In South Africa, a goal-aligned investment portfolio is what you urgently need to secure your future financings from the turbulent economic tides. That way, you can ensure your retirement, save to get a house, or amass your wealth; these can all be achieved readily through a well-crafted investment portfolio. In so doing, you can build a portfolio that goes hand in glove with your unique goals, risk tolerance, and time horizon but not lose sight of the aspirations behind them. This article will take you through all the individual steps of how to align an investment portfolio in order to realize targets, compute a portfolio, invest with minimal funds, and develop a diversified investment strategy.

How To Build an Investment Portfolio Around Your Goals

This starts with stating your financial objectives. Are you saving for a long-term venturing objective such as retirement, saving for education, or simply saving for a big purchase? Each of these goals has a different timeline and associated risk profile, which, in effect, shall govern your investment strategy. For instance, you might focus on growth assets, including equities or equity funds, in the case of goals intended for the long run, such as retirement.

This means that shorter-term goals are likely to favor more conservative approaches regarding investment, focusing on bonds or cash investments for the preservation of the capital.

More importantly, building off your portfolio in South Africa comes through a set of local economic conditions and regulatory environments. From the Johannesburg Stock Exchange, one has a wide range of investment instruments, including blue-chip equities and exchange-traded funds, among others, both that offer growth and diversification. However, not forgetting the possible impacts of inflation and currency fluctuations on investments is also highly relevant in the South African scenario.

It is also very important for you to review and rebalance the portfolio at regular intervals in a way that ensures it remains in line with your goals. Due to the change in your financial situation or the closer realization of the set objectives, there is a need to switch the asset allocation to keep up with the change in your risk-taking ability and investment horizon.

How do I calculate my investment portfolio?

Calculating your investment portfolio may refer to determining the value of all assets and whether they serve your financial goals. The first step in doing so is to collect all your various papers for venturing, including stocks, bonds, mutual funds, ETFs, and anything else along those lines, and list them down. Find out the current market value of each of these with the help of an online fiscal platform or a monetary advisor.

Next, you can see how well your portfolio has performed by benchmarking it against applicable benchmarks or indices—this ties in with your investment objectives. In other words, an investor wanting to buy South African stocks will compare his or her portfolio performance with the JSE All Share Index on the assumption that it will yield a superior return than merely holding onto cash.

Another critical step is to evaluate your asset allocation. This means computing the percentage of a ventured portfolio in various asset classes, such as equities, fixed income, or cash. An adequately diversified folder should provide the right combination of assets that expresses your risk tolerance and venturing goals. For instance, a higher percentage of the folder in stocks could be for long-term growth, and a more significant portion of bonds could be appropriate for capital preservation.

Lastly, think about the investment fees and tax, as this would have a significant effect on your overall returns. In South Africa, one needs to take into consideration things like capital gains tax and other buying and selling-related fees of assets.

How do I make an investment portfolio with little money?

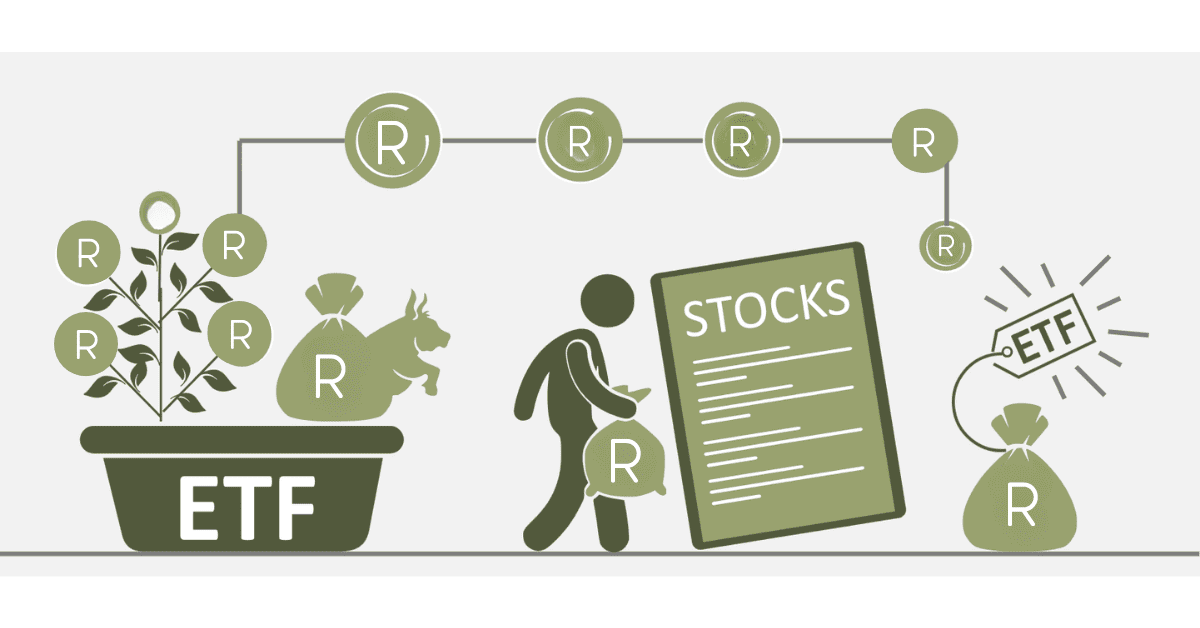

It’s entirely possible to build an investment portfolio with limited funds in South Africa if one has a strategic approach. Begin by setting clear, achievable financial goals and determine how much you can invest on a regular basis, no matter how small. One of the most efficient ways to achieve diversification across asset classes without needing too much money upfront is to use low-cost exchange-traded funds.

ETFs afford you an inexpensive way, on the JSE, to buy into a small portion of a fully diversified portfolio in stocks or bonds, thereby spreading your risk across many companies or sectors. It implicitly means that you are likely to have diversified market exposure such that the single-stock influence of volatility is held at a minimum.

Consider looking even into the tax-free savings accounts by South African financial institutions. These accounts will offer you an opportunity to invest up to some limit without paying tax on the returns that surrogate these products. This makes them an exciting option for the average person with only a limited amount of money to invest.

Next, small but regular contributions have the power of compounding interest over time. Making small, regular investments will build a sizeable portfolio over time. Finally, utilizing investment applications and online sites that support small investors will allow you to begin investing with very little capital while offering resources for education in making prudent decisions.

How do I create an investment portfolio?

This requires careful identification of the venturing goals, tolerance to risk, and time duration for the investment. Understanding what you are going to achieve will push you closer to your goals, like giving you money for retirement, education money-making, and so on. After all the goals have been set for the portfolio, it’s time to take your time and agree on the amount of risk you are willing to take. In turn, this will affect your investment in the asset allocation strategy.

Next will be building the next asset mix that suits your goals and fits your risk tolerance. South African investors could consider a mixed bag of JSE-listed equities, government bonds, and ETFs. Diversify your investments to spread risk; consider supplementing similar stocks with exposure to different sectors or asset classes.

Once you have picked your investment focus, it becomes imperative to monitor your portfolio on a regular basis. Have some discipline: markets and personal circumstances change, so review your portfolio at more or less the most minor annual intervals to ensure it continues to meet your stated goals. Sometimes, the act of rebalancing— of changing your portfolio’s asset allocation — is needed to maintain the level of risk you want.

Consult a financial advisor if you are a novice or if your investment portfolio becomes sufficiently complex; indeed, in giving expert financial advice and assisting you in alleviating a unique South African investment dilemma while maintaining the performance of your investment portfolio in pursuit of your financial goals.

Final Thoughts

Building an investment portfolio based on your goals is a fluid process—dynamic, calling for careful planning, regular monitoring, and adjustments according to changing circumstances over time. Leverage local investment opportunities in JSE-listed stocks and ETFs to provide a solid foundation for your portfolio in South Africa. Be it a little or a lot that you are investing, the key to succeeding in the complexities of the investment world is to remain focused on your goals and adopt a diversified approach to secure long-term financial success.