South African commodity speculation is a very trendy type of investment where investors and traders can make money through natural resource price movements like oil, platinum, gold, and agri-commodities. The commodities market is traded based on a sequence of financial products like exchange-traded funds (ETFs), futures contracts, and physical asset trade. While risky where market volatility is involved, speculation is similarly innovative business to someone with market insight, supply-demand knowledge, and understanding of drivers of global economics. Once the world’s leading gold, platinum, and coal producer, South Africa now has an adequate system in which commodity speculation flourishes.

What is Commodities Speculation?

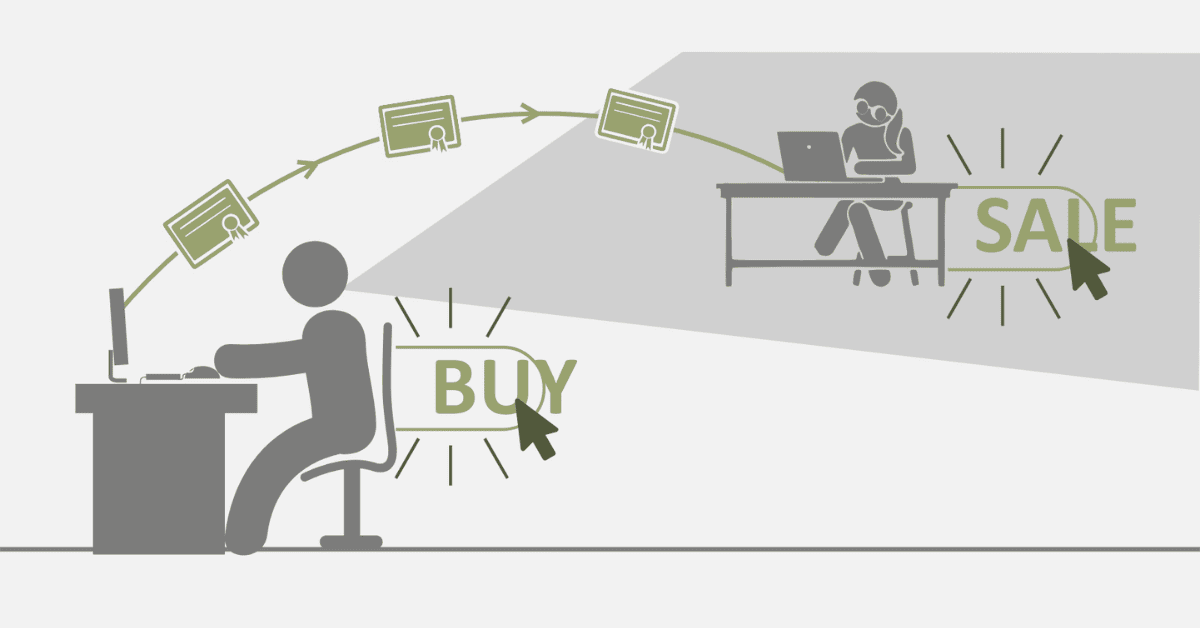

It is buying and selling commodities to profit from price variances instead of using the product. Speculators deal in commodities instead of hedgers who buy or sell commodities to hedge business risk. They do so mainly to profit from price variances. SA commodity speculators deal in significant commodities like gold, platinum, oil, and food items like maize and sugar. Speculative by essence, the market requires traders to monitor the world economic happenings, & geopolitical events closely. This further includes supply chain disruptions that shape commodity prices.

How Do You Bet on Commodities?

South African commodity speculation comprises various trading strategies through which the speculators can bet on price variations without having any commodities. Futures trading is the most prevalent strategy in which both the buyer and the seller of the commodity agree to exchange it at an agreed time and price. The Johannesburg Stock Exchange (JSE) has a vibrant derivatives market where speculators can trade the commodity’s futures in investment products like gold, platinum, and agri-commodities.

The second is by showing a single basket of the commodity through the use of commodity exchange-traded funds (ETFs) without ever taking an actual position in the asset. The third is through Contracts for Difference (CFDs) utilized by speculators in large quantities who buy leveraged and bet on the direction of the price action of the commodities and rollover risk and resultant profit. Options trading is where other speculators buy and sell the option to buy or sell the commodities at the price specified on or by the date assigned to it.

What are the Top 3 Commodities to Invest in?

South Africa’s natural resource abundance propels market leadership of the supply of some of its commodities to invest in. Gold is no exception, as South Africa always has been one of the largest gold-producing countries in the world. Prices of gold are determined by economic stability, inflation, and world demand, so it is always in high demand when there are uncertain times.

Another leading commodity is platinum because of South Africa’s market leadership in the world production of platinum. Platinum is highly sought after in producing cars and the jewelry sector. It thus promises high market demand. Lastly, crude oil is the leading constituent of the South African economy, even though the country is a net oil importer. Its value depends on worldwide demand and supply, OPEC decision-making, and geopolitics. This offers quite several trading opportunities.

What is An Example of a Commodity?

A raw product or unrefined material purchased and sold by volume is a commodity. One of the finest examples of this in SA is gold. It’s one of the most valuable minerals and significant contributors to the SA mining industry. Gold is extracted, processed, and locally and internationally exported. Besides, it is one of the major contributors to the SA economy. It is used in various applications ranging from jewelry making to investing in coin metal and bullion to being utilized by industry. World forces of market demand and supply pressures, inflation rates, and central bank intervention set its price.

How Do People Make Money from Commodities?

Investors and speculators make money from commodities in several ways with differing risks and sophistication. One of the most sought-after is through futures, where commodities are bought or sold at a predetermined price with the expectation of reaping profits from the price difference before the contract’s deadline. Commodity shares are another, where one invests in mining company shares, petroleum product extraction, or agriculture, and thus, it derives from rising prices of commodities.

Exchange-traded funds (ETFs) are another diversified means of exposure to a basket of commodities without trading commodities. There are even arbitrageurs who derive their profits from price differences between two markets or two exchanges. As South Africa is a resource economy, most investors also trade in physical commodity trading, buying and selling raw materials like gold and platinum.

How to Invest in South African Commodities?

Investing in South African commodities through several channels, each best suited to the investor’s varying risk tolerance and inclination, is possible. One of the simplest is buying actual commodities such as crops or bullion gold, which necessitates safe storage and management. Much more commonly applied, however, is the use of financial derivatives such as actively traded currency futures on the Johannesburg Stock Exchange (JSE), which permits speculators to bet on future prices.

Exchange-traded funds (ETFs) are also handy when one gets exposed to a basket of commodities without having possession of the underlying physical commodity. Indirect exposure is also gained through holding South African mining and resource company stocks. Other investors buy commodity-linked Contracts for Difference (CFDs) that permit leveraged punting on price direction.

Conclusion

South African commodities speculation is a risk and potential for investors wanting to capitalize on shifting prices of significant natural commodities. Gold, platinum, and oil are some of the most substantial economic drivers of the nation, and commodities trading is present in so many channels, from exchange-traded funds and future contracts to straight investments in mining houses. You can make humongous profits through commodity speculation, but it must be closely connected with the market trend, demand and supply cycle, and other extrinsic economic elements. The speculators must develop appropriate risk management strategies while considering the world and local market situation to make the right choices.