In reality, mutual funds are one of SA’s most popular investment options. Investors prefer them because they offer diversification, professional management, and the realization of great potential returns. The ventures pool money received from numerous investors to be invested in a diversified portfolio of assets, namely equities, fixed-income securities, and money market instruments. In a way, they help reduce risks and seek consistent growth through diversification.

However, mutual funds are regulated under the Financial Sector Conduct Authority of South Africa, which is intended to spread financial investments and protect the investors’ interests transparently. Also, different kinds of mutual funds, such as equity, bond, and balanced funds, are available for investors based on what they can handle.

Can I Save Tax by Investing in Any Mutual Fund?

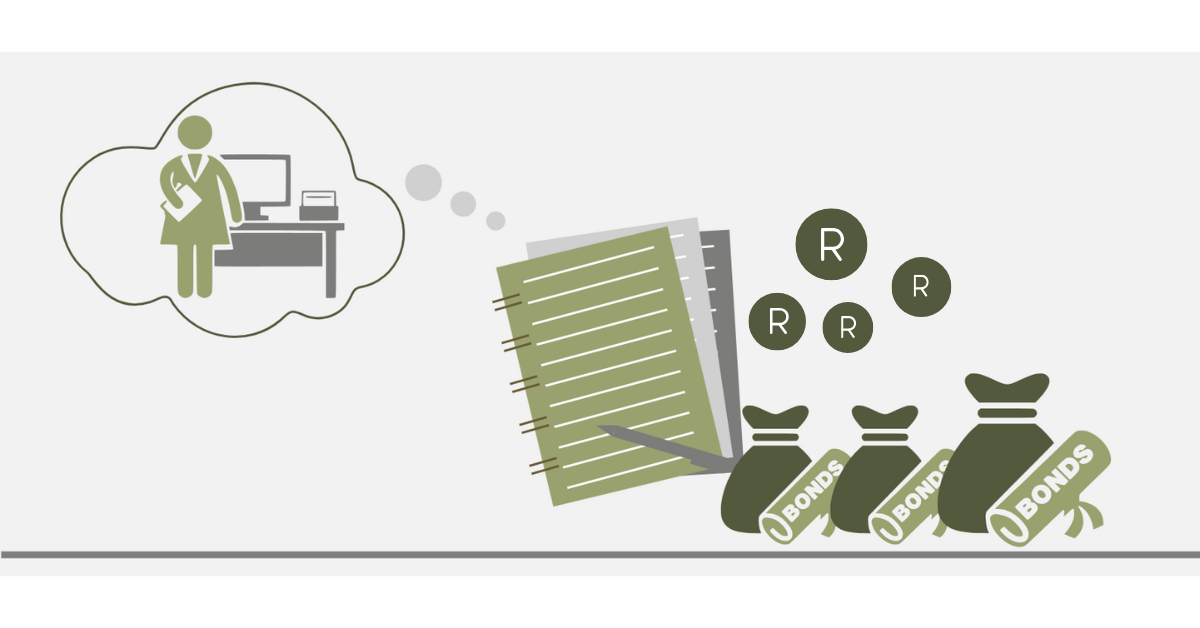

Not all mutual funds from South Africa can secure some tax-saving benefits. One needs to invest in these pocketed TFSA or tax-saving mutual funds to save taxes. TFSAs allow South Africans to invest up to R36,000 yearly and have a lifetime amount of R500,000 without the impact of taxes on the return generated, whether from interest, dividends, or capital gains. Several financial institutions and asset management companies offer them. In general, selecting the tax-saving mutual funds inside the TFSA allows investors to enjoy tax-sheltered mutual fund growth while benefiting from significant tax savings.

How to Invest and Save Tax Using Mutual Funds

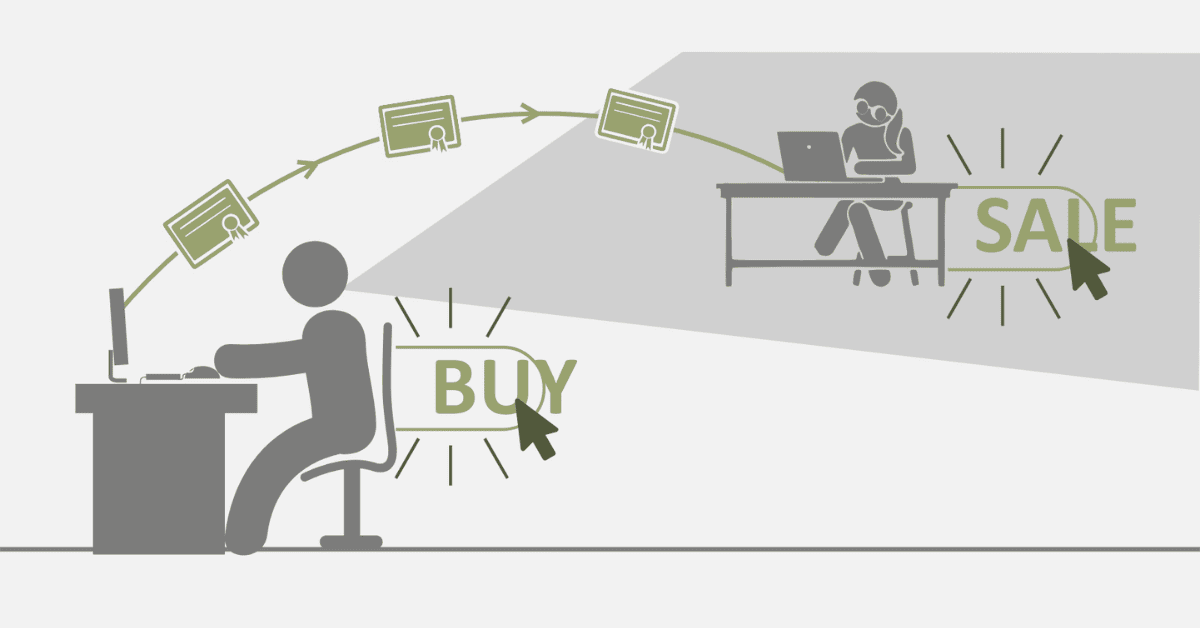

There are a few key steps to invest in mutual funds to save taxes in South Africa. First, there is a need to set clear financial goals and, at the same time, ascertain the degree of personal risk tolerance. This will help you avoid mistakes and sell in a panic when the price declines.

After this, one should research the available mutual funds, including the historical performances, track records of the fund manager, fees, and expenses. Upon completing the above two steps, open an investment account with any licensed financial institution or a licensed investment platform. Fund your account and go on to pick your mutual funds that are in line with your goals. Monitor your investment and occasionally revisit it to rebalance the portfolio to the desired asset allocation.

What is the Best South African Tax-Free Investment?

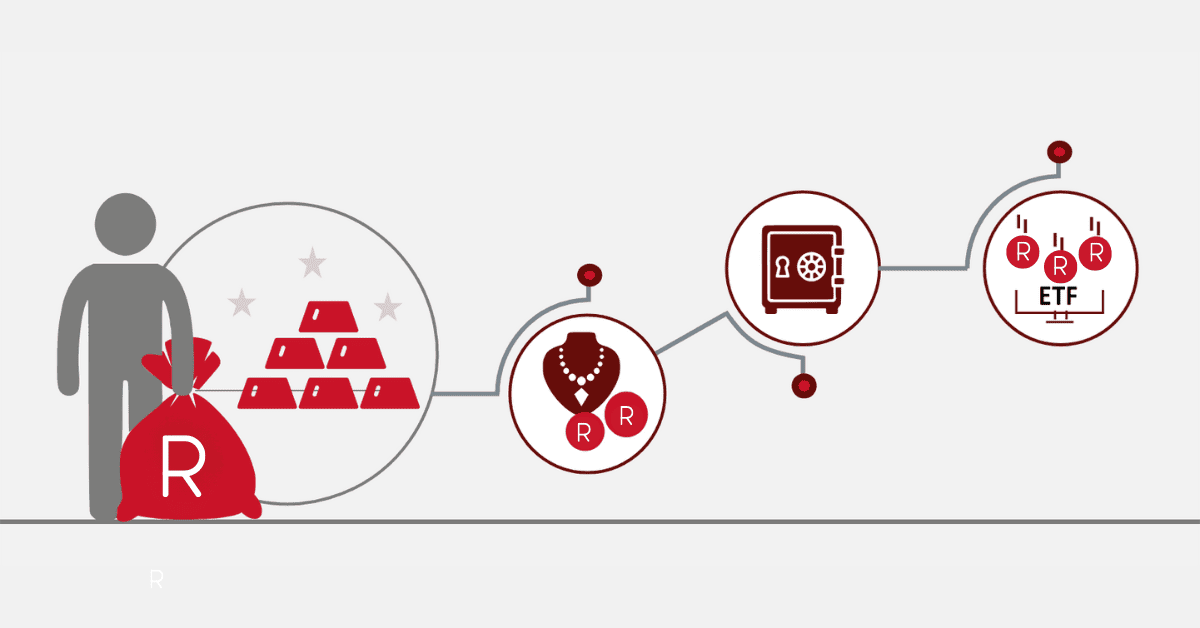

SA’s top tax-free investment is the TFSA. The TFSAs, initiated in 2015, have provisions allowing individuals to invest up to R36,000 per year (up to an advanced lifetime cap of R500,000) in various financial instruments, namely equity mutual funds, ETFs, fixed deposits, etc., strictly tax-free. It’s the best investment vehicle for long-term savings – be it retirement or any educational pursuits- because of the power of compounding growth, which goes hand in hand with tax-free returns. While many financial institutions, like banks and asset management companies, provide TFSAs, each offers a wide range of investment options to fit different investment strategies and hunger for risk.

How Much Should I Invest in Tax-Saving Mutual Funds?

The amount to invest in a tax-saving mutual fund can generally be gauged from factors like the financial goal, risk tolerance, and overall investment strategy. Begin with the setting of a budget. Consider the annual R36,000 contribution limit for TFSAs to leverage the associated tax benefits. If you are new to saving and investment, start with the amount you are comfortable with and increase it gradually with time while you continue to get familiar with the market and your financial health improves. Diversification plays an indispensable role here. It involves spreading investments to various funds to balance risk and potential returns. However, for personalized guidance, consider consulting with a financial advisor.

What Happens When Cashing Out Mutual Funds?

If you decide to withdraw the cash, several things may arise. If the mutual fund is placed inside a TFSA, the withdrawals can be without taxes, no matter the amount or growth of the underlying investment. However, if the mutual fund is not inside a TFSA, then capital gains tax applies to any profit made from the investment. The timing of withdrawal also impacts return because market conditions may differ. Some funds have a rule about exit fees and liquidity requirements within a particular time. Generally, notice must be taken of terms on which mutual fund works and advice gotten from the advisor concerning cashing out.

Final Thoughts

Investing in tax-saving mutual funds in South Africa offers disciplined ways to increase your hard-earned money and simultaneously decrease the taxes on your wealth to the biggest degree possible. This could be better achieved by using tax-free savings accounts and being a bit great at selecting mutual funds that suit your targets well. Make sure you do all your scrupulous homework, define your investment objectives, and seek professional help to ensure you get your investment strategy right. Monitoring and rebalancing your portfolio regularly keeps it on a straight path to your financial objectives and a balanced take on your risk tolerance. With the correct strategy, mutual funds can be a valuable tool in your financial plan.