In South Africa, having your own transport isn’t a luxury. It’s a necessity for many people. With unreliable public transport, being able to get yourself where you need to be could be the key to a better job and personal freedom. Vehicle prices have soared in recent years, however, especially as South Africa is an import-only market. Most of us will need a vehicle loan to make this dream come true. Now is not the time to find out you have a low credit score

Can I Get Vehicle Finance With a Low Credit Score?

If you have a low credit score, that means lenders see you as a bad risk. Your creditworthiness is poor, so you are more likely to not repay your loan and interest and leave the lender holding the bag. This isn’t great news for your vehicle ownership dreams.

You can get vehicle finance with a low credit score, but it is going to be considerably harder. Even if you are successful, you will be approved for less, and face much higher interest rates. So if the matter isn’t urgent, it is well worth trying to fix your credit score (even a little) before you apply.

If that’s not possible, there are some reputable lenders out there who specialize in bad credit vehicle loans. This will be a very costly option, however. Make sure you aren’t making this decision because you fancy a flashy top-end car. The long-term cost won’t be worth it.

How to get Vehicle Finance With a Low Credit Score

Getting vehicle finance with a low credit score is tricky. While some thoroughly above-board lenders specialize in people like you, there are twice as many loan sharks and scammers who will make your life worse. You will have to vet every offer exceedingly carefully, and be very certain it is both legitimate and at a rate you can afford. Be honest with yourself on this. If a deal seems too good to be true, it is. No ifs, buts, or maybes. Walk away.

If you can offer a deposit- as large a one as you can afford- you will both reduce your installments and get better loan terms. Make sure you can show a stable employment history with a large enough salary to comfortably make the repayments. Then shop around for the very best rate you can get. Even a single percentage point in lower interest will make a big difference.

If you can, get pre-approval from the loan company. This can help you negotiate better terms with the dealership. You also have the peace of mind of knowing what your maximum budget is. Don’t feel pressured to spend to the max, however. Remember, it isn’t free money- you have to pay it back. With interest. Asking a family member to stand surety on the loan may give you more options. If you fail to pay for it after being approved this way, keep in mind your family member will be stuck with your debt. Not the way to cordial family relationships! Only commit to what you can realistically pay.

Lastly, even if you know your credit score is low, take out a credit report. There may be erroneous items affecting your credit score you can fix. This will also help you work out what to improve to get a better credit score. Even a small improvement can have a big impact.

What is the Minimum Credit Score to Buy a Car in South Africa (2026)?

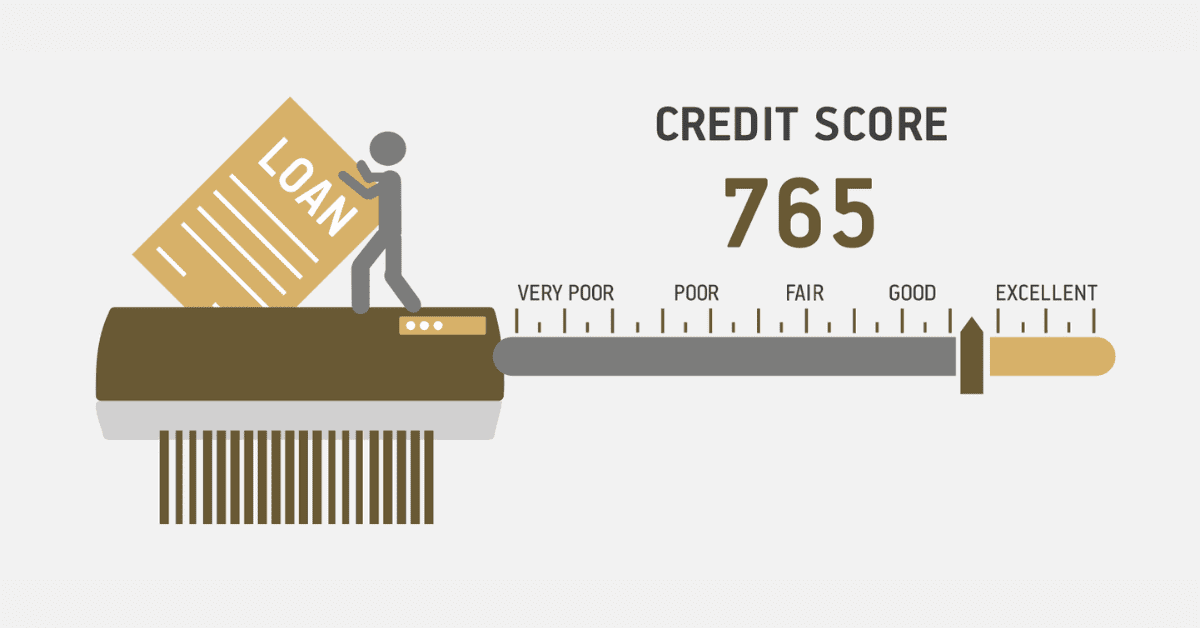

Very similar to home loans, the minimum credit score to realistically buy a car in South Africa is around the 660 mark. You will need it to be over 700 if you want to get better deals and larger loans.

Can I Get Vehicle Finance if I am Blacklisted?

If you are blacklisted, a vehicle finance company specializing in bad credit clients may still be willing to loan to you. You will face the highest interest rates and monthly premiums, however. Depending on exactly how bad your score is, you may not get approved at all. Remember, there are plenty of scamsters in the world who will promise otherwise to steal your money. Be careful.

How Long Does Wesbank Take to Approve Vehicle Finance?

If you are a strong candidate for a vehicle loan, with a great salary and a good credit score, you can get online pre-approval from Wesbank in as little as 10 minutes. Otherwise, it can take between 7 days to several weeks to hear back on an application made through a dealership.

How Do I Qualify for Car Finance in South Africa?

To easily qualify for car finance in South Africa, you should:

- Be over 18 years of age

- Earn at least R7,500 on a formal payslip

- Have a credit score of at least 660

- Have a valid license

- Be a legal citizen

The more you earn, and the higher your credit score, the easier the qualification process will be, and you will qualify for a larger loan, too.

Buying a car is an exciting time in anyone’s life. If you are struggling with a low credit score, however, the process will be difficult and you are likely to struggle. Why not take some steps today to rehabilitate your credit and unlock more potential?