Can subscriptions to services like Netflix boost your credit score in South Africa? This is a common question, as they are helpful in some overseas markets, like the U.S. South Africa uses a different regulatory landscape, however, and subscriptions will not universally count towards building your creditworthiness. Let’s take a look in more depth.

Which Subscription in South Africa Will Build Your Credit Score?

In many international markets, most notably the U.S., different reporting standards and a broader definition of ‘credit’ means that subscription services like Netflix and Hulu are counted on your credit report. Through Experian, you can now sign up for a BOOST program that weights this sort of payment for your credit report. In South Africa, you will often see monthly payment accounts shown on your credit report, too, such as Telkom and Vodacom. However, they don’t have the same kind of effect on your credit report.

Only those that can genuinely be counted as credit, even short-term credit, will have an impact on your credit score. For the most part, this means cell phone contracts only. While all rental payments theoretically should be reported, many landlords simply don’t bother, so this can be a double-edged sword. Streaming and gaming subscriptions, as well as app subscriptions, will often not be reported at all as they are seen as immediate payments, equivalent to cash, not credit. That said, showing a good payment record will always help you in your quest for credit, so be sure to pay on time and cancel services you don’t need timeously.

What is the Fastest Way to Raise Your Credit Score in South Africa?

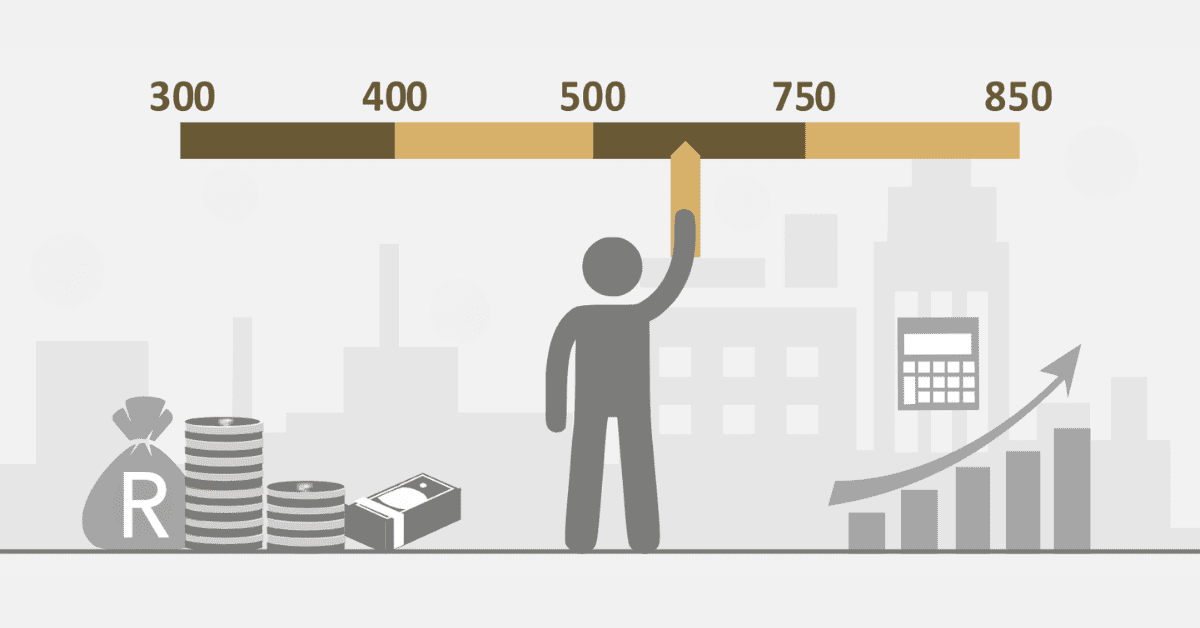

Regrettably for those with a poor credit score, there is no quick-fix way to raise your credit score fast. It will always come down to taking charge of your debt, paying off outstanding balances, and improving your credit behavior by using less of your total balances and paying on time. Over time, this will boost your credit score. How long it takes to see a specific rise, however, depends entirely on your individual circumstances, and how poor your credit profile was to start with.

What Apps Help Improve Credit Scores?

While there are a few apps in South Africa that will help you track your credit score, such as some banking apps and the ClearScore app, there is no app, even subscription apps, that will help you build credit. Most app store purchases, regardless of platform and even those that take a monthly subscription fee, are seen as immediate or ‘cash’ payments and not a credit line, so they don’t count on your credit report.

Do Cell Phone Contracts Build Credit in South Africa?

Cell phone contracts are a viable way to build credit in South Africa, especially if you are paying them by debit order from your bank. However, as they are small value and count as short-term loans, their impact on your credit score will not be massive. It can still be a great way to start building your credit history, however!

How Do I Add Streaming Services to My Credit Report?

In the U.S., you can sign up for the Experian BOOST option to have these small, regular subscription service payments added to your credit profile, but they have not yet rolled this service out to Experian in other countries. Hopefully, that will change soon! Experian does offer the GeleZAR app in S.A. currently, but that is focused on education, not your actual credit score. There is currently no option to ‘add’ things to your credit report. Whether or not the financial institution reports it to bureaus will be key.

There is a smart trick you can use to leverage your streaming services to help your credit, however. Sign up for them using a credit card, and pay off the subscription in a rolling 60-day window, so your credit card stays active and registered as debt you are using at the credit bureaus. A 30-day window will not be enough, as settling a credit card balance within that time frame counts as ‘cash’ purchases.

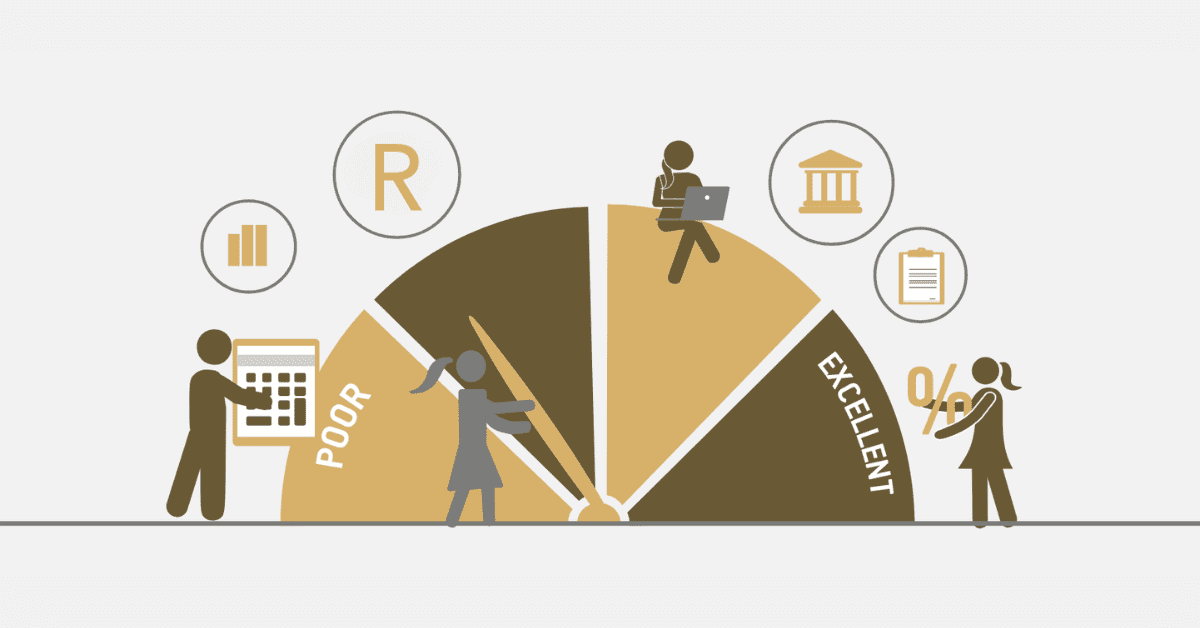

Don’t be shy to ask the subscription service provider if they report to the bureaus, too. Some do, while others don’t. That way you can choose a partner that will directly report your account for use on your credit report. Remember that these types of monthly payment services are not particularly important to building a credit score, however. Actual credit lines, like store cards, credit cards, mortgages, and loans, will have a much greater impact. Still, showing you pay the subscription monthly on time will have a small positive impact, and cell phone contracts are treated as a full credit line.

While we can’t yet leverage all of our subscription services to build credit history in South Africa, the financial landscape is always changing. Lenders also like to see regular, timely payments on accounts, which can help a little. For now, however, your streaming and other ‘fun’ subscriptions won’t build your credit history for you.