Credit score, which is considered a figure that could determine how credible you are when it comes to finances, has extra features. This credit score, over time, is translated into credit history, which provides an overview of an individual, debt, payment, etc, within a period.

As part of the features, there are so many of them. Some include credit checks, payment history, debt utilization, etc. These things form part of the credit score build.

But when we look at one particular aspect of the credit score, there is an act, in its right way, that can provide a positive impact but at the same time, a negative impact.

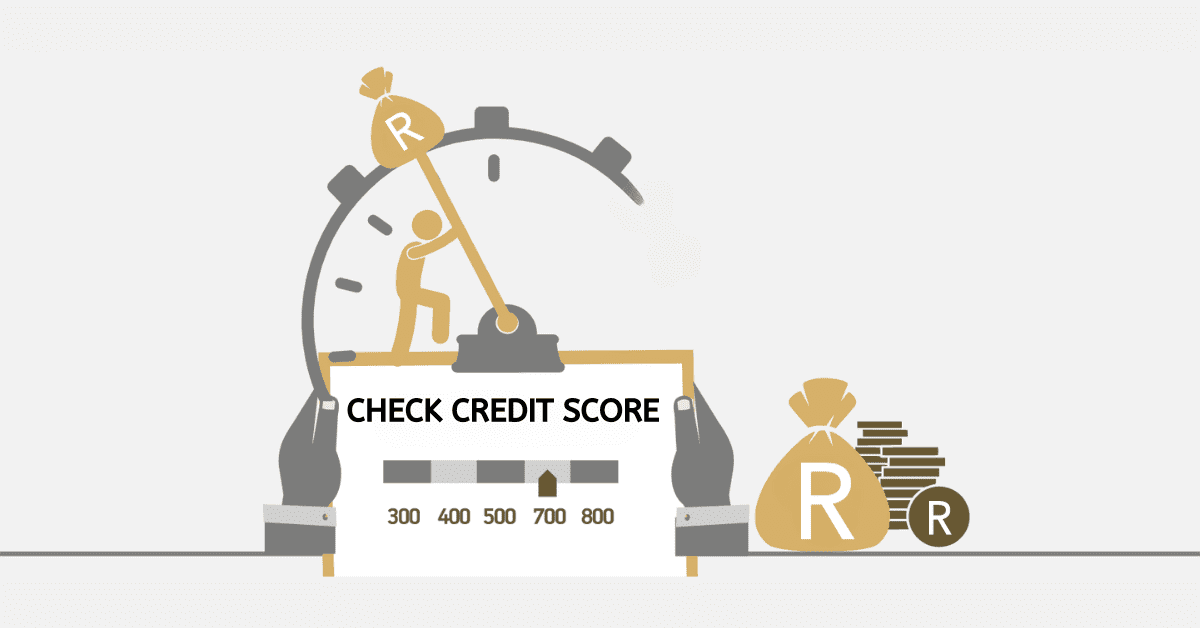

And this is the credit check or credit inquiry.

The credit check in some cases does not have any negative impact on your credit score. But once it is done by external parties can have that negative impact.

in today’s blog post, our focus will be much more on credit checks and the number of points it takes from your credit score.

As you continue to read, you should know the number of points a credit check takes off your credit score, what hurts your credit, and how you can improve your credit score by 200 points in 30 days.

How many points does a credit check take off

Before we look at how many points a credit check takes off your credit score, let us look at whether it is possible or not.

Certainly, someone can lose points off his credit score after a credit check. This happens when an inquiry is conducted about your credit history. Lenders who may apply for a loan may need to check if your credit history describes your ability to pay. Once you apply for a loan, this check needs to be done by the lender or third party. These checks are not done with your consent. However, there are cases where there could be errors or wrong approval that could make you lose some points.

The number of points one gets to lose is defined by the type of inquiry. There are two types of inquiry when it comes to credit checks. These are soft inquiry and hard inquiry; with each having its own processes.

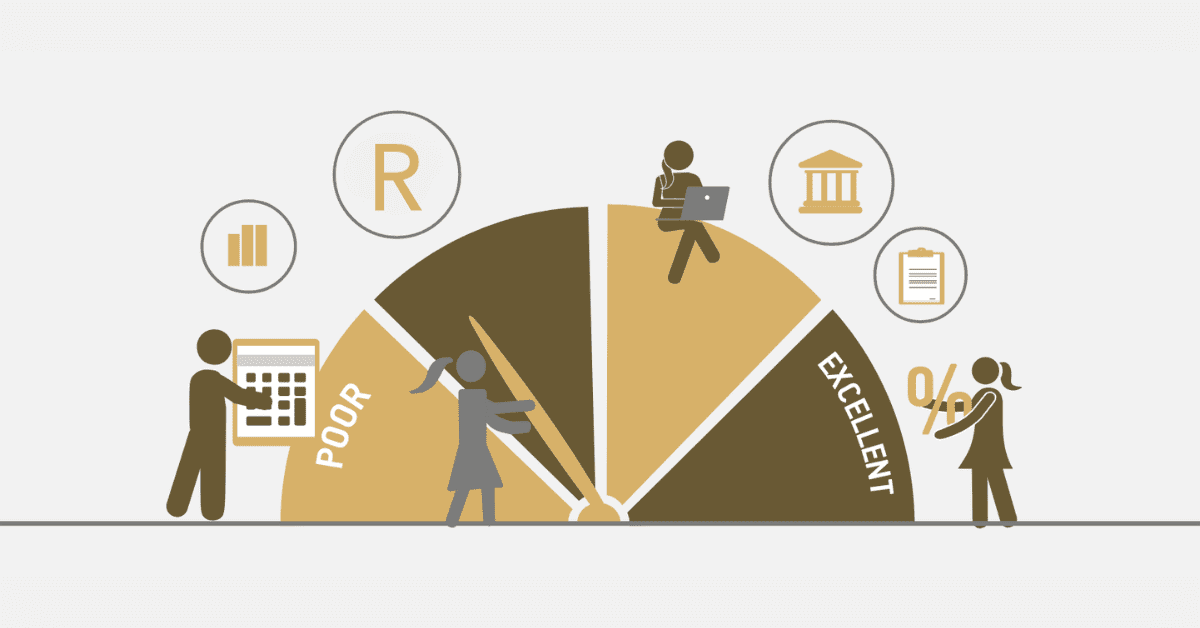

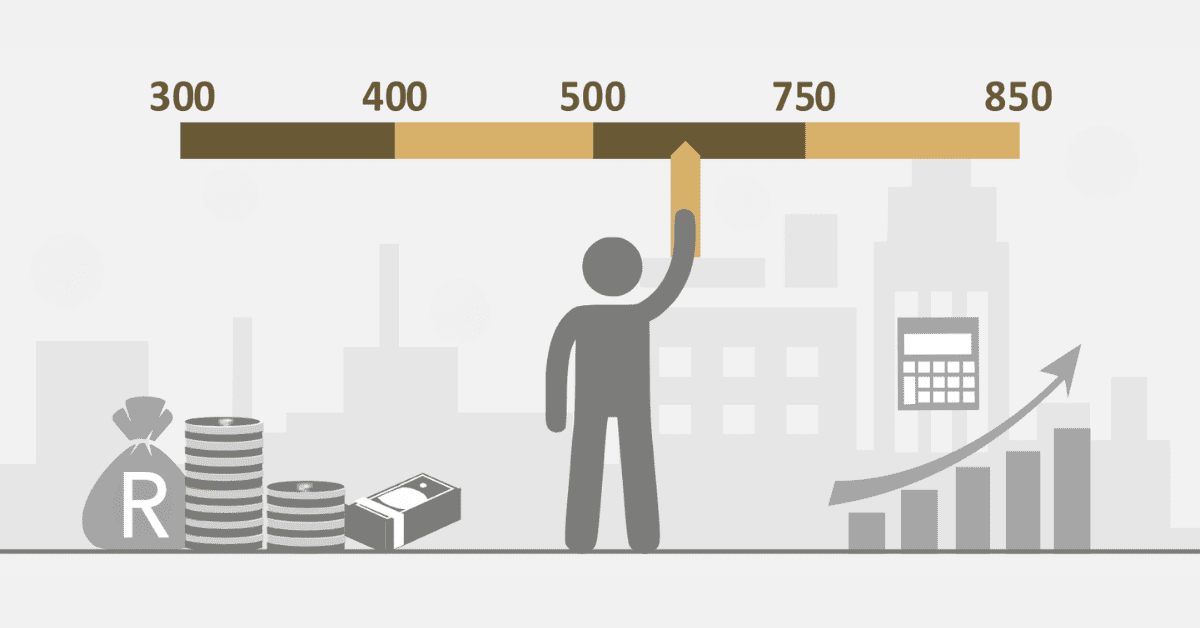

When it comes to losing points, a credit check which is translated into hard inquiry is the main focus. One person can lose between 5 to 10 points after a credit check.

Credit score builds are usually in multiples of 5. The 5 can be considered to the part of the common lowest points any individual can lose after a credit check.

About 5 to 10 points can be taken off your credit score after a credit check.

Do you lose points every time a credit check is done?

Losing points every time a credit check is done may depend on the kind of check.

A lot of people have wrong ideas about credit checks and how they affect their credit scores. It is important to make it clear that not all credit checks lead to points being taken off.

Credit checks come in two main types: soft checks and hard checks. A “soft check,” also called a “soft inquiry,” is when someone or an organization looks at your credit report for informational reasons, like a background check or to give you credit before you apply for it. Soft checks do not affect your credit score.

Because of this, you do not lose points when there is a soft check.

A hard check, also called a “hard inquiry,” happens when you ask for credit, like a loan or a credit card. When someone does a hard inquiry, they look over your credit report carefully. This can lower your credit score by a few points for a short time.

If you get a lot of hard inquiries in a short amount of time, like when you are looking for a loan, lenders might think that you are taking on a lot of debt, which could hurt your creditworthiness.

It is important to keep in mind that hard inquiries are a normal part of handling credit and should not have a big effect on your score.

However, multiple hard checks on several loans can have a bigger risk on your credit score making you lose some going points.

Do credit checks hurt your credit score?

Credit reports, or “credit checks,” are what businesses or lenders look at to see how responsible you are with money. They might be able to do this without your permission, but only if they have a good reason.

Do keep in mind that there is no link between how often you check your credit record or score and any changes to your score or ability to get credit.

Credit checks come in two main types: a soft credit check, which is also called a “soft inquiry,” and a hard credit check.

Businesses can see your credit report if you ask for credit and have it hard-checked.

Your credit score will not go down if you do a “soft query,” like checking your own credit score. A lot of credit card companies will let you see your credit score for free.

Others even offer credit tracking. A website or app may do a “soft inquiry” into your credit file to keep an eye on it. Your credit score will not change at all because of this request.

Only hard credit checks hurt your credit score. This normally happens when a lender wants to see your credit history after applying for a loan.

Should you apply for a couple of loans within a short period, it could easily hurt your credit score. Lenders or businesses may see you as an individual who possesses higher risk when it comes to lending money.

How to raise your credit score by 200 points in 30 days

To be able to raise 200 points for your credit score, you must be dedicated, disciplined, consistent and diligent with your finances.

You can raise your credit score by 200 points, but it might take some work and help from a professional.

But getting 200 points is not easy if you do not have help from an expert. There are a few things you could learn to help you get 200 points within 30 days.

- Someone with a “short credit history” is one of the main reasons individuals have bad credit. It looks like there is not much on your credit report that would make lenders trust you. Creating a new account is the best thing to do in this case. Loans like credit cards, personal loans, loans to build credit, and mortgages are all in this group. In 30 days, you should be able to get to 200 points if you do these steps right.

- Getting more credit accounts is a great way to raise your credit score faster, without having to pay a lot of money all at once. Reducing your credit card debt, on the other hand, may take longer. But within weeks when done right can give you good points for your credit score.

- Paying off all of your credit card debt quickly and improving your credit usage ratio might be possible if you refinance your debt or get a personal loan. Personal loans can be obtained from banks, credit unions, and online lenders. When you use a personal loan to pay off high-interest credit card debt, you can be sure of a set monthly payment and length of time to repay the loan. A lower credit use rate is another benefit. This is because personal loans are considered installment credit, not open credit like credit cards.