This can be considered a critical financial investment that requires some prior planning and extensive research. With the various property investments available within South Africa, one has several alternatives as an investor. On the other hand, real estate can also be complicated and full of risks. So, to make an extraordinarily safe and profitable investment, it is essential to understand various elements. These include the market, the best locations, and the property type. The following article is a step-by-step guide on how to do this in South Africa. It offers hands-on tips and insights to help one successfully negotiate the market.

Tips For a Safe Real Estate Business

This investment is more a matter of intelligent decisions than just buying property. It entails ensuring that the risks associated with it are minimized while at the same time optimizing the returns on the venture. South Africa traditionally provides an unpredictable property market, and this way, its investment requires strategic thinking. Herein, we narrow down to some significant strategies for safe investments, including thorough research, starting small, focusing on location, and choosing the right property type.

Invest Time into Researching a Suburb

A little research of a suburb can go a long way toward making a safe real estate investment. There are differences from one region to another in South Africa, so this localized knowledge is handy. Begin by researching market trends in your suburb. Observe the trend from the past data on property values, rental yields, and other aspects informing market demand. Websites like Property24 and Private Property will give you valuable insights and data to digest about the state of the market.

Liaise with local real estate agents who can tell you about the area’s growth potential, infrastructure developments, and community plans. Going to see the suburb will give a better picture of its livability prospects for the future. Observe the considerations that can affect the property values, like safety, accessibility, availability of schools, amenities, and so on.

Consider also the suburb-driving economic activities. A suburb with intense economic activity and job guarantees will likely attract more residents, bringing about higher demand for properties in the area. An excellent feasibility study may also prepare you for possible risks or homelessness in the case of political instability or inadequate, impending environmental concerns.

Starting Small is a Safer Investment

The best strategy, especially for new investors, is to start small and grow up. South Africa has its fair share of options, from single-family houses to apartments and townhouses. A small investment will teach you much without exposing you to excessive financial risk.

Most of these small-scale investments are manageable, not too stressful, and involve little capital upfront, which exerts little financing pressure on the investor, therefore able to leverage any available resource. An example is taking an affordable apartment in a developing suburb. As the area grows, it yields high returns.

Starting small also gives one the flexibility that, in case of a shift in market conditions, it’s much easier to change your investment strategy or sell without facing huge losses. Furthermore, managing one property that concerns taking care of the practical experience in property management, tenant relations, and maintenance will be very useful when scaling the portfolio.

Seek low-renovation or low-repair properties, for these can become a money drain if not watched. Consider turnkey properties that are move-in ready and ready to collect rent immediately.

Location is Key to Making Safe Real Estate Investments

In real estate investment, location is a factor that turns the tide of success or failure. Regarding South Africa, it defines several critical elements that turn around property values and demand.

Firstly, the economy of the area must be checked. Areas with good economic growth, such as Johannesburg, Cape Town, and Durban, will likely have better investment opportunities. All these areas have dynamic economies with a spate of industries and are experiencing high population growth rates. Demand for residential and commercial property is therefore evident in places like this.

Second is infrastructure and availability of facilities. Transportation systems, schools, clinics, and shopping centres enhance the value and increase the demand for a property. Places with upcoming infrastructure development, like new roads or public transport, increase property values more than other places.

Another fundamental issue is safety. Check the crime rates and initiatives for their safety being done by the community. Generally, more tenants can become attracted to properties located in safer neighbourhoods. Finally, check the future growth prospects. For example, areas proposed to be developed, such as business parks or institutes expected to come up or those located near recreational centres, enhance the property’s value. Monitoring government and municipal plans will show where growth will occur in the coming times.

Invest in the Correct Property Type

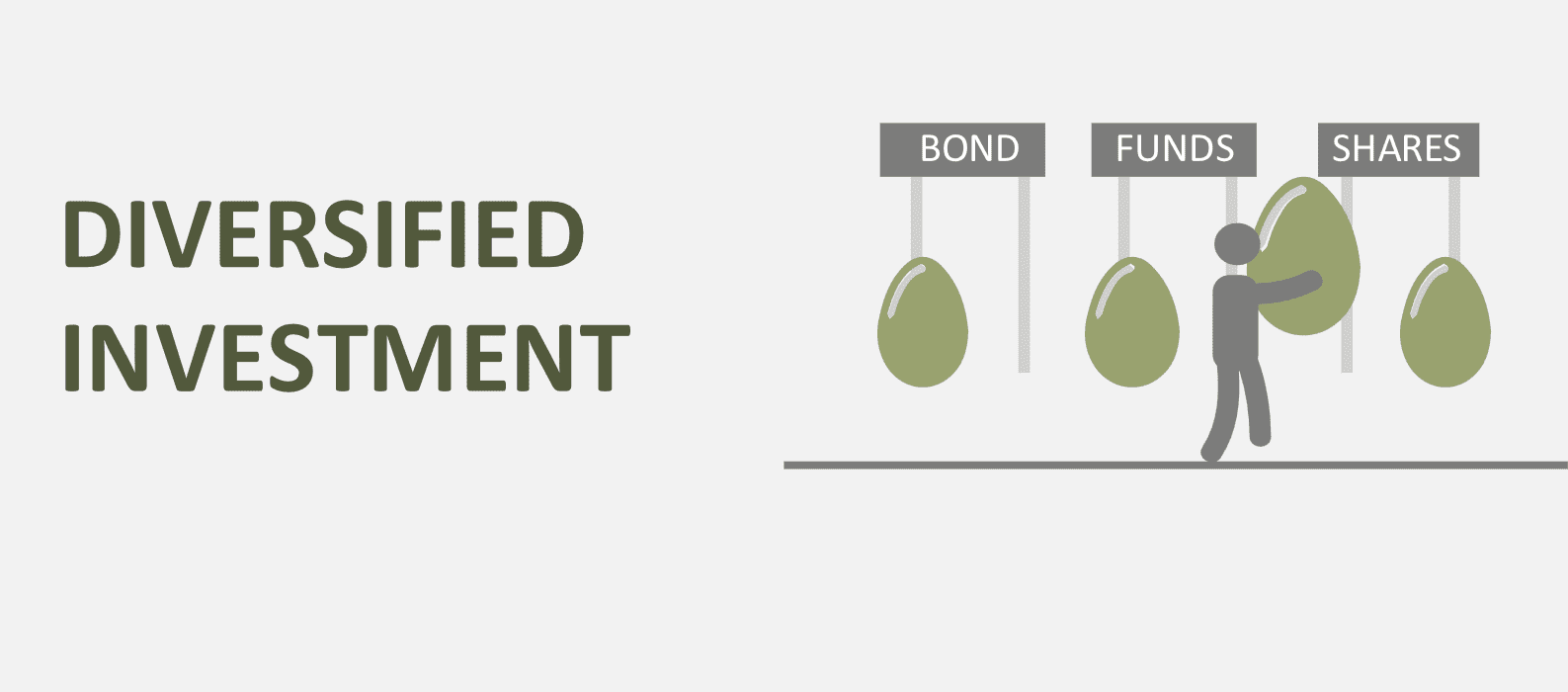

The correct choice of property type is critical to ensuring a safe real estate investment. South Africa’s property market offers various property types, each with benefits and risks. It is crucial to know the different kinds of constructions and how they align with your goals.

Many capitalists prefer concentrating on residential properties, single-family homes, apartments, and townhomes. These properties provide stable rental income due to reduced vacancy rates in hotspots. At the very foundation of any investment in residential property, one has to consider the quality of tenants, proper maintenance of the property, and capital growth prospects.

Offices, shops, and industrial units are other commercial property investments that could be expected to give better returns but are fraught with higher risks. Such assets call for a better understanding of the market and knowledge about tenant requirements. See that your commercial property is in a first-class area with easy accessibility and passersby. Stable long-term tenancy will add financial stability to your investment and reduce the risk associated with the same.

Mix up your property-based portfolio with mixed-use properties—where residential and commercial spaces come together. These provide diversification within a single investment, further balancing risks and returns. Indeed, increasingly popular in urban hubs, mixed-use developments display great convenience and lifestyle features for tenants.

Final Thoughts

Strategic planning and homework should be done while making a safe real estate investment in South Africa. Some significant factors that could help the investors through the market, cutting down on associated risks, are exploring suburbs, starting small, and analyzing the location and the type of property. Knowing the local dynamics of South African property is one thing, but using local insight can make all the difference to any real estate portfolio in the final analysis.

![What are ETF [Exchange-Traded Funds]?](https://www.searche.co.za/wp-content/uploads/etf.webp)