The GCash app offers a feature called GCredit, which allows users to access credit that is specifically designed to meet their individual financial needs.

When it comes to GCredit terms, they are not fixed and can vary based on your GScore. There have been reports from users who have mentioned that they were given larger credit terms right from the beginning.

On the other hand, some users might initially receive smaller terms, but these terms gradually increase over time as they continue to use the service. The GScore, which is based on your past transactions in the GCash app, is an important factor in calculating your credit score. By consistently practising good financial habits, you can positively impact your credit score and improve your credit terms.

Learn more about the number of credit scores to unlock Gcredit, the qualification for the Gscore and many more topics related to Gcredit.

How Many Credit Scores to Unlock GCredit

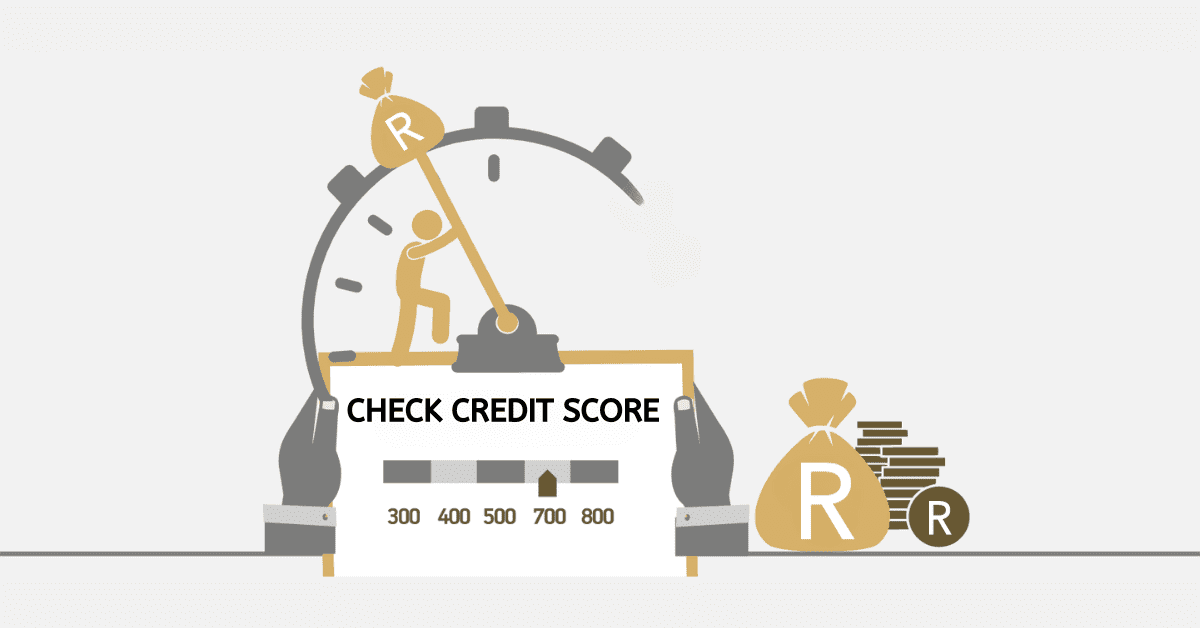

Unfortunately, Gcredit does not have a specific number that guarantees access, which is quite disappointing. Unlocking Gcredit can be influenced by various factors, making it difficult to determine the exact credit score required. When individuals are interested in opening Gcredit, they frequently inquire about the minimum number of credit scores that need to be fulfilled. There is a popular money-saving service known as Gcredit that allows users to access credit and conveniently make purchases. Sometimes, it can be unclear what steps are necessary to unlock this tool.

If an individual has a credit score of 400, they might encounter difficulties when trying to unlock their Gcredit. However, if their score is 500, they may have a better chance of being able to do so. Following the rules of Gcredit can sometimes be challenging. There is no precise rule or credit score to unlock Gcredit. All you need to do is to keep using the platform, funding it, making minimum payments and you can have the chance to unlock Gcredit.

How do I know if I am eligible for GCredit?

In order to be eligible for GCredit, make sure that you are a fully verified GCash user and that you have a verified email address. To keep your financial record in good shape, make sure to always meet your financial obligations and steer clear of any suspicious or fraudulent transactions. Eligibility for GCredit is strongly linked to exhibiting responsible financial behaviour on the GCash platform. Make sure to regularly check the status of your GCash account and review your transaction history. It’s important to promptly address any issues that may arise. By meeting these criteria, you can improve your chances of qualifying for GCredit. This will enable you to enjoy convenient and flexible credit options within Gcash.

What is a qualified GScore?

The GScore is a financial metric that evaluates your financial behaviour and responsibility from different angles. It provides a comprehensive assessment of your financial qualifications. The system considers various factors when evaluating your financial profile. These include your frequent use of GCash, your ability to maintain a balanced financial profile, how well you repay loans, your habit of paying bills promptly, your regular contributions to savings and investments, making payments on time and your involvement in purchasing insurance products. The score is a measure of your overall financial well-being and how responsible you are in handling different aspects of your financial life. It shows how reliable you are when it comes to managing your finances. Having a higher qualified GScore is seen as more favourable, suggesting a strong and responsible financial profile.

What is the maximum credit limit for GCredit?

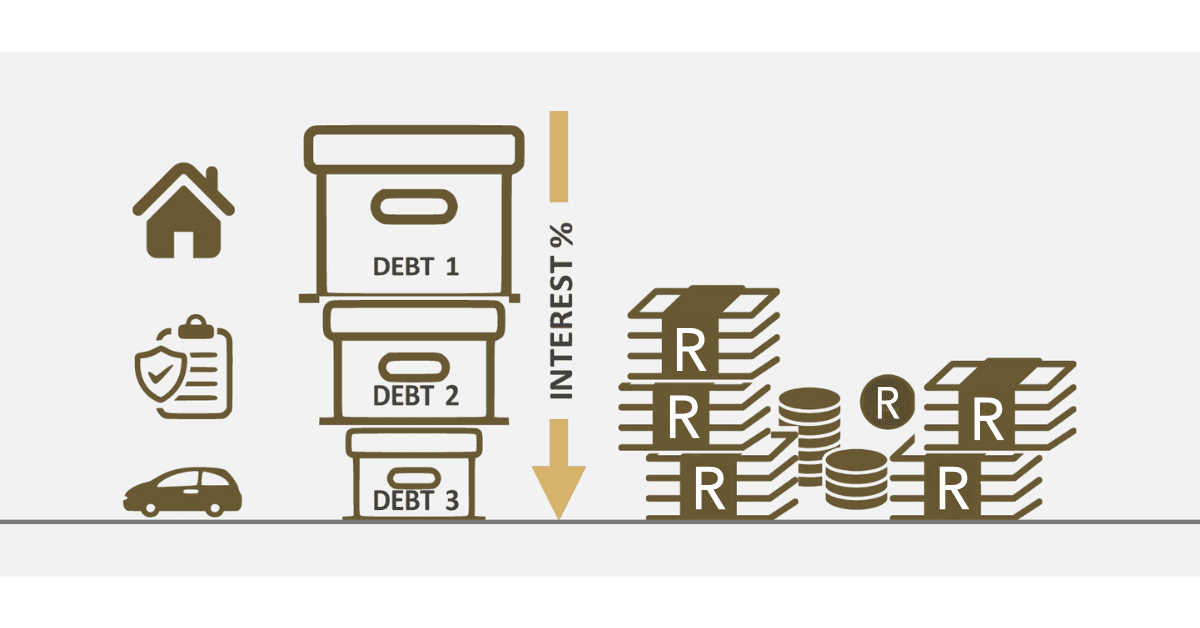

Gcash has set a maximum credit limit of 500,000 PHP. This limit is determined based on various factors such as the user’s history, transaction behaviour, and financial activities. The credit limit provided allows users to easily make transactions like buying items, paying bills, and transferring funds, giving them more freedom with their finances.

What are the requirements for GCash loan?

Gcash has become a versatile platform that provides support to most Filipinos with a convenient way to access the funds they need. To get the Gcash loan, there are certain requirements need to be fulfilled. Applicants should be between the ages of 21 and 65, as we believe this age range reflects a responsible and mature attitude towards financial obligations. Gcash’s commitment to supporting its local community is underscored by the fundamental requirement of being a Filipino citizen.

As part of the requirement for a Gcash loan, it is beneficial to have a fully verified Gcash profile, a strong credit record, and a clean financial history.

To unlock a world of financial possibilities through Gcash loans, it is important to maintain a favourable GScore and be financially disciplined; by adhering to the simple guides on the Gcash platform.