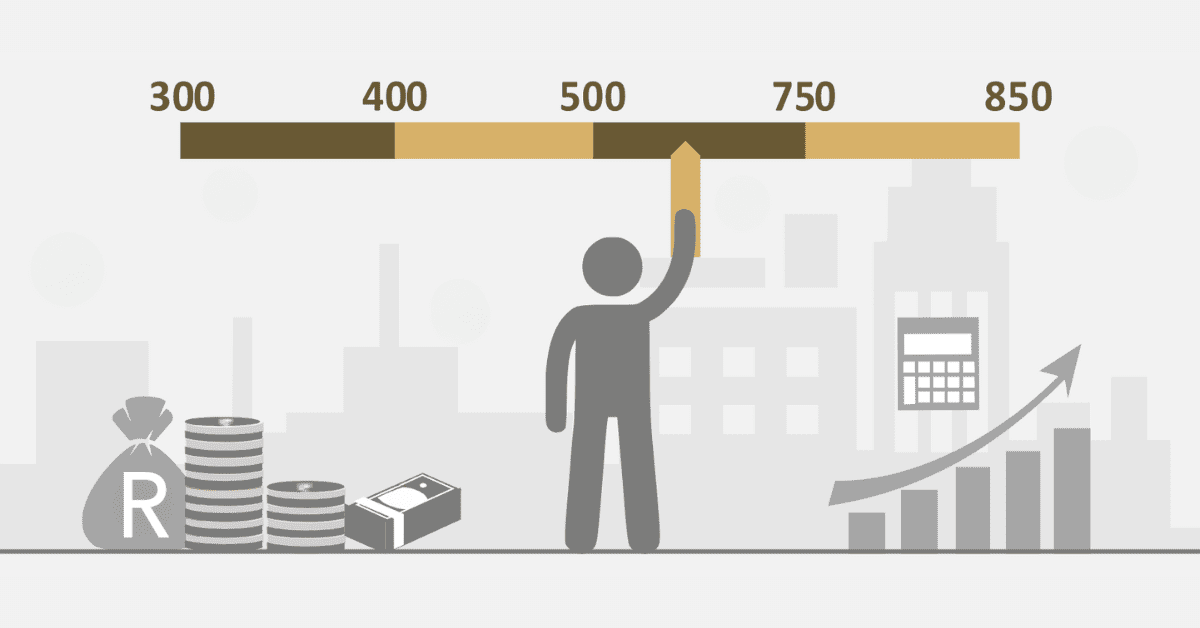

Most rental purchase plans seem to be structured for the protection of the potential buyer: the ability to remain as a rent payer and to be a saver to create a purchasing deposit for the future. A good credit history, however, may work in your favor when the time comes to finance the purchase. This avails the borrowers a window to better their credit scores, save well, and in good time towards a deposit; give them an opportunity to build a robust track record of consistent payments to the advantage of getting a mortgage at the end of the rental term.

While the first rental-to-own agreement does not require a credit check upfront, buyers will likely need one at a later time when a rental-to-own changeover is being made. It is at this point that the credit history accumulated during that period will have its effect.

How Does Rent-To-Own Property Work In South Africa?

According to the Tenants’ Association of South Africa, “rent to buy” works through an arrangement where a tenant agrees to the payment of rent as is the norm but is intertwined with an aspect of buying the house at the end of a certain period. “Here’s how Buy-Now, Pay-Later generally works:

- Rental agreement: It may assume the form of a rental amount and a period for which it shall be rented, besides being possibly subject to a contracted length of time before the ‘option to purchase’ period.

- Option to Purchase: There exists an up-front premium that the lessee will have to pay, plus an ongoing premium over and above the usual rent that will act as a savings deposit towards the purchase of the property, eventually, when the contract ends.

- End-of-Tenure Option: The Tenant has the end-of-tenure option to acquire the same for possession. The pre-sheeted option fees, after two months of tenancy, may be given for consideration toward the home prices and, thereby, adjusting toward reducing the balance to mortgage the home.

- Fixed Purchase Price – Usually, the purchase price of the property is fixed at the beginning of the contract implementation so that the tenant may be in a safe area, whereby changes in market prices do not necessarily affect them.

- Building of Credit History: It helps build credit history over time, which a tenant further needs when applying for a mortgage during a property purchase.

How Do I Qualify For Rent-To-Possess In South Africa?

Being eligible for a rental-to-retain in SA means one has to meet some criteria that might convince an owner that you will be able to buy his/her property by the end of the lease. Meet these criteria before continuing:

- Stable Source of Income: All amounts reflected to be paid as rentals monthly, together with any other consideration fees, should be above an affordable, stable source of income that one has.

- Option Fees: It is standard practice for a compulsory fee to be levied upfront in the form of an option fee, along with further ongoing option fees accruing, meaning it will finally go towards the deposit for the purchase.

- Financial Position: Consider your medium and long-term financial position. You might feel reasonably sure that your financial position will materially change in the future, and then you may actually consider rent-to-own.

- Credit History: A good credit history is also very helpful, although it may also help people with less-than-perfect credit improve that in the meantime.

- Legal Capacity: The applicant shall, as a general policy, have a valid full civil capacity to satisfy liabilities: 21 years old, not married or divorced. The exception is for an applicant who has secured an income of 18 to 21 years, dependent on an ability to afford it.

- Understanding the Agreement: Understand clearly what the lease agreement entails and all its obligations. This includes figuring out what lease purchase agreements you have a responsibility to buy as was initially agreed upon.

Is It Better To Rent Or Purchase A Home In South Africa?

This is quite a big decision when you consider whether to secure/rent a property in SA. Here is the checklist:

Renting

- Flexibility: Renting offers the ability to move without the long-term commitment of a mortgage.

- Lower Upfront Costs: The rent paid is often lower than what would be required upfront by payment as a down payment towards buying a house.

- Maintenance: As a tenant, you are not typically responsible for property maintenance, which can be costly.

Buying

- Long-run investment: A home is the only long-run investment one can make, which appreciates over time, whereby later, it may probably give back your invested capital.

- Stability: Homeownership provides a sense of firmness and security.

- Freedom: Owning a home gives you the right to make changes and improvements to your property.