Have you ever contemplated the consequences of being late filing your tax returns or making your tax payments in South Africa? If taxpayers do not fulfil their tax obligations, they will be subject to fines from the South African Revenue Service (SARS). Hence, every taxpayer must understand how these penalties are calculated. In this article, we’ll look at how SARS calculates

How are SARS penalties calculated?

If you’re a provisional taxpayer, you know the struggle of estimating your taxable income and submitting your provisional tax returns on time. But failing to comply with SARS’ requirements can cost you a pretty penny. So, what penalties can you face, and how are they calculated?

Late payment penalty

If you don’t pay your tax on time, you’ll be hit with a 10% penalty of the total amount payable. And that’s not all – SARS will charge you interest at 10% per annum. So, ensure you set up reminders and pay on time to avoid this hefty penalty.

Under-estimation penalty

If you underestimate your taxable income and end up paying less tax than you should, SARS will hit you with a penalty if your actual taxable income is more than what you estimated. The penalty amount differs for taxpayers who earn more or less than R1 million.

Late submission of tax returns

SARS also does not take the late submission of tax returns and payments lightly. Even a day late can result in a penalty. If you submit a nil return (an estimate of zero taxable income) when your actual taxable income isn’t zero, SARS will slap you with a 20% under-estimation penalty.

Finally, if you’re penalized for late payment and underestimated your taxable income, you won’t face the full amount of both penalties, but you’ll still be charged an additional amount. In this case, the underestimation penalty will be reduced by the late payment penalty already applied.

To avoid these penalties, estimate your taxable income accurately, pay on time, and submit your returns before the deadline.

What is the SARS late submission penalty?

Due to SARS’s harsh penalties, late tax returns might be even more intimidating. SARS notified a late submission penalty for the 2021/02 EMP501 return. Employers who fail to file returns before 31 May 2021 will be penalized 1% each month.

This penalty encourages firms to comply with tax requirements and submit information on time. The penalty helps SARS process returns faster and gives taxpayers correct information.

The penalty applies to employers that fail to submit the complete return, so double-check that all the needed information is included before filing. Also, remember the penalty will accrue until the return is complete.

SARS has stated that they will enforce tax regulations, and late filing fines are one way they make this possible. To avoid fines, file your tax returns on time and contain all required information.

How much is the penalty tax?

If you don’t submit your income tax return on time, you could be hit with a penalty tax. The amount of the penalty tax depends on your taxable income and the length of time you remain non-compliant. The penalty tax is a fixed amount that ranges from R250 to R16 000 per month for each month that the non-compliance continues.

If you fail to submit your income tax return, you’ll face the administrative non-compliance penalty, recurring every month for a maximum of 35 months. This case means that the longer you remain non-compliant, the more you’ll be penalized.

It’s important to note that even if you disagree with the penalty, submitting the outstanding return is best to stop further admin penalties. If you ignore the return submission, you will face the penalty tax for each month the return(s) remain outstanding.

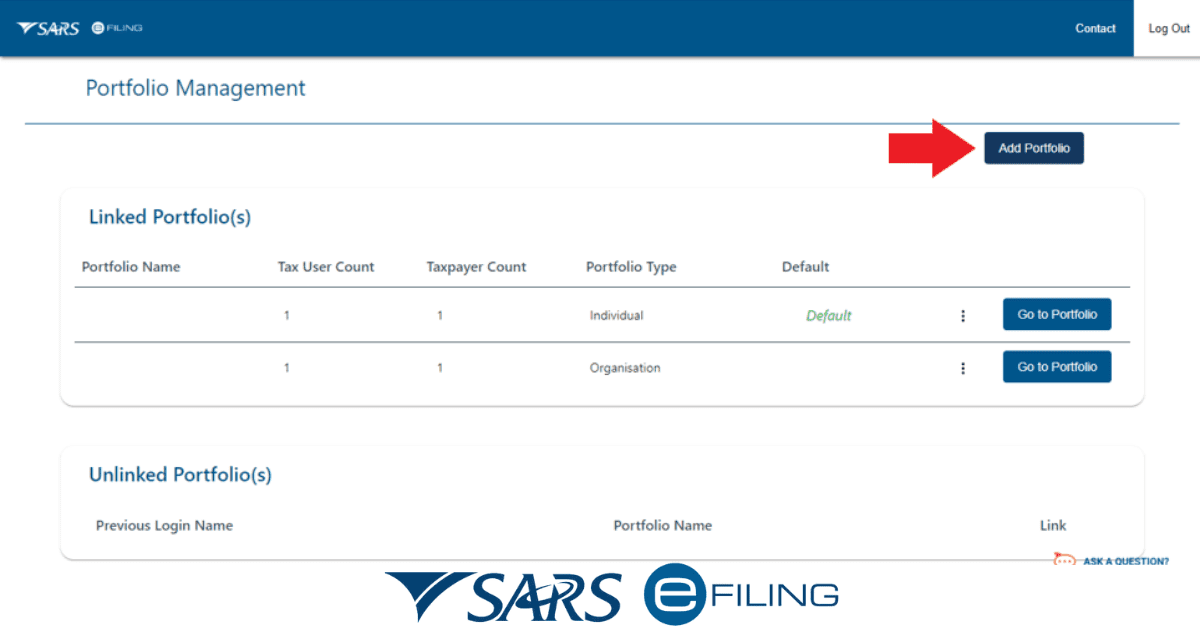

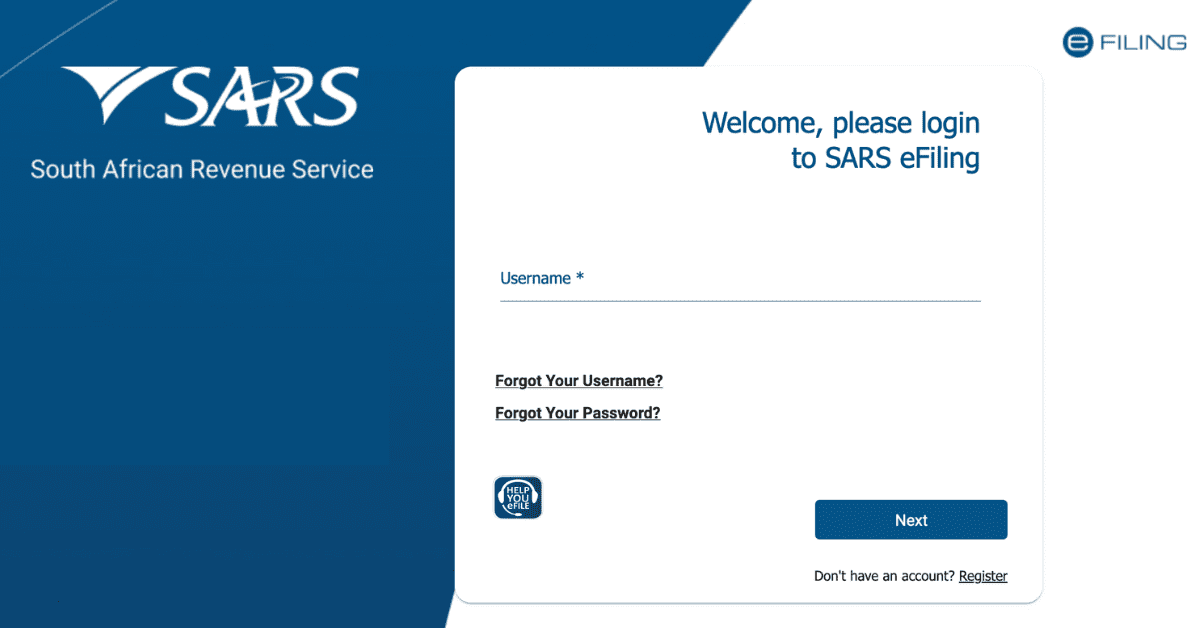

If you receive a penalty assessment notice, note that you’ll longer receive the Penalty Statement of Account (APSA). However, you can request an APSA by contacting SARS through eFiling, calling the SARS Contact Centre, or visiting a SARS branch (remember to make an appointment).

Generally, submitting your income tax return on time is crucial to avoid the penalty tax. If you miss the deadline, submitting the outstanding return as soon as possible is advisable to stop further penalties.

What is the penalty for not paying taxes in South Africa?

South Africa penalizes incorrect tax payments, and the penalties range from 5% to 200% of the unpaid tax. You’ll encounter various penalties here, including percentage-based, fixed amount, reportable arrangement, and understatement tax penalties.

Remember, SARS may mistakenly or correctly issue tax penalties, and you can appeal a tax penalty to SARS. However, tax legislation regarding fines and objections is complex; therefore, you should consult a tax specialist.

Conclusion

In sum, violating South Africa’s tax regulations can result in severe repercussions, such as monetary fines and legal action. Therefore, taxpayers should know their responsibilities and pay their taxes on time to avoid paying interest or fines. However, if you find yourself subject to a tax penalty, it is crucial that you seek professional guidance to maximize your chances of waiving the penalty or reducing it. Remember that fulfilling your tax responsibility is the right thing to do and helps the nation thrive and grow.