Do you need clarification and support about your tax return? Understanding the ins and outs of tax laws can be daunting, but it is crucial to ensure you are paying the right amount of taxes and taking advantage of any potential savings. One aspect that may need to be clarified is the concept of a negative tax return. In this post, take a closer look at what it means for your tax return to be negative and how it can impact your financial situation in South Africa. Whether you are an individual taxpayer or a business owner, this information will give you a better understanding of your tax obligations and opportunities for savings.

What Does It Mean If Your Tax Return Is Negative?

A negative tax return means that the amount of taxes you owe SARS is less than the number of tax credits you are eligible for. This happens if you have more tax deductions or credits than the taxes you owe, based on the tax laws in South Africa. The Tax Act of 1962 governs the laws related to income tax. The act specifies the rules and regulations for assessing and collecting taxes, including the different tax brackets, deductions, and credits that can be claimed and the penalties for non-compliance.

The act also lays out the legal framework for tax refunds, which includes the conditions under which a refund can be claimed, the procedures to be followed, and the time frame within which a refund claim can be made.

Normally, if you’re owed a refund, it will be processed electronically and reflected in your bank account within 2-3 days of receiving your ITA34 assessment. However, there may be instances where your refund is released after a period of time. Some possible reasons for this delay include the following:

- Audit/Verification: The SARS may need to verify certain information on your tax return before releasing the refund.

- Banking Details: Make sure your banking details are correct and up to date.

- Outstanding Returns: If you have any outstanding returns or taxes that you owe, the refund may be held until these are cleared.

- Unpaid Balances: If you have any unpaid balances or debts with the SARS, the refund may be applied to these before being released to you.

It’s important to note that these are not the only reasons for the delay, but they are some of the most common. By understanding these potential issues, you can take steps to ensure that your refund is released as quickly as possible.

Can You Have Negative Numbers On Tax Returns?

Yes, a person’s or business’s tax return can have negative numbers. This can happen if the taxpayer overpaid taxes during the year and is due a refund from SARS. This can happen if there are a lot of deductions, like medical costs or contributions to a retirement plan, which lowers the amount of taxed income. It can also happen if a person or business gets a tax credit for research and development or hires disabled people. The negative number on the tax return shows the tax refund amount the taxpayer is due.

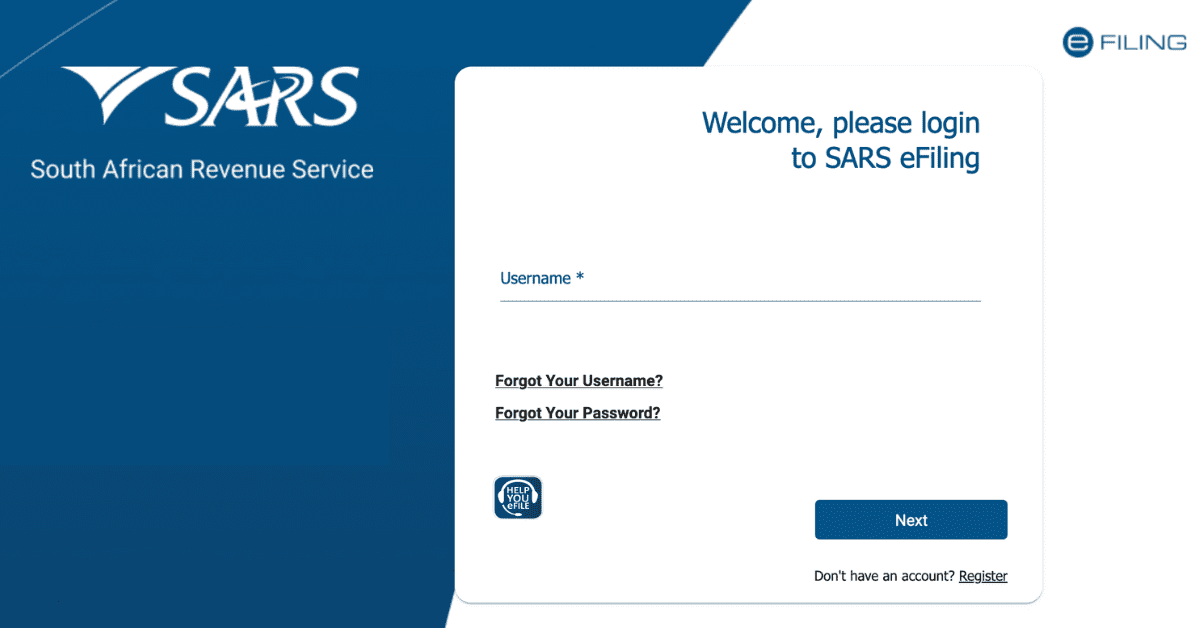

What Does A Positive Amount Mean On Sars Efiling?

A positive amount on a SARS eFiling tax return means that the taxpayer owes money to SARS. This can happen when the taxpayer needs to pay more taxes during the year and has a tax liability. The positive amount on the tax return represents the amount the taxpayer still needs to pay to SARS. If the amount is not paid by the due date, SARS may charge interest and penalties on the unpaid balance. Taxpayers must ensure they have paid the correct amount of taxes throughout the year to avoid owing money on their tax returns.

Why Does My Tax Return Show A Negative Balance?

A negative balance on a tax return means that the taxpayer has overpaid their taxes during the year and is entitled to a refund from SARS. This can happen for several reasons:

- High level of deductions: Taxpayers can claim deductions for certain expenses, such as medical expenses, retirement contributions, and business expenses, which can lower their taxable income.

- Tax credits: Taxpayers may be eligible for certain tax credits, such as for research and development, employment of disabled individuals, or investment in designated areas, which can reduce the amount of taxes they owe.

- Prepayment of taxes: Some taxpayers may have paid estimated or provisional taxes throughout the year, which may result in overpayment if the final tax liability is lower than the amount paid.

- Errors: Sometimes, errors on the tax return or in the calculation of taxes can result in an overpayment.

Can You Have A Negative Tax Return?

Yes, it is possible to have a negative tax return, also called a refund. This happens when a taxpayer has overpaid their taxes during the year, either through withholding or estimated payments, and is entitled to a refund from the government. A negative tax return can also happen when the taxpayer is eligible for tax credits or deductions that lower the taxes they owe.

When taxpayers file their tax return, the refund will be calculated by subtracting the taxes paid or withheld from the total tax liability. If it is a negative number, it means that the taxpayer has overpaid their taxes and is entitled to a refund.

Not all taxpayers will receive a refund every year, even if they have overpaid taxes; if the taxpayer has any outstanding debt or unpaid taxes, that money will be applied to that debt before issuing a refund.